Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThanks for coming to the Community for help, @ShirleyT.

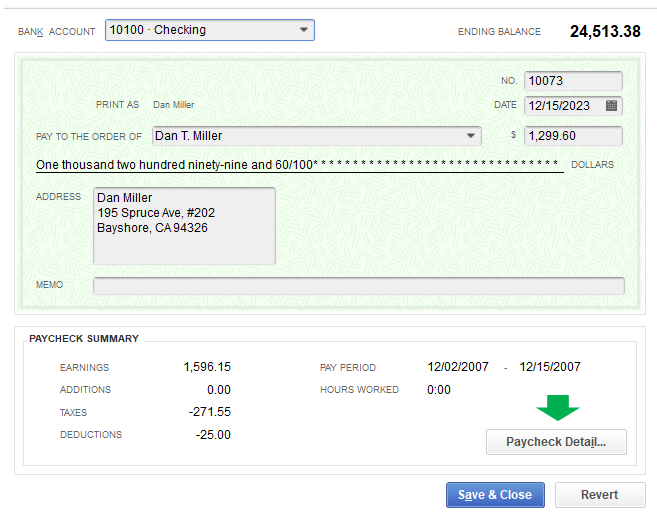

If you're already setup for DD, you can void the printed ones and run payroll again. This time, make sure to place a checkmark on the box next to Use Direct Deposit when creating the paychecks.

Check out this screenshot for visual reference:

Before making these changes, I recommend backing up your data to avoid accidental data loss. Then, follow these steps:

For more information about the process, take a look at this article: Void a paycheck.

Once done, create and send direct deposit paychecks to your employees. Here’s an article to serve as your guide: Send payroll and direct deposit paychecks in QuickBooks Desktop Payroll.

Know that I'm only a couple of clicks away if you need anything else. Have a great day!

I only want to void 1 check & direct deposit just that 1, not all of them. also I have already paid payroll liabilities, how do I fix this?

Thanks,

Thank you for getting back, @ShirleyT.

The steps provided by KhimG is the correct way to void a check and be able to process a direct deposit paycheck. It won't void all of the transactions, it'll just void the paychecks selected.

Since you've already recorded the payment in QuickBooks Desktop, you can delete it under the Payment History section.

You can skim these articles for more information about paying payroll tax liabilities:

Drop a comment below if you have any other questions. I'm always happy to help. Have a good day!

So I delete the payroll liability payments I made to fed & state before I delete the one printed pay check, then I process payroll liabilities all over again once I send the new check to direct deposit? Is this the process to correct it all?

Thanks,

I've read the whole thread, ShirleyT.

