Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy company uses Paychex for payroll. How do I enter this:

for January 2021 Payroll--

Net pay taken out of bank account 12/31/20 $10,000

Taxes and fees taken out of bank acct 1/4/21

thanks.

Solved! Go to Solution.

Banking transactions can still be matched even if they have different dates, parksbarbie.

You can manually change the From and To dates when looking for a match. Just make sure they have the same amount so they can be paired together. Here's how:

Let me also share this article about finding a match for more details: Categorize And Match Online Bank Transactions In QuickBooks Online.

Don't hesitate to get back to this thread if you have follow-up questions. I'll jump right back to help you again.

I can help you enter these payroll transactions to your account, @parksbarbie.

You can create journal entries to track those paychecks you've created outside QuickBooks Online (QBO). First, you'll just have to create manual tracking accounts for your payroll liabilities and expenses.

You must have or create accounts for Payroll Expenses (Wages and Taxes) and Liability accounts (Federal Taxes, Federal Unemployment, and State Taxes).

To create these new accounts:

To create the journal entry:

You may also consult an accountant for guidance with the best category to use.

Check these articles for more information:

Let me know if there's anything that I can help in tracking these payroll transactions. Take care and have a wonderful day!

How do I account for the money taken out on 12/31 if the journal entry is dated 1/4/21? I do not think it will match in the QBO banking feed.

Please anwer my question?

Banking transactions can still be matched even if they have different dates, parksbarbie.

You can manually change the From and To dates when looking for a match. Just make sure they have the same amount so they can be paired together. Here's how:

Let me also share this article about finding a match for more details: Categorize And Match Online Bank Transactions In QuickBooks Online.

Don't hesitate to get back to this thread if you have follow-up questions. I'll jump right back to help you again.

One final problem. When I reconsile the bank account the money that came out on 12/31 is not on the list to reconsile since the GJE is dated 1/4/21. How do I reconsile??

I can help you with that, parksbarbie.

Since these transactions have different withdrawal dates, you'll have to delete the original journal entry then create separate entries for the fees/taxes and net pay. This way, you'll be able to reconcile them. Here's how:

Once done, follow the steps provided by my colleague, MaryJoyD in recreating the journal entries. After that process, it's time to match them to your downloaded bank transactions. Then, reconcile your accounts so they always match your bank and credit card statements.

Additionally, I've included some articles that will help you resolve common reconciliation errors and issues in QuickBooks Online:

Fix issues for accounts you've reconciled in the past

Fix issues at the end of a reconciliation

If I can be of any additional assistance, please don't hesitate to drop a comment below. The Community always has your back.

So to be clear I do NOT do what the first person suggested but I now need to make 2 journal entries...one for the money taken out 12/31 and one for the money taken out 1/4/21. Is this correct?

This payroll is for January 2021 so shouldn't it be in January transactions? I don't know how to handle this. Please give me instructions. Thanks.

You're right, parksbarbie.

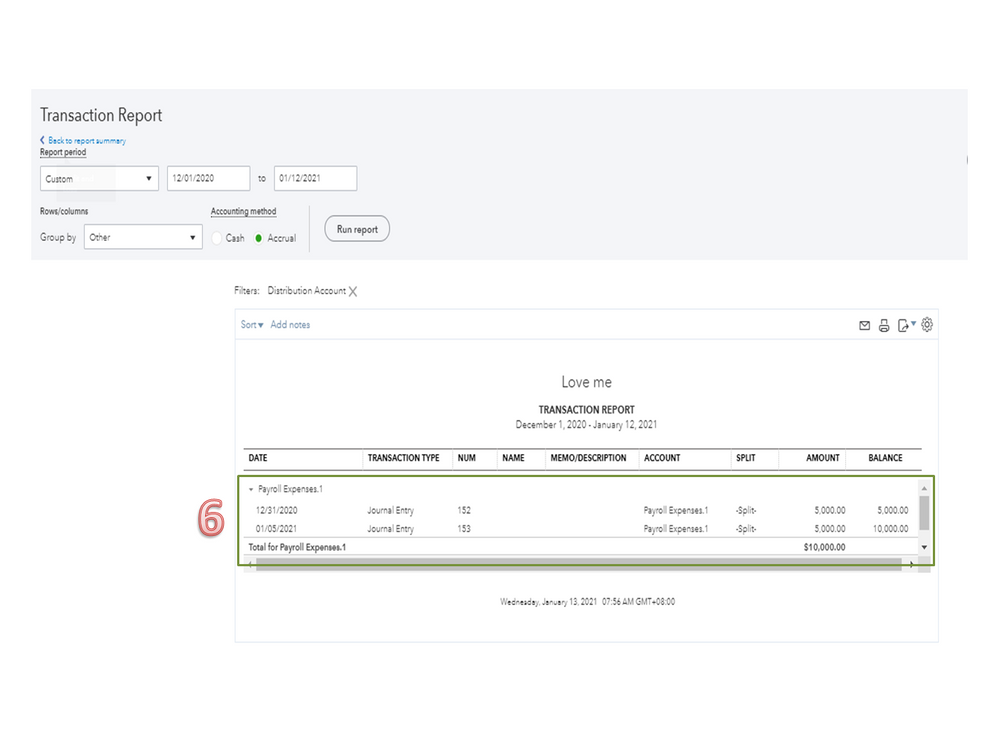

You'll need to create two journal entries. Since these transactions have different withdrawal dates.

