Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have an employee with an ITIN which isn't accepted by QBO. The social security administration accepts it, but I can't use it in QBO payroll. Apparently, based on this thread, QB Desktop accepts it too. I find this absurd. Anyway....how do I find the place within the employee's record in QBO to mark "applied for" as this thread suggests? My e-filing works with a dummy SSN entered instead of his ITIN, but I have to submit end of year forms manually to the state and SSA so that his information is processed properly.

Thank you for posting here in teh Community, @mbell19.

It's my pleasure to give you an insights about Individual Taxpayer Identification Number (ITIN).

Yes, you're correct, only QuickBooks Desktop Payroll accepts the ITIN number. The reason behind that is QuickBooks Online payroll doesn't support ITIN per IRS regulation. We can only carry employees with valid SSNs.

Regarding the applied for on the employee's page, even though you've entered that in QBO, you're still unable to go through the process.

As a workaround, since the Social Security Administration (SSA) accepts the ITIN number of your employee, I suggest getting a piece of information needed for the year-end forms inside QBO and process it manually.

Concerning the dummy number saved in the employee's record, leave at it is in QBO so that you can still run payroll.

To learn more about the difference between two numbers, please visit this article: SSN vs. ITIN.

For Future reference on how to print W4/W2 forms and the different tasks to complete the year end, please browse these articles:

Please leave a comment below if you have follow up questions. I'm always here to help. Take good care always!

"Regarding the applied for on the employee's page, even though you've entered that in QBO, you're still unable to go through the process. "

No, I have been unable to enter that in QBO. I was hoping you could tell me how to do so. I only saw the instructions for desktop - I cannot find it within QBO on the employee page.

Let me walk you through the steps, mbell19.

QBO Payroll only accepts numerical character in the Social Security Number field. This means the program will not accept the word "Applied For". Instead, temporarily enter "000-00-0000" in that field.

Let me show you how:

Let me also share our year-end guide in case you might need this: Year-end checklist for QuickBooks Online Payroll.

Please continue to add a reply below if you need more help when filing tax forms in QBO.

I had previously tried entering all zeroes in the SSN field, but received an error message. However, I tried it again using your steps.

"Go to Step 2 (under the Withholding section), then click the Pencil icon to edit the W4 details."

This is not under step 2 - it is under step 5, Withholding. I clicked the SSN box - entered [removed] (I did not enter the dashes - QBO automatically added them) - and immediately received a message saying "social security number is not valid. Enter a valid 9-digit number in this format [removed]."

Thank you for joining this thread, @enc120585.

Some issues in QuickBooks Online (QBO) is often caused by large data stored in the browser cache. We can do basic troubleshooting steps by clearing the cache to boosts your browser's background processes.

Here's how:

You can check this article link for more information: https://quickbooks.intuit.com/learn-support/en-us/set-up-employees/what-s-changing-with-the-federal-.... This is about the new changes to the Federal W-4 and how to enter and print a W-4 for employees.

Please let me know how it goes, leave a reply if you have other concerns with QuickBooks. I'll appreciate the opportunity to help. Have a wonderful day!

This problem is persistent, all zeros do not work, so unless you can give us a proper "dummy" SSN to work with, we cannot even add an employee or contractor in this use case. Please provide us with an SSN that will work with QBO.

In fact, I even tried the example listed in the attached screenshot, and that does not work either.

Thanks for the screenshot, bulldog8934,

Let me clear things out for you. You can't enter zeros for the SSN, and that's why you're getting an invalid error.

As a workaround, you'll want to copy a number from one of your employees, then change the last digit. Just make sure to enter the correct one before filing W-2s to prevent incorrect information on your returns.

The SSN is provided by the IRS, not from QuickBooks. Perhaps, you can search a dummy one online and enter it on your employee's profile.

I've added a quick video tutorial for guidance about adding an employee: How to set up QuickBooks Online Payroll.

Keep in touch with me if you need additional information. Just tag my name and I'll get back to you.

This is what is so confusing. A QB employee told us to use all zeroes! See below.

<JenoP

Let me walk you through the steps, mbell19.

QBO Payroll only accepts numerical character in the Social Security Number field. This means the program will not accept the word "Applied For". Instead, temporarily enter "[x]" in that field.>

Note: stating that I need to say "applied for" was mentioned in a previous thread, which I linked in my initial post to start this thread. Clearly, entering all zeroes doesn't work, even temporarily, as was suggested within this thread.

How do we know who can give the correct answer here???

You state that we should use another employee's SSN and change the last digit - but remember to change it to the correct number when processing W2s. Now, how is that going to work exactly, when QB won't let me off the screen until a valid SSN is entered? There's no way that I know of to change it to the correct number before processing W2s when the SSN has to be entered on the employee screen and I cannot save the employee data with what QB thinks is an invalid SSN. And, to be clear, I'm well aware that SSNs are provided by the IRS. I have a copy of my employee's valid ID card with an ITIN number from the IRS - but QB will not accept that number.

