Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Re: After tax Roth 401(k) employee deductions & company contributions

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

We are having trouble setting up the after-tax Roth 401(k) employee deduction & company contribution. My question has two parts -

1) When following the instructions to set up an after-tax Roth 401(k) employee deduction, we hit a snag at the end of the process. The only option in the drop down menu when trying to enter the employee deduction are to calculate an amount based on "gross pay" and there is no "net pay" option. Since this should be an after-tax deduction, shouldn't we have the option to calculate the amount based on net pay?

2) quickbooks states the after-tax Roth 401(k) is not available as a company contribution through their service but the explanation for why does not seem adequate. It says that the entire contribution should be paid and reported separately through the provider. The funds will go into separate accounts with the provider - but how do we account for the company contribution on the employee's paystub if we don't run it as a company contribution through quickbooks? Is anyone else totally confused by this explanation? Any further details on why this is not allowed would be much appreciated!

Solved! Go to Solution.

Labels:

Best answer February 14, 2019

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Glad to have you here with us, jwallace,

Let me help share information about setting up Roth 401(k).

A Roth 401(k) plan is a type of retirement plan. If the participant elects to designate a portion of their elective deferrals as a Roth contribution, then the designated contribution is taxed immediately and placed in a Roth 401(k) account. Earnings on the account accumulate tax-free. When the monies are distributed as part of a qualified distribution, the distribution is entirely tax-free. So the earnings on the Roth 401(k) account are never taxed if they are distributed as part of a qualified distribution.

The Roth plans are deducted after tax, therefore, the employee does not pay the taxes on the amount drawn at retirement. On the other hand, After tax means that this deduction item is taxable to taxes in which Gross Pay is the basis.

As for the Company contribution, per IRS requirements, the company contribution must be set up as a traditional 401(k), not as a Roth 401(k). You can check out IRS Publication 4530 for more information.

For other reference, I'm attaching a helpful article that you can check on: Set up a Roth 401(k) plan.

If you need further assistance with the steps, you can always contact our Customer Care Support team. They have the necessary tools like screen sharing to walk you through.

To contact us, here's how:

- Click the Help icon on the top right.

- Click Contact Us at the bottom.

If you have further questions concerning Roth 401(k), please feel free to reach back out. I'm always here to help. Have a great day!

12 Comments 12

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Glad to have you here with us, jwallace,

Let me help share information about setting up Roth 401(k).

A Roth 401(k) plan is a type of retirement plan. If the participant elects to designate a portion of their elective deferrals as a Roth contribution, then the designated contribution is taxed immediately and placed in a Roth 401(k) account. Earnings on the account accumulate tax-free. When the monies are distributed as part of a qualified distribution, the distribution is entirely tax-free. So the earnings on the Roth 401(k) account are never taxed if they are distributed as part of a qualified distribution.

The Roth plans are deducted after tax, therefore, the employee does not pay the taxes on the amount drawn at retirement. On the other hand, After tax means that this deduction item is taxable to taxes in which Gross Pay is the basis.

As for the Company contribution, per IRS requirements, the company contribution must be set up as a traditional 401(k), not as a Roth 401(k). You can check out IRS Publication 4530 for more information.

For other reference, I'm attaching a helpful article that you can check on: Set up a Roth 401(k) plan.

If you need further assistance with the steps, you can always contact our Customer Care Support team. They have the necessary tools like screen sharing to walk you through.

To contact us, here's how:

- Click the Help icon on the top right.

- Click Contact Us at the bottom.

If you have further questions concerning Roth 401(k), please feel free to reach back out. I'm always here to help. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

This doesn't seem to answer the question on how to set it up for the employer portion. What if the employee has both 401k and Roth contributions. How do you set up the employer match for both.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Greetings, @R2919.

Welcome and thanks for joining this conversation.