Check out these articles for managing journal entries in QuickBooks Online:

Don't hesitate to leave a reply if you need more help.

Is there a way to show the withdrawal for net payroll on 12/31/20 on 2021 reports? This is for January 2021 payroll. Thanks.

Welcome back to the Community, parksbarbie.

Thanks for adding more details about your concern. This can help me provide a timely solution to fix the issue.

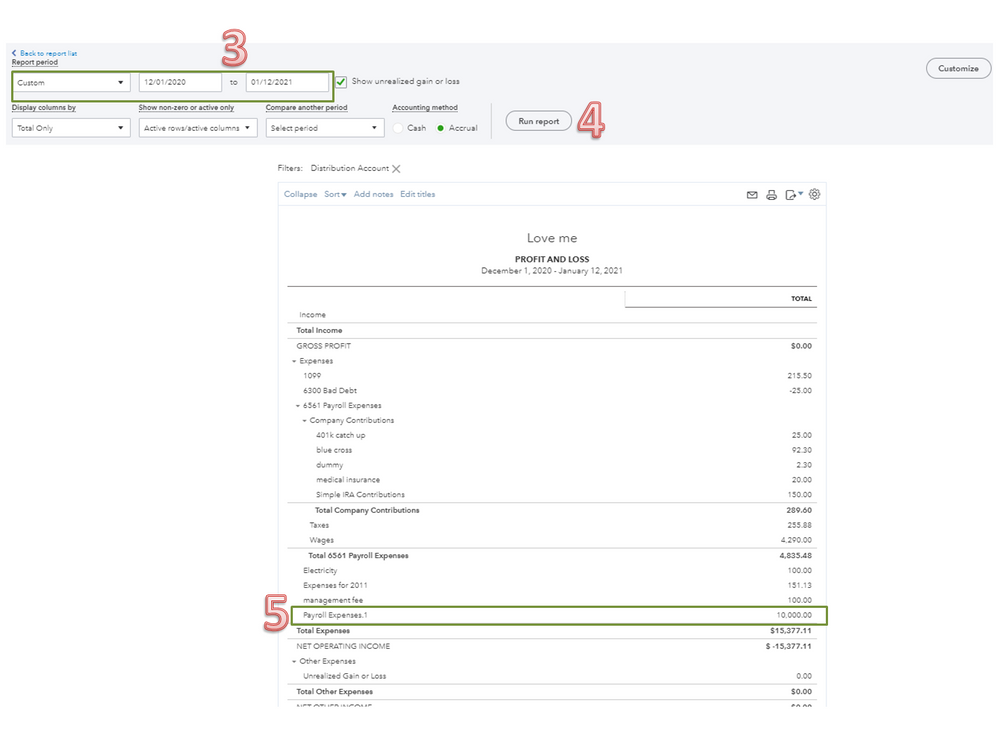

The date affects how transactions are reflected in the report. For your net payroll (12/31/2020) to show on the 2021 reports, you’ll have to set the date range to All or Custom. Let’s try to run the Profit and Loss Report as an example.

Here’s how:

The following article provides an overview of managing reports and refining the information: Customize reports in QuickBooks Online.

Keep in touch if you have any clarifications or other concerns. I’ll be around to answer them for you. Have a great rest of the day.

Good day to you, @Need to chat with someone.

I’m more than happy to help you with your payroll concern. Can you share with me what specific payroll issue you need help with? This way, I’ll be able to provide you with the right resolution for it. Any additional information is appreciated.

Nevertheless, if you’re referring to running your payroll in QuickBooks Online (QBO), you may follow these easy steps:

You can also see this article for more details about the process: Process or run payroll.

However, you’re implying to running payroll reports, you can utilize this link for guidance: Run payroll reports. If you wish to get in touch with our Support team, you can refer to the steps provided in this article: QuickBooks Online Support. Ensure to review their Support hours to know when agents are available.

Know that you’re always welcome to get back to me in this thread if you’re referring to something else. I’ll be around to help you in managing your payroll and your account. Keep safe and have a great week ahead!

Accounting for cash entries is correct to be recorded on the date cash is paid, whenever that date really occurs. Sounds like you are paying payroll in advance if you are paying on 12/30 or 01/04 for January payroll. Suggest best to record labor expense as incurred and to pay for work once completed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here