We are going in circles here.....no one knows how to solve this issue.

Thanks for actively responding, @mbell19.

I appreciate you for voicing out your concerns to us. Let me chime in to share some insights and clarify how you can enter your employee without SSN in QBO so you can start using the payroll service.

Generally, NRA employees are subject to Federal Withholding, Social Security, and Medicare taxes on their earnings for services they performed in the U.S. Thus, everyone who works in the United States must have a Social Security number (SSN).

As per IRS in this article: Eligibility to Work in the United States, any employee without a social security card should apply for one using Form SS-5, Application for Social Security Card (PDF). The Social Security Administration (SSA) offers a social security number (SSN) verification and quick access to relevant forms and publications.

Furthermore, exceptions are made based on an employee's non-immigrant status by un-marking the taxes as needed when you set him/her up in QBO payroll.

As an employer, you'll need to determine first which taxes your employee needs to pay according to his/her visa status. Refer to this article for proper guidance: The exemption status of foreign employees with particular visa types.

Should you need further guidance on visa types and your employee tax setup, consulting your accountant or tax professional is highly recommended.

Lastly, I'd recommend getting your worker's name and SSN for employee's Form W-2 year-end filing. Use this link to verify the Social Security numbers of your employees once you'll have it.

Let me know if you have additional concerns about payroll. We're always delighted to be your guide.

Let me re-iterate what I've already said.

This employee has an ITIN number. He was not given a SS number. The ITIN number is not accepted by QBO, but it is accepted by the SSA when I submit W2 info for him annually on their website. I have to submit all of my employees' information manually to the SSA on their website because of the fact that QBO will not accept the same ITIN number that SSA will accept for filing. So, my question is why will QBO not accept such a number when the SSA will? Clearly it is valid for W2 reporting through the SSA.

Hi, mbell19.

QuickBooks Online Payroll doesn't support ITINs as per IRS regulation. We can only support employees with valid SSNs. You'll want to manually submit all of your employees information to SSA website.

You can check out the IRS Publication about ITIN for more information.

For future reference, here's an article for more information: Year-End Checklist for QuickBooks Online Payroll.

Fill me in if you have any other concerns. I'll always be around to help.

So why does QB desktop payroll accept it? It makes no sense that Desktop payroll is allowed to accept that number for filing and Online payroll is not. You're under the same company umbrella - I cannot understand why the IRS would have different regulations for desktop vs online.

Hi @mbell19,

I appreciate your prompt reply. Allow me to take care of your concern about the ITIN filing within QuickBooks Online (QBO).

Intuit follows IRS regulations, although there are features that are exclusive for QuickBooks Desktop (QBDT). The same goes for QBO. I suggest following the workaround provided by my peer @MaryLandT above.

QBO is still fairly new compared to QBDT. With that said, it's still evolving. Our product engineers are still looking for new features to add so QBO can serve our users better. Rest assured, we've taken note of what you stated.

If you have other questions in mind, feel free to place them below. I'll be sure to get back to you.

The workaround you referenced doesn't work, as I've already explained previously. I can enter a "dummy" SSN for the employee, and use it most of the year, but I cannot correct it before processing W2s because QBO won't let me use the corrected number for this employee. I cannot leave the employee's information screen after correcting the number, to process W2s, since the number I enter for him is not accepted by QBO.

Hi @mbell19,

I'd like to redirect you to the best support group to get this addressed right away.

Since you won't be able to proceed with processing W-2 after changing the dummy SSN for the employee, I encourage contacting our Payroll Support Team. This way, they can check on what option you can perform to process W-2s in QBO. They can also provide additional information with your concern.

