Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowI first started out using Quickbooks Desktop. Less than a month into it we switched to Quickbooks Online. I entered in all existing transactions manually into QBO. I had run 2 payroll periods in Quickbooks Desktop prior to switching to Quickbooks Online. When setting up the employee records in Quickbooks Online I entered the previous paychecks as previous payroll records. My issues are:

1. How do I show the these prior tax payment being deducted out of the check register? I can view them as prior tax payments but I need those payments deducted out of the check register.

2. How do I show the paychecks from the prior 2 payroll periods that were run in desktop deducted from my check register in QBO?

3. Those 2 payroll periods do not show up in the employee paycheck list in the employee record. How can I verify that they are included in each individual employee earnings? The payroll summary report has 1 line item as "historical checks".

QBO has been a struggle for me I have spent the last 20 years using Desktop and am finding QBO not so user friendly. Any help or insight is greatly appreciated.

Hi there, @djsta5.

Thanks for sharing detailed information on your concerns. I'd be glad to help you resolve them.

There should be a payroll transaction in your register that represents the payroll expense when you convert from QuickBooks Desktop to QuickBooks Online. You can view them in your check register. Here's how:

If you can't find those transactions there, create a check for the net pay amount. Here's how:

When recording your prior tax payments, please know that it's a non-posting transaction. Hence, it will not affect the bank register, but it will clear the taxes from showing due and record the deposits.

For more detailed insights, see this article: Recording prior tax payments.

Additionally, you'll want to run the Payroll Details report to verify your employee's earnings and view their payroll info. Here's an article that contains lists of available reports in QuickBooks: Run payroll reports in QuickBooks Online.

I'm also adding these articles to help you learn more about what data aren't converted after the migration:

Let me know if you have follow-up questions by commenting below. I'm always around to answer your concerns.

I did not do a conversion from desktop to online. I manually entered the transactions. So when I entered each employee record in I included prior payroll records. Those prior payroll records did not create the transaction of a check in the check register. Adding the net payroll amounts into the check register seems like it is producing a double entry. What account would they be posted to when adding them into the check register?

What about deducting the prior tax payments from the check register? How do I do that without producing a double entry?

How do I verify that the prior payroll records that were entered are included in each employee record? I don't see any detail for those records in reports or in the employee record. I want to make sure that the W2's are correct at the end of the year.

Let me make sure your employee's prior payroll is recorded accordingly, @djsta5! This way, W2s are also calculated correctly by the end of this year.

Prior payroll entered for an employee will automatically associate the payroll information direct to the payroll accounts affected. We can pull up and customize one of your payroll reports to determine your employee's YTD totals. I'll show you how.

Once done, you can open and review each paycheck to determine the payroll account used. Here are the reports available in QuickBooks Online Payroll to learn more: Run Payroll Reports.

I'm also adding this article to further guide you in managing your payroll account and employee expenses: View all Help References for QuickBooks Online Payroll.

Don't hesitate to comment below if you have other payroll concerns or inquiries about managing prior payroll in QBO. I'm always ready to help. Take care and stay safe!

I have the same problem. For me the profit / loss report shows the net salaries and wages not the gross and the IRA matching for that month is $0. The payroll taxes are incorrect and do not show up either for that month. The months that I used QBO for payroll the report is correct. HELP !!!!

Help has arrived, Ken.

The gross figures reported in your Profit & Loss statement are revenue or the total amount of income from the sale of goods or services associated with the company's primary operations. Deducting expenses, such as payroll, would result in a figure called net operating income. It’s also the amount found in your bank statement.

For your payroll taxes, make sure the date you selected is correct. This way, they’ll be included in the report.

You can use this reference to learn more about QuickBooks payroll reports: Run payroll reports.

Don’t hold back to drop a comment if you need further assistance with your payroll taxes and reports. We’ll be here anytime to help. Take care always!

I have the same issue. I run payroll and the checks do not appear in the check register. I have called 4 times and still can not get this fixed. The person on the phone says to this and do that which has NOTHING do do with putting the checks in the register. It has been sent to the back end 3 times. They never fix it! QBO is the worst!! Should have stayed with desktop version.

Good afternoon, @saover95.

Thanks for chiming in here on this thread. Let's work together to get this problem handled.

To clarify, can you provide me with some screenshots of where you ran payroll and then the check register?

This will help us determine the best solution for your business. I'll be right around the corner when you're ready!

Did you get this fixed? I’m having the same issue. Paychecks are mapped correctly and in paycheck list but not showing up in my check register.

Did you find a fix? I am having the same issue. Run payroll, which is amped to the correct accounts, and see the transaction in payroll list but the actual transaction is not showing up in my checking register.