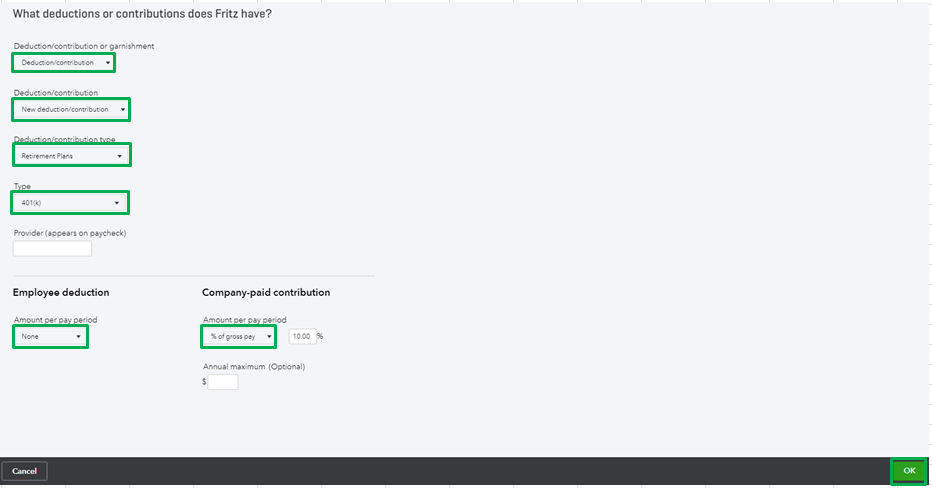

You can set up a company contribution for an employee who has both 401k and Roth. However, as per IRS requirements, the it must be set up as a traditional 401(k), not as a Roth 401(k). Here's how:

1. Go to Workers menu at the left pane, then Employees.

2. Select the employee's name, then click Edit in the Deductions & Contributions section.

3. Choose the following:

- Deduction/contribution or garnishment - Deduction/contribution.

- Deduction/contribution - New Deduction/contribution.

- Deduction/contribution type - Retirement Plans.

- Type - 401(k).

- Employee deduction - None.

- Company-paid contribution - the amount or % you need.

4. Hit OK.

That should do it. I'm also including these articles for additional information:

- Retirement plan deductions/contributions.

- Set up a Roth 401(k) plan.

- https://www.irs.gov/pub/irs-pdf/p4530.pdf.

Please let me know how everything goes or if you need further assistance. I'll be here to help. Take care and have a good one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

HI,

Thank you for that explanation. Are you saying that we should set up a Roth deduction with the employee contributions and then set up an additional 401K just for the Company contribution

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Thanks for reaching out to the Community, Bsnye.

The steps provided by my colleague, FritzF, detail how to set up a company contribution as a traditional 401(k). You'll be able to find additional information about entering deductions/contributions for retirement plans in the articles he included.

If you need assistance making an entry, Intuit has a tool called Find an Accountant which can be utilized to locate the right accounting professional for your business. Each ProAdvisor on this part of our website is QuickBooks-certified. They'll be able to provide helpful insights to drive your business's success.

Here's how it's used:

1. Go to https://quickbooks.intuit.com/find-an-accountant/.

2. In the Find an expert in section, choose what you're looking for, then use your search field to enter a City or ZIP code. 3. Select Search.

3. Select Search.

4. Browse through the results and find one that works best for your business. You can click on each ProAdvisor's profile to learn more information about them.

4. Browse through the results and find one that works best for your business. You can click on each ProAdvisor's profile to learn more information about them.

Once you've found an accountant, they can be contacted through their Send a message form:

1. Use your available text box to introduce yourself. Be sure to include details about the services you're looking for. 2. Enter the appropriate info in the Your name, Your email, and Your phone number (optional) fields.

2. Enter the appropriate info in the Your name, Your email, and Your phone number (optional) fields. 3. Hit Send message.

3. Hit Send message.

Additionally, many resources about using QuickBooks Online can be found in our help article archives.

I'll be here to help if there's any other questions. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

There is no employer contribution tab for 401k Roth

Just add the employee contribution as a 401kRoth

Then add another contribution for the employee as a 401k

Deduct 0 from employee and type in employer amount

This can all be done under edit employee

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

As of Jan 1, 2023 the rules have changed as follows:

Employers can offer matching contributions to Roth 401(k)s the same way they do with regular 401(k)s. Currently, however, that Roth match has to go into a regular 401(k) account, before you pay income taxes on it. The new rule gives employers the option to let employees choose between putting the match in a Roth 401(k) or a regular one.

