Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My MA PFML is not being limited to the $137,700 I double checked that the payroll item did in fact have that limit in it. How do I fix this. This is for the current payroll year.

Welcome back to the Community, @cmacdonald.

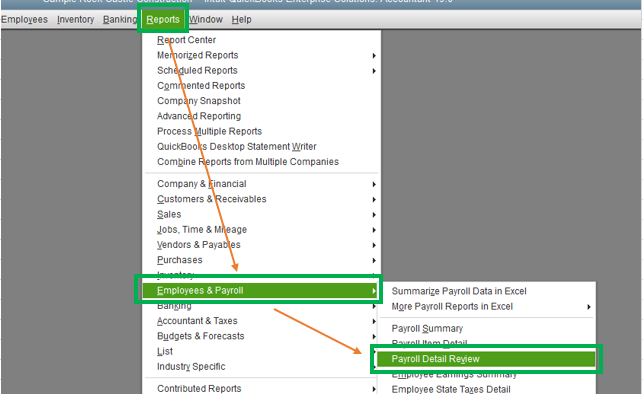

Since you've verified that the payroll item is set up correctly, we can create a payroll liability adjustment to fix this. Let's start by pulling up the Payroll Detail Review report. This will help us determine if you need to decrease or increase the wage base, tax amount, income subject to tax, and by what amount.

Here's how:

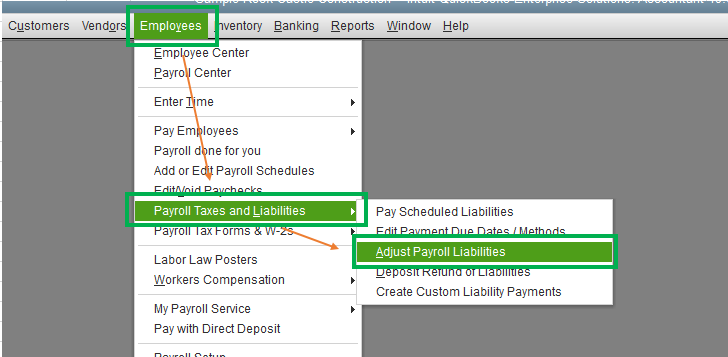

After that, here's how to create a payroll liability adjustment:

Once done, open the Payroll Detail Review report again to verify if the taxes are already correct. For more information, refer to these articles:

I also suggest updating your payroll tax table to its latest release. For further guidance, consider checking out this article: Get the latest payroll tax table update.

Please let me know if you have any other issues or concerns in the comment section below. I'm always here to help. Have a good one!

Thanks for the tip but I do know how to adjust it. My question is how to fix it so it calculates correctly. I do have the latest payroll tax table/update.

What sort of payroll items are you using to track this benefit?

How is the item set up? It reads like you want an item that will stop calculating when the wages used to calculate it reach $137,700. However, I don't think that's an option in QB when setting up a custom tax or deduction or company contribution.

There is an option to enter the max amount for these items, which will be a much smaller number.

For example, if you're setting up the company contribution for the medical leave portion of the benefit, then the limit might be calculated as:

Wages * overall % * company portion % = limit

or...

$137,700 * .62% * 60% = $509.60

The rate is calculated much the same way:

overall % * company portion % = rate

or...

.62% * 60% = .372%

When you set the item up with this smaller limit, then it will calculate until the YTD amount is $509.60. Is that what you're after?

I think I figured it out. The client initially set it up correctly. BUT at some point since then, they then added it in as an other deduction and started using the other deduction instead of the tax. Hopefully that's all that it is because it did work before.

thx

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here