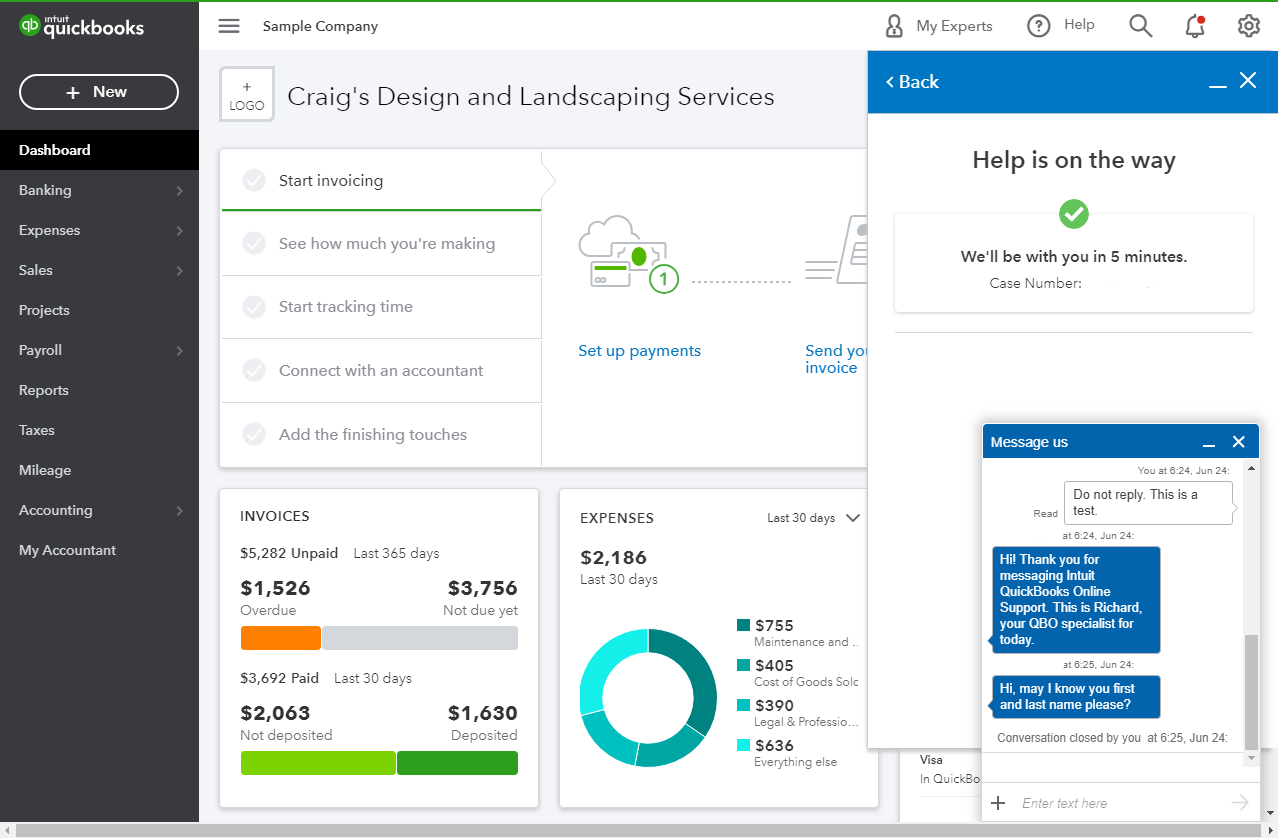

To reach them, click the ? Help button at the top right corner and select Contact us to talk with a live agent.

Just in case you want to print your W-2s in QBO, feel free to check out this article for the detailed steps and information: How to print W-2 forms.

Please keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and keep safe.

Also having the same problem as you. I know this post is over a year old but was the issue ever fixed or did you find a way to make it work? Thanks

I've got you covered, Here_.

I'm here to ensure you're able to complete your employee's information and forms in QuickBooks Online (QBO).

As of the moment, QBO still supports employees with valid Social Security Number (SSN). Have you tried the workarounds outlined above? If you didn't try it yet, I'd recommend doing so. Here are the summary of the workarounds discussed overhead.

To learn more about ITIN and SSN, check out these articles below for your later reference.

Please leave a comment below if you have follow-up questions about entering employee information. I'm always here to help. Take good care always!

Thanks for joining the thread, @Nelio,

QuickBooks Online Payroll doesn't support ITINs per IRS regulations. We can only support employees with valid SSNs for W-2s.

If you need to file your forms, fill out the W-2s from the IRS website and manually file it to the SSA. See these links to get the form:

If you need help extracting the data to fill out the forms, contact our Support Team for assistance. Here's how to get in touch with out live support:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

Let me know if there's anything else I can help you. I'll be right here to assist you with your payroll forms and take care of other concerns in QuickBooks. Have a nice day!

Thanks for joining the thread, cbhc1.

We can only support employees with valid SSNs for W-2s since QuickBooks Online (QBO) Payroll doesn't support ITINs per IRS regulations. To file your forms, we'll need to fill out the W-2s from the IRS website and manually file it to the SSA. To answer your question on when to submit it, I'd suggest contacting SSA to provide you the detailed information. You can check out these links to get the form:

See the Payroll Tax Compliance Links article to access your state agency websites. This helps you find details on tax forms, withholdings, unemployment and other tax, e-file and pay information, general state and agency information, and employer registration.

Feel free to visit our Payroll page for more insights about managing your payroll forms and transactions.

I'm just one post away if you need a hand with creating paychecks or any QuickBooks-related. I'll be here to ensure your success. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here