Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have been using QB desktop for years and suddenly my past due payroll liabilities are not showing up in the pay taxes and other liabilities section of pay liabilities. Why?

It's nice to have you here on the QuickBooks Support page, kitchen1.

I can share some clarifications on how to resolve your payroll liabilities not showing as due.

There are a few reasons to consider:

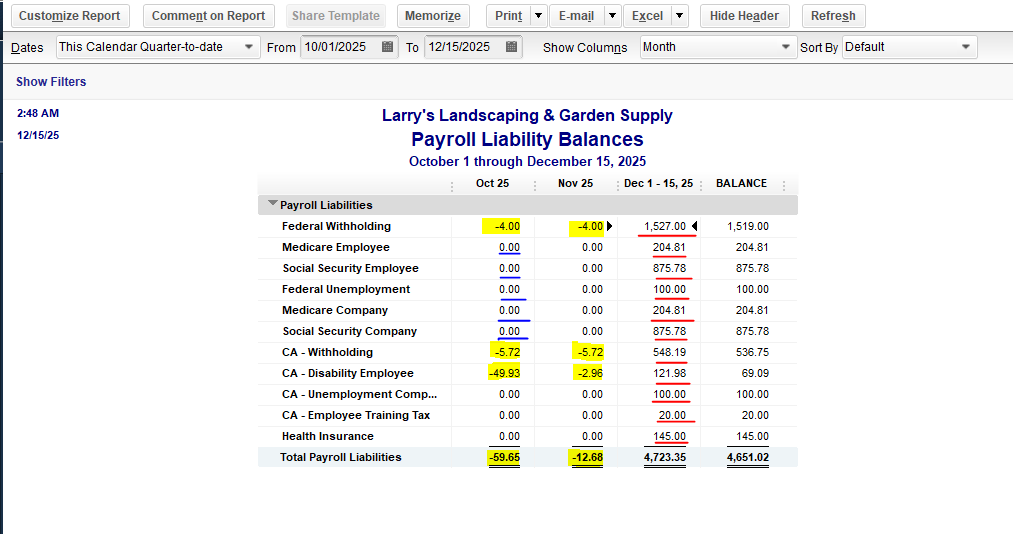

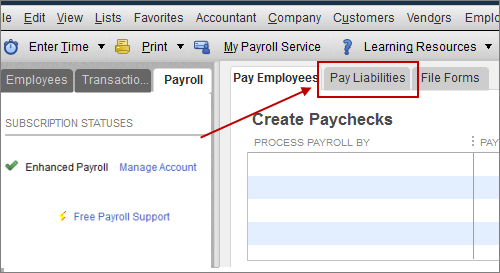

To check on this, let's take a look at your payroll liability report. This reporting is where we can if the company has existing unpaid liabilities.

Here's how to open the report:

Next, let's make sure you're able to download the latest tax table update version, 22116. You can check that by following these steps:

If the same thing happens, run the Verify/Rebuild Utility tool. It will diagnose and identify any data issues that cause the liability not posting.

Please post here again if you have other QuickBooks payroll liability questions. I'll be right here to help you anytime. Have a wonderful week!

Hello Jen_D,

I checked everything, I am on the latest version 22116, and I also have the Quickbooks updated to the latest version, and even ran the utility. Other than going back and running the reports quarter by quarter, I am at a loss. I will be scrutinizing the reports to see if I am missing something. Next question would be, If I find a Payment that has not cleared can that be deleted? And if so, will the liability then show in the pay liabilities window? I did try to make payments, but the payments were rejected by the QB system because it seems that they will only go back just so far, and then I tried on the EFTPS, but that only went back so far also, so by following those methods, it is a possibility that I have payments against them. And BTW--- thanks for the warm welcome to the community!

Let's make sure liabilities show up on the pay liabilities window, kitchen1.

Generally, once payment is rejected, you'll find the reason code under the Status column so you'll know why this happening and apply the best possible solution to fix this. You'll want to check for the codes instead of deleting the payments, follow the steps below:

Once you've double-checked the reason, you may want to resubmit the e-payment or create a printed liability check. If you choose to resubmit the e-payment, it is important that you check the status again after resubmitting. Please go through these articles for more information:

You may also want to review the taxes and contributions through the payroll summary report. For reference, check out this article for the steps and details: Customize reports in QuickBooks Desktop.

Reach out to us if you have any concerns about Payroll Liabilities. We're here to help you as always.

My pay has not been released by intuit. My employer said pay was completed by I have to wait until Intuit releases my pay to my bank. Direct deposit. I have not received two pay checks 9/10/23 and 9/25/23 Help! who can I contact

Hello, gfernandez.

I am sorry to hear that you experienced delays with your pay. Rest assured, this is not something we want to happen again in the future. We apologize for any inconvenience this may have caused you, and we will do our best to ensure your paycheck as soon as possible.

Let's take a look at the factors that are causing the delays. Here are a few possible reasons, which vary depending on the following scenarios.

If a payment is rejected or mistakenly deposited into an incorrect employee's account, it can cause delays. But don't worry, options are available to recover the funds depending on the scenario.

If none of the scenarios mentioned happen to you, you can always reach out to our customer support team for assistance. Rest assured that our customer support team is always available to provide you with the necessary assistance. They have the essential resources and expertise to investigate the root cause of any delay or issue you may be facing and help you solve the problem promptly and efficiently. Whether you prefer to connect with them via phone call or chat, they are ready and eager to provide you with the help you need.

I came across an informative article that can greatly assist you. The article offers a comprehensive guide on verifying the status of your direct deposit paychecks on QuickBooks Payroll. Please take the time to read through the article: Check the status of your employee direct deposits in QuickBooks Desktop Payroll.

Should you have any queries or concerns, do not hesitate to reach out to me for further assistance. Take care, and have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here