Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am working on Q2 2020 form 941. The tax liability showing on Schedule B month 1, tenth of the month does not match what it should be per the payroll summary for that day. The difference appears to be our COVID sick leave wages however there is still a difference of over $500.

1. How do I find out where the number on Schedule B is coming from? Is it supposed to subtract the COVID credit?

2. The bulk of the COVID wages we paid were in month 3 so it seems weird that it would be subtracting it in month 1.

Any help would be greatly appreciated.

Thanks for posting to the Community, @jennrobe.

Let me share some insights on how to view the 941 Schedule B liability line item.

QuickBooks is adding the tax liability showing on Schedule B for the total taxes accrued each day on paychecks for Federal Withholding, Medicare Employee, Medicare Company, Social Security Employee, and Social Security Company. It doesn't suppose to differ the COVID 19 credit.

You can run the Payroll Summary report and customize it to show the Payroll item for Federal Withholding, Medicare Company, Medicare Employee, Social Security Company, and Social Security Employee to show the amounts in Schedule B (Line 16).

Here's how:

The bulk of the COVID wages you paid for from the first to third month should total the amounts in Line 13e.

This way, I'd suggest consulting a tax accountant to help you with the amounts.

I'll be adding this article as your source to know more details about how QuickBooks populates the lines on Form 941: How QuickBooks Populates The 941. It includes links on how QuickBooks fill the other forms.

Feel free to ask questions below if you need clarifications. I'll keep my notifications open. Take care!

I ran the report and I am now 100 percent certain that Schedule B liability amounts are being reduced by COVID credits. I was able to reconcile to the penny.

Is this the proper treatment to carry the credit back to the beginning of the quarter?

Did you ever find an answer on this? I have the same problem.

I don't think the credit for qualified sick and family leave wages is booking correctly to the COA. The instructions for setting up the National Paid Leave payroll items said to use the COVID19 expense account for both the liability and expense side of the transaction. I don't think this is right. That's why the credit is not going to the Schedule B (I think).

ANYBODY????

I had several problems in my form. The accounts were setup wrong to begin with due to old instructions from QB that were later changed. But I did find IRS instructions that indicated to reduce the Sch B liabilities. I am not sure that the timing was correct but we have not taken any credits for the EPSL payments to employees yet.

https://www.irs.gov/pub/irs-pdf/i941sb.pdf updated in September 2020 does explain deducting the Covid Sick pay costs from the Schedule B liabilities.

Thank you Jennrobe for sending me that direction, I appreciate it! Hours of wasted time - wish QB's "Help" was actually helpful. Just a simple one line comment would have gone a long ways. The top response to my various queries was "How to cancel your payroll subscription". It was at least good for a laugh!

Did you go in and reset up the National Paid Leave in order to get it to post correctly to the 941/Schedule B?

Thanks fro checking in, @kfrem,

You can try updating your payroll version to apply the recent changes for the 941 form. Our developers recently updated it to release version 22016 which includes updates for the Federal Form. See this link for more information: Latest payroll news and updates.

Use these steps to download it:

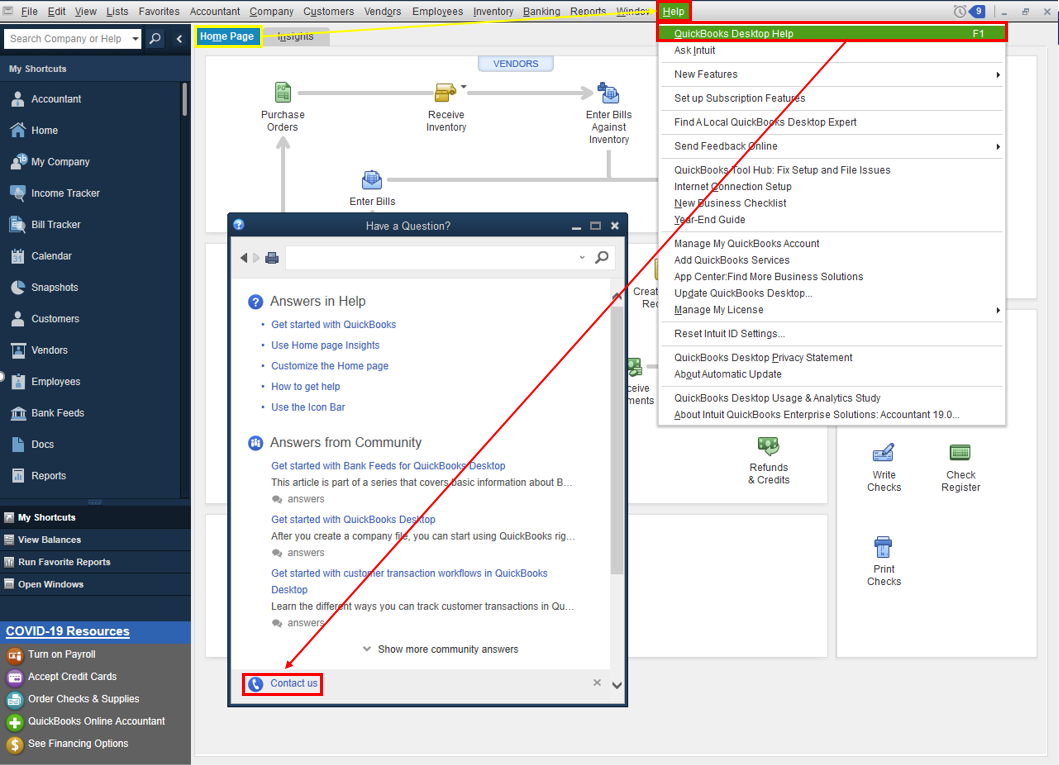

If you're using the updated form and still having the Schedule B information incorrect, I suggest getting in touch with our Support Team for adjustments.

Please note that all our representatives are currently available through chat or messaging. You must enable pop-up windows on your browser settings to launch the chat box and connect with our live agents. To get our Support, follow the steps below:

Another option to contact us is through the web. Here's how:

Let me know how it goes. I'll be right here if you need further help. Have a good one!

I re-setup the National Paid Leave payroll item and changed the affected paychecks to the new item. I was finally able to balance by tying Worksheet 1 line 2a(ii) to the National Paid Leave amount on my Payroll Summary. Everything for Q2 and Q3 seems to be correct.

The only thing is the credit is not booking to the G/L. I am entering a liability adjustment for that.

Hey there, @marysolmonson.

Thanks for sharing what solutions worked for you.

It's customers like you that make helping others easy. Sharing ideas and solutions is the best part of using the Community, and we thank you for each time you do. Please know if you need anything, we will be here for you, as you are for others.

Have a wonderful weekend. Take care!

Thank you so much for this response. It was so helpful to know that the deduction was all being put into the first payroll's liability calculations!

Where is the updated article for how to correctly set up the EPSL payroll items?

You’ve come to the right place, @JCABELL.

I’d be glad to walk you through the steps in setting a payroll item for your Employee’s Paid Sick Leave (EPSL).

Before we proceed, I’d recommend working with your accountant for guidance. This way, we can ensure the accounts used in setting up this item is correct. If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

Nonetheless, here’s how to create a payroll item for your EPSL. First, you’ll have to create an expense account for the paid leave:

Then set up a payroll item for the leave. You can refer to this article for the complete process: How to track paid leave and sick time for the coronavirus.

Once you’re done, you can now add the item to your employee’s paycheck and process their payroll seamlessly. To be guided, check out these links:

You can always get back to me if you need further assistance setting up your payroll item. Just leave a reply with the details and I get back to you as soon as possible. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here