Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, @nmtltd. We understand how frustrating it can be when things don't go as planned. Please know that we're here to help and will do everything we can to make things right for you.

Just to make sure, did you receive any error message when changing your bank account? I checked the status of the investigation mentioned above and it's already closed. The engineers have already found a fix to the issue in QuickBooks Online Payroll.

In your case, I suggest reaching out to our Support team if you haven't done it yet. They can pull up your account securely and further assist you in resolving this on your end. They can also create a new investigation ticket if need be.

Moreover, always remember that you'll be unable to update the banking information of your payroll account if you have pending tax payments. To learn more about it, see this link: Change your payroll bank account.

I'm adding this article for future reference if you want to update your employees' information: Edit or change employee info in payroll.

Feel free to leave a reply if you have other QuickBooks-related concerns. The Community is here to lend a helping hand. Keep safe always.

No change in bank account and not taxes due except 940 which I don’t pay until December.

I can't change my bank account. It keeps saying that I have pending tax deductions at what point will I not have pending deductions? Payroll is done every other Friday so there is always going to be pending deductions. I wish they would get this fixed.

Joining you here to help and ensure that you can successfully update your bank information, dflaird.

To ensure that payments and employee Direct Deposits are timely and accurate, the system restricts changing bank accounts for payroll until all transactions are fully cleared.

Since you are processing payroll every other Friday, you'll want to process the payment directly on the EFPTS website or state agency. This allows ample time for pending transactions to clear out. Once the tax payments are deposited, promptly process the necessary changes.

After entering the new bank account information in QBO, please take note of the following important details:

You can also use this article as guide on how to verify the new bank account: Verify Your Bank Account for Payroll.

If you require further guidance and information on paying taxes, I'll be happy to share these articles with you as well:

Let me know if you need any more help, and I'll be happy to guide you through the process!

The tax payments must be cleared at this point. My message now is, “You can't change the bank info right now because there are pending, unprocessed direct deposit paychecks.”

However, nothing pending for any employees.

Thanks

Thank you for providing the exact error message you've received, nmtltd. Let's ensure you're able to update bank info in QuickBooks Online (QBO).

I've checked our records and found that the investigation of this error is already closed. Therefore, I recommend contacting our Customer Support Team. By doing so, they can securely access your account and further investigate the problem.

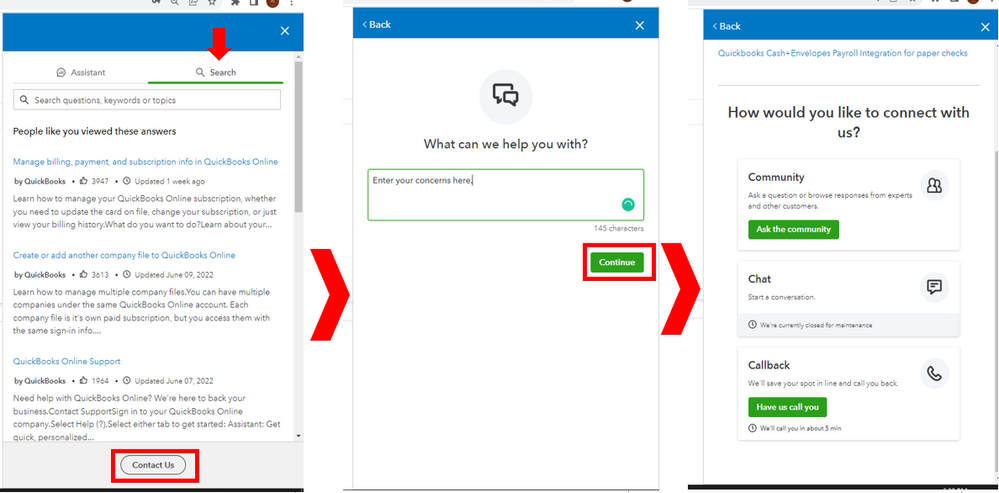

Here's how:

Furthermore, considering that you have already made the payment, I suggest waiting until the IRS or receiving agency accepted the payment.

Additionally, you will receive an email containing information about the scheduled payment date and a confirmation number provided by the IRS.

Once you're ready, follow the steps in this article to be guided in changing your company's bank account for payroll: Change your payroll bank account.

I'm also adding this reference to learn how to update your employee's bank account for direct deposit: Change your employee's direct deposit info.

Leave a comment below if you have any other concerns or follow-up questions. I've got you covered.

We've moved on and are using different software for payroll. Best decision we every made. Intuit seems to have no interest in supporting their products, even when they are fatally flawed where we cannot pay our staff using direct deposit. We strongly suggest looking at other payroll solutions.

I too have this issue which I have been trying to resolve for 6 months. Each time I contact support, I get the same canned response that it appears the rest of you have - "I took the liberty to check with our Internal team which consist of our software engineers and developers and we identify that we have an ongoing investigation for this concern. Currently our back end team is on top of this issue. Rest assure our team of experts will get his fixed for you. I know this is very important for you to run your business. I'll be attaching this investigation to your account so you will be receiving an email update coming from our experts." Needless to say, I received no email updates. I requested that my issue be escalated on my last chat and was assured it would be. Yeah, yeah - guess that's why I've had all these emails and phone calls clamoring to help me. Not! Seriously - it's a good thing I still have money in this bank account, otherwise I would not meet payroll. I see that I've received no credit on my account for this - yet I did receive a notice that rates are increasing. How ironic. Come on Intuit - get it together!!!!!

Hello there, @SWyatt502.

I understand the importance of resolving the issue of unable to change payroll bank accounts as soon as possible. I can also see that you already contacted support.

Currently, the best team who can help you check specific details of your account is our Customer Care experts. They can access your account with your permission. I recommend contacting them so they can check further details.

Here's how:

If everything works, you can try again to change your bank account. Refer to this article for the detailed steps: Change your payroll bank account.

For future reference, you can also read this article to learn about changing employees' direct deposit information: Change your employee's direct deposit info.

Let me know if you have questions about changing your bank account in QuickBooks. I'm always here to help. Have a great day.

Been there done that - multiple times. They are the ones that give the canned response basically saying "we're aware of the issue. We'll get back to you." Not helpful at all. I'm glad they are aware. So am I. I'm also aware that rates are increasing on a product that continually gets worse. Also, I know you are probably required to add in steps on how to change the accounts. The problem isn't that I don't know HOW to do it. The problem is that the system will not ALLOW me to do it becuase of this "issue they are aware of".

Thanks anyway.

It is incredibly disheartening to read through this thread knowing full well that I am having the exact same issue and nothing will be done about it! How is it that QuickBooks "serves" so many customers and can't fix something as simple as this issue? From reading this thread, is it even worth trying to get "help" if the helpers are as helpless as I am?

@fpuutreasurer Do you mind sharing which software you chose? I am interested in comparing.

Thank you.

We use QuickBooks Online Payroll Premium and QuickBooks Advanced.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here