With this in mind, how can I set up a 401k with a before-tax contribution option for the employer match? I can't seem to figure that out.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

I can help you set up a before-tax deduction 401 (k) in QuickBooks Online, Mita.

Make sure to choose the correct category when entering the retirement plan. This way, it'll be taken out of the account before taxes. I'll show you how:

- Open the Payroll menu, then click on Employees.

- Pick the employee's name.

- Go to the Deductions & Contributions section, and hit Edit.

- Go to the Deductions for Benefits section, and hit Add a Deduction.

- Choose Retirement Plans as the category and Before-tax Roth 401(k) as the type.

- Type in a description.

- Once done, click on Ok.

For more information about how you can manage plan deductions and company contributions, check this out: Set up supported retirement plans in QuickBooks.

You may also find this helpful when paying your employees: Create and run your payroll.

Just leave a reply below if you need extra assistance with payroll or QuickBooks in particular. The Community is available 24/7 to guide you. Keep safe!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Thank you. I am using Quickbooks payroll online, so these instructions don't match up. However, I was able to add the ROTH 401k as a deduction. It is the employer contribution that I am struggling with. I think I have found a solution in choosing the "Company-only plan" as a "type". That seems to be adding the company contribution after taxes.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Yes, I am having the same issue setting up a correct Payroll Item. The company wants to contribute to an employee's Roth IRA (not a company 401k), which would be an after tax deduction. It needs to be shown on the pay stub as a company contribution and added to the employee's overall gross pay, but expensed to a company payroll expense or employee benefit account. I cannot do this with an employee deduction payroll item. This should be Payroll Item setup as a company after tax contribution listed in Payroll Liabilities and then paid to the employee's financial institution. Maybe the Qb Devs should do end user work and they would see the issue.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

That response is for QBO, I have Qb Desktop. I need the Employer payroll item setup for the Employer to contribute to the employee's Roth IRA. Basically in increase to his gross wage but deducted after tax and paid to the employee's financial institution.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

After tax Roth 401(k) employee deductions & company contributions

Let me explain how you can set up an employee payroll item to contribute to the employee's ROTH IRA, CMego.

First, let's set up a retirement plan deduction or company match item. To do so follow the steps below:

- Go to Lists, then Payroll Item List.

- Select Payroll Item ▼ dropdown, then New.

- Choose Custom Setup, then Next.

- Select Deduction or Company Contribution, then Next.

- Enter the name of the deduction or company matching item, then select Next.

- Select the name of your retirement plan provider, or add it, and enter the account number. In the Liability account field, select the account that tracks the deduction or contribution to be paid. Select Next.

- For company match items, in the Expense account field, select the account that you want to track the item. Select Next.

- In the Tax Tracking Type window, select the applicable retirement plan. Select Next twice.

- Under Calculate based on quantity, select Neither and select Next.

- Leave the Default Rate and Limit fields blank. You can add the rate and limit when you add the item to the employee profile

- Click Finish.

Secondly, you can add items to the employee profile. Here's how

- Go to Employees, and then select Employee Center.

- Select your employee.

- Select Payroll Info, then add the retirement plan items in the Additions, Deductions, and Company Contributions section.

- Enter the amount per period and the limits.

- Select OK, when you're done.

After setting them up, the amounts you or your employees contribute to a retirement plan will be reported on Form W-2. Ensure the retirement amounts are showing in their paychecks when you pay your employees.

In addition, QuickBooks offers several reports that cater to the different parts of your business and employees. You'll only have to customize them to ensure it shows up the right data. Check out this article for more details: Customize Reports In QuickBooks Desktop.

You always drop your comment down below if you need further assistance when adding a contribution. Remember, we're here to get you covered.

Log in today

Get expert help and peer support to tackle all your QuickBooks questions effortlessly.

Related Q&A

Featured

Hi Community! Have you felt overwhelmed learning QuickBooks Online? Are

the...

Make your QuickBooks Online invoices, estimates, and sales receipts work

fo...