Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

I have read many articles but still trying to find the best solution to our dilemna.

Facts:

1) We have less than 10 employees

2) Several Assigned to Different Classes in Employee Settings

3) Liabilities Increase and Expenses show up correctly when recording and creating paychecks

4) For reporting purposes (and the fact that we have to use Fund Accounting as a Governmental Unit), we have to have all reporting under the Class the B/S and P/L reports it belongs to

Dilemma:

1) Liabilities do not Decrease by Class when Paying the Paychecks but instead directly to Unclassified (as there are several Classes in one lump sum to the Vendor)

What is the easiest way to ensure that the liability accounts are cleaned up without having to make manual Journal Entries each time a paycheck run is performed (which is generally monthly)?

I can share a couple of info and steps to ensure you can manage your paychecks and liability accounts seamlessly in QuickBooks Desktop (QBDT), @NNeese.

First, once you create a paycheck, there's only one option to assign a class, and it will affect both the employee and employer's payroll taxes. If the transaction doesn't have a class, it will show as Unclassified.

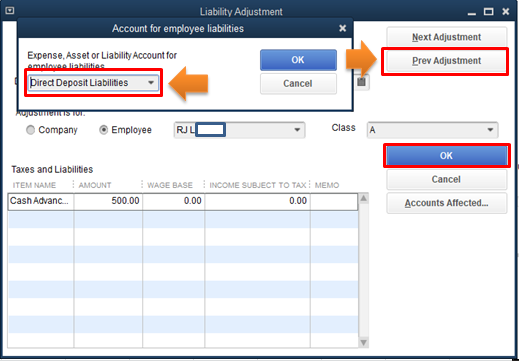

Second, if you've set Do not affect accounts when entering liability adjustments, this will cause it not to change or decrease your payroll liability accounts by class.

To verify and fix this, here's how:

For more info, please check out this article: Payroll Liability shows incorrect amounts.

Lastly, you can run the Payroll Summary report to ensure your payroll liabilities/accounts are updated. To do this, go to the Reports menu, and then select the said report from the Employees and Payroll section.

You can count on me if you have more questions about managing your payroll in QBDT. I'd love to hear more from you in the comment section. Take care.

To do this for existing liability checks, edit the liability payment checks and split up the payment lines as needed, adding the appropriate class to each line. I'll look like this:

As you make new payments, you can add this detail before initially recording them.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here