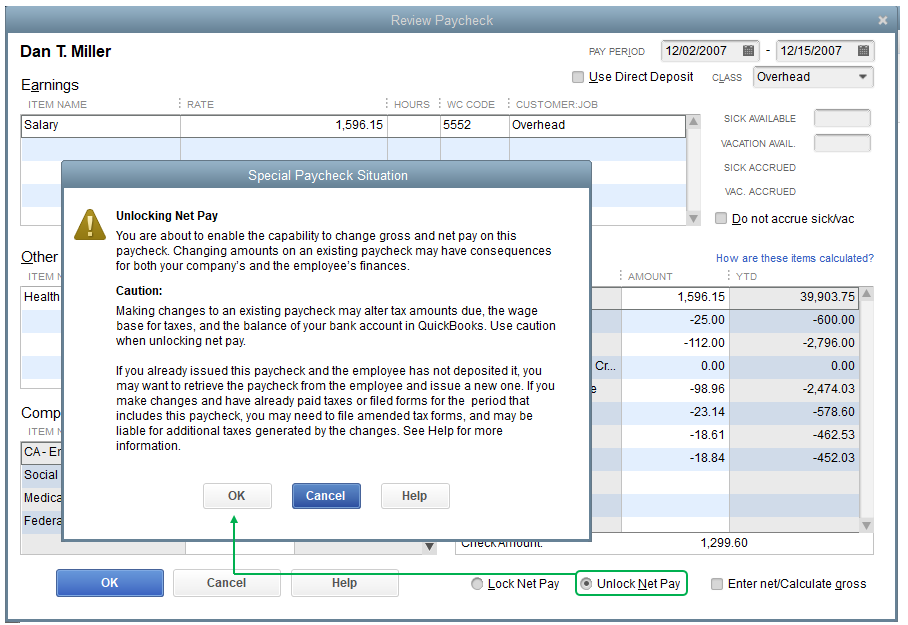

You can leave the liability payments as is. You'll just have to open the printed paycheck and place a checkmark on the Use Direct Deposit box. Once done, you'll be prompted to send it through direct deposit.

In case you want to change a direct deposit paycheck to a regular one, refer to this article: Change a direct deposit paycheck to a regular paycheck in QuickBooks Desktop Payroll.

Keep us posted if you have further questions. We'll be around.

Thanks so much your info was perfect, did not have to void check as others said, did not effect payroll liabilities etc.

Just tried this same process in DT 2024 and it does not work. Make the changes as listed but nothing happens. When I go back into the check detail, the DD checkbox is unchecked again.

I appreciate you for following the recommended steps above, Chris. Let me assist you further with updating your check details in QuickBooks Desktop (QBDT).

First off, let's make sure that you download the most recent release QuickBooks Desktop to avoid unexpected errors and ensure that your payroll is up to date.

Then, we can now void the printed check as long as it hasn't been cashed yet.

Here's how:

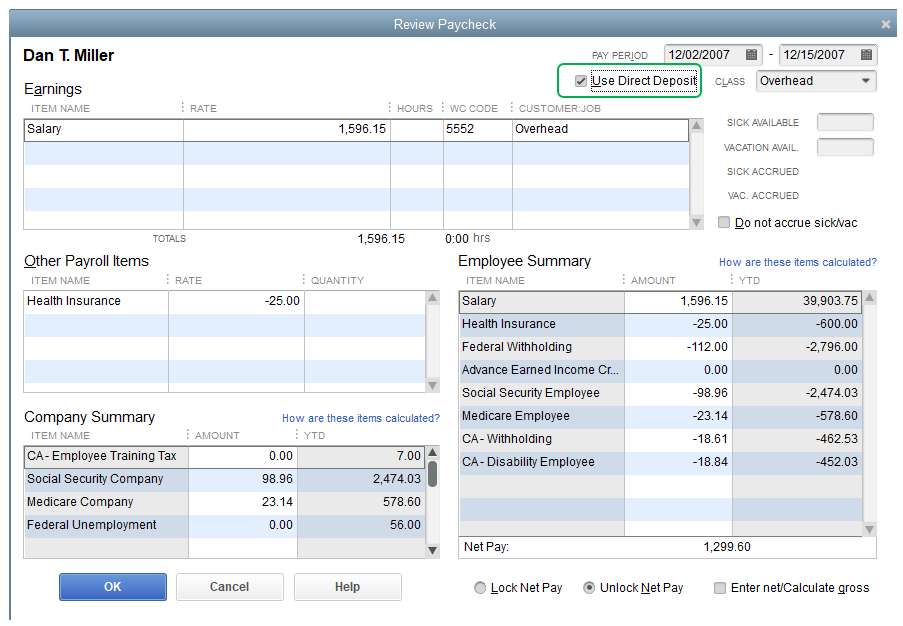

After which, ran your payroll again and make sure to check the Use Direct Deposit checkbox.

You can browse through these articles for additional details on managing payroll tax obligations:

Keep us posted if you have further questions with printing check and direct deposit or QuickBooks Desktop related concern.

QB and payroll are up to date. I've been running QB payroll for 20 years so I'm very familiar with how it works and its shortcomings. What I was looking for was a solution to this scenario:

- I usually do payroll direct deposit but due to an unexpected bank account change, had to print paper checks.

- The paper paychecks were mailed out and all tax liabilities paid.

- I had one employee destroy the check (long story) and asked if I could just