Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- HSA in Payroll Liabilities

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

HSA in Payroll Liabilities

I followed the the posted directions on how to create an HSA account (I created the deduction and addition payroll items), and was able to have it directly deposited into the employee's account but now the amount shows up in the Payroll Liabilities due screen and I don't know how to "pay" it.

How do I clear it without creating a check and have it deduct it from my checking account?

Solved! Go to Solution.

Labels:

Best answer April 24, 2024

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

HSA in Payroll Liabilities

I'm here to share steps to help you pay off the amount on your payroll liabilities screen, Ana.

To ensure accuracy in future tax deposits and filings, enter a prior payment to fix them.

Here's how:

- Go to the Help menu and choose About QuickBooks.

- Press Ctrl + Alt + Y or Ctrl + Shift + Y to open the Setup YTD Amounts window.

- Click Next until you reach Enter prior payment, then click Create payment.

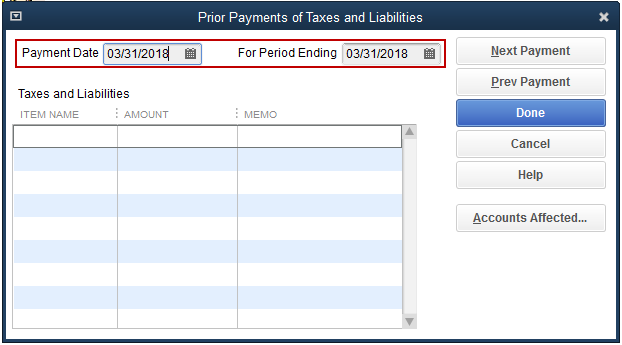

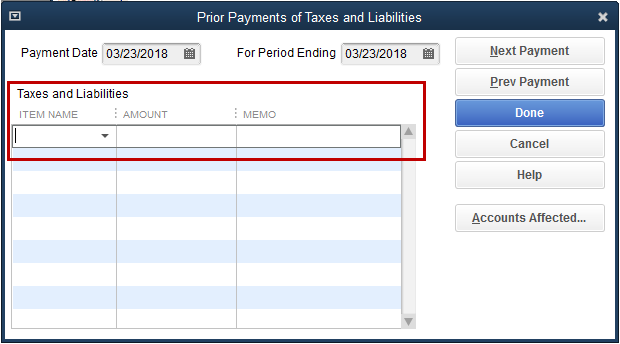

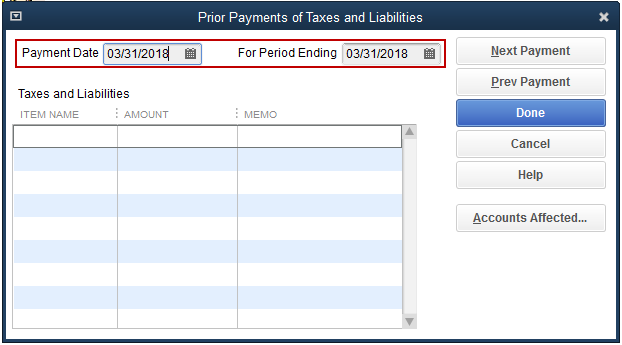

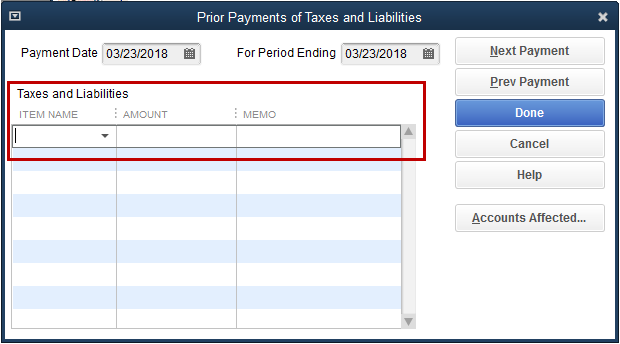

- Enter the Payment date and For Period Ending date (refer to the payment in the payroll liabilities window)

- In the Taxes and Liabilities section, enter the payroll tax item you've already paid and input the amount.

- Then click on the Accounts affected button, and choose Affect Liability and Bank Accounts to affect it on your checking account.

- After, select Done once finished. If you have additional payments to enter, proceed by selecting Next Payment. Continue this process until you have completed all payments.

- Then select Done to save your work.

- Select Finish to close the window.

For more detailed steps, refer to this article: Enter historical tax payments in Desktop payroll.

I'll add this article to guide you when you need to file your tax forms: E-file and e-pay federal forms and taxes.

Please let us know if you have other payroll liabilities concerns. I'm always here to help. Have a good day ahead.

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

HSA in Payroll Liabilities

I'm here to share steps to help you pay off the amount on your payroll liabilities screen, Ana.

To ensure accuracy in future tax deposits and filings, enter a prior payment to fix them.

Here's how:

- Go to the Help menu and choose About QuickBooks.

- Press Ctrl + Alt + Y or Ctrl + Shift + Y to open the Setup YTD Amounts window.

- Click Next until you reach Enter prior payment, then click Create payment.

- Enter the Payment date and For Period Ending date (refer to the payment in the payroll liabilities window)

- In the Taxes and Liabilities section, enter the payroll tax item you've already paid and input the amount.

- Then click on the Accounts affected button, and choose Affect Liability and Bank Accounts to affect it on your checking account.

- After, select Done once finished. If you have additional payments to enter, proceed by selecting Next Payment. Continue this process until you have completed all payments.

- Then select Done to save your work.

- Select Finish to close the window.

For more detailed steps, refer to this article: Enter historical tax payments in Desktop payroll.

I'll add this article to guide you when you need to file your tax forms: E-file and e-pay federal forms and taxes.

Please let us know if you have other payroll liabilities concerns. I'm always here to help. Have a good day ahead.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...