Same problem here too. I'm a little behind in reconciling. Just noticed all paychecks since June 2022 are in the paycheck list, but not in the register. Also, when I make tax payments (scheduled for a future date), they do not show up in the register either. In the past, they were always delineated in the register with a colored line separating future from current transactions. Thought maybe I forgot to do something, so I deleted the tax payment and started over, double checking my steps - same thing, not in the register. I write out all my own paper checks, so I always make sure not to check the box for the checks to be printed later. Contacted qbo twice about this via online chat...the first time it took so long (over an hour) to make no progress that I had to get off because I had other things to do. The next time, the qbo chat agent asked me to verify my bank account information 'for security purposes' and I ended the chat because they don't need that info, nor has any chat agent ever asked for it in the 8+ years I've been on qbo, reaching out to them on average 5-7 times per year. It seemed strange to me. I provided more than enough information, even my member ID, etc. It appears based on this thread there is a common problem. Any qbo person out there to help? Could this be a glitch?

Hi there, @kritter5386.

I understand the convenience of seeing your tax payments and payroll checks in the Check register. I also appreciate you reaching out to our Support Team along with the things you’ve done.

There's an in-progress report about the payroll transactions not showing up in register. Please know that our engineering team is working to find a fix. Rest assured that this will be prioritized among other issues.

To link your account to the list of affected users, I recommend reaching out to our Customer Care team again. I know you already contacted them but this is the only way you’ll get updates and learn when a solution is available.

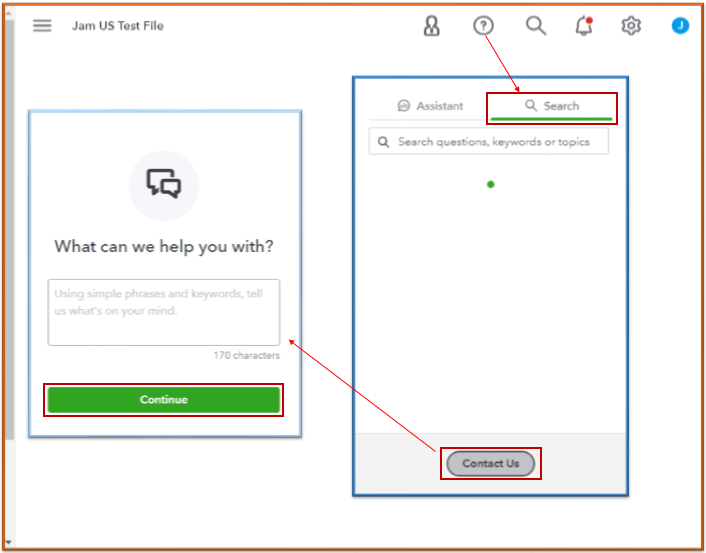

Here’s how:

Feel free to read these resources to help you learn more about what data aren't converted after the migration:

For future reference, you’ll want to visit this link to learn more about other payroll tasks: QuickBooks Online Payroll hub. From there, you can browse articles that will guide you through running reports or record transactions.

Drop me a line if you have another question about your QuickBooks account or any other payroll concerns. It will be my pleasure to help you again. Take care.

Hello, I am having the same issue of my online payroll transactions not showing up in my Mac Desktop register. I understand there is a fix in the works - do you have a suggestion as to what we should do in the meantime to balance our registers and do our year end tax reports, etc.

My concern is that if I manually enter this payroll information (which is quite a bit of work) - then when this issue is fixed, I will have double entries. Please advise. Thank you.

Welcome back to the QuickBooks Community, mel2022. I'll share an update about an issue with payroll transactions isn't showing in the register. Then, let me point you to the right support team to assist you further on this payroll matter.

The issue with payroll entries not showing up in the register has been marked as resolved and closed. We are unable to provide specific suggestions on how to balance your registers and complete year-end tax reports because the problem has been fixed.

Since you're experiencing the same issue, I suggest contacting our QuickBooks Support Team. They have the tools to pull up your account in a secure environment and be able to investigate the cause of why your online payroll transactions still not showing up in the register. You can follow the steps provided above on how you can reach them.

On the other hand, manually entering the payroll information or entries isn't recommended to perform in QuickBooks. This will result in duplicate transactions in your account and inaccurate data.

Lastly, you may refer to this article to see various details on how you can run several payroll reports so you can use to view useful information about your business and employees: Run payroll reports in QuickBooks Online Payroll.

Don't hesitate to click the Reply button below if you have other concerns related to payroll. I'm always here to help, mel2022. Have a good one!

I have a payroll check issued on June 3, 2022 that is not showing up in the QBD anywhere. The reason I know it is a missing transaction is because I have the check stub. I checked the employee issued checks to make sure the wrong check number was not entered, I searched by amount as well. I then checked the voided/deleted transactions. The transaction is no where. I do remember that in June, we upgraded to Quickbooks Desktop 2022 but it looks like this is the only transaction missing. Where else can i check to see what happened?

I agree. No one knows what they are doing!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here