Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe have employees in many states, recently added DC and now whenever I add a new employee, no matter what state I choose for their work in and live in state, This DC family leave tax gets auto added to their profile!

I can delete it, but would prefer this didn't get auto added.

Checked everywhere and can't see how to stop this from auto adding.

Hello there, @SESolutions. It's my goal to ensure you'll be able to add the correct state for your employees in QuickBooks Desktop (QBDT).

QBDT provides a wide range of preferences and default settings that apply to all or most of your employees. Since only the DC state is being added to your employee's payroll information, it's possible that it's set as the default in your settings.

To rectify this, let's change the Taxes Defaults to None. Here's how:

Please see this article to learn more: Set payroll preferences in QuickBooks Desktop Payroll.

Moving forward, here's a reference containing a detailed step-by-step guide on how to run payroll for your employees: Create and run your payroll.

Feel free to swing by the Community if you have additional questions concerning your employees' payroll profiles. You can always count on us. Be safe and have a great rest of the day!

Thank you for the reply, however I checked that already and there is no default set.

DC is not the ONLY state being added, as you can see in my screen shot. But it is being added, no matter which state I select.

Any other suggestions?

Thank you for the reply, however I did check that section already and there is no default selected.

DC is not the ONLY state being added, as you can see in my screen shot, I choose IA for 'works in' and 'lives in' state, and it auto added the tax for DC. It's adding DC tax no matter which state I select.

Any other suggestions?

Thank you for updating this thread after following the suggestion above, @SESolutions. I'll provide additional troubleshooting to stop the system from auto-adding an incorrect state to the employee's profile.

Let's start with downloading and getting the newest tax table in QuickBooks Payroll. This delivers updated and accurate rates and calculations for federal and supported state taxes, payroll tax forms, and e-file and e-pay options. To proceed, go to Employees, then select Get Payroll Updates.

To know your tax table version, follow the steps below:

Next, let's get the latest tax table:

Feel free to read these resources about adding or updating an employee's workplace and rectifying incorrect state forms used on paychecks.

Please know that I'm only a couple of clicks away if you have clarifications updating the tax table in QBDT. The Community is always open to answering your concerns regarding the states added to your employee's profile. Stay safe, and have a great day.

So no other suggestions to provide a solution to this issue?

How to you remove states that shouldn't be added for payroll taxes on Quickboooks Online?

I wish the online was like the desktop. The lack of control is so frustrating.

Does anyone have any suggestions of a different company to switch our books away from Quickbooks online?

I understand how QuickBooks Online (QBO) differs significantly from QuickBooks Desktop (QBDT) regarding features and interface, @abbooks. Rest assured, I'm here to assist you in removing states that should not be included in your payroll taxes within QuickBooks.

Before proceeding, I suggest reviewing the Employment Details setup for your employees. QuickBooks relies on this information to calculate payroll taxes based on the employee's personal and working addresses.

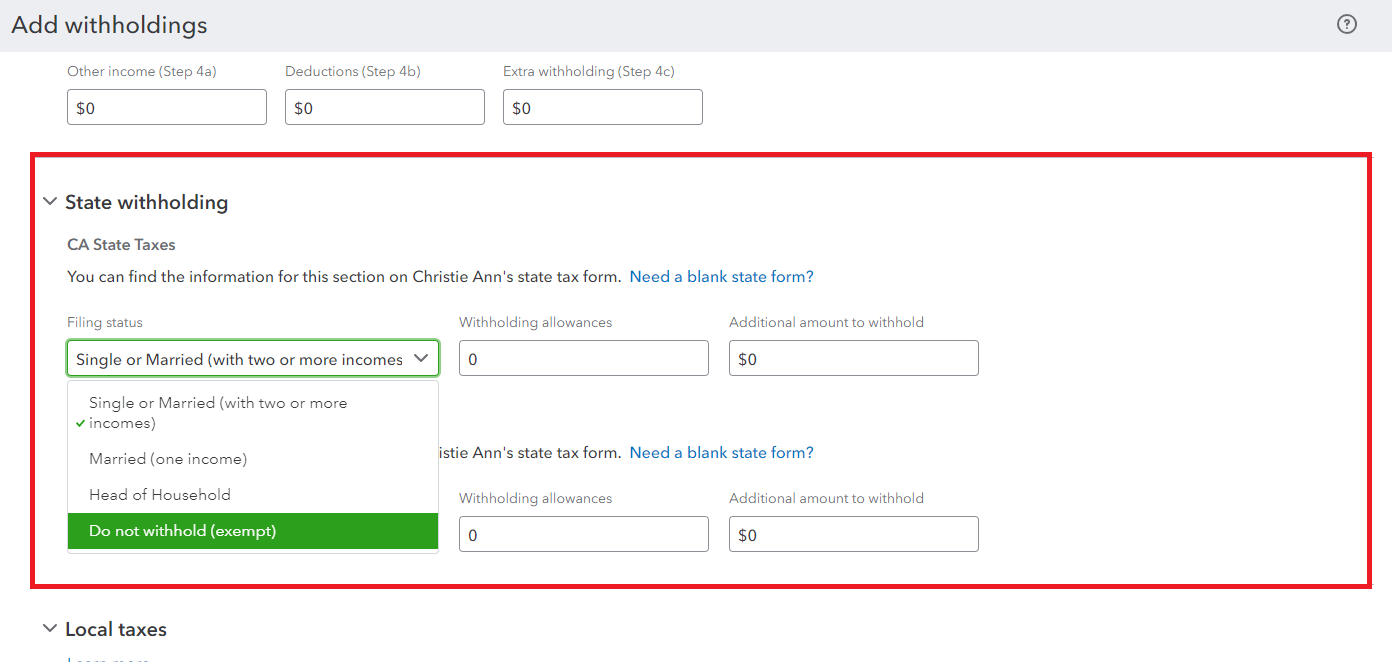

Once you have verified the details of your employees, you can choose not to withhold state tax in QuickBooks. Allow me to guide you through the steps to accomplish this:

Moreover, I understand that there are various accounting software options available in the market. However, I am unable to provide you with suggestions on which company you can switch to. That said, it's best to research and compare different accounting software options, including QuickBooks, to find the one that best suits your requirements.

Furthermore, you might consider exploring an informative article that provides guidance on how to view payroll tax payments and forms within QuickBooks: View your previously filed tax forms and payments.

If you could keep me in the loop by leaving a comment below, I'll be available to provide the necessary assistance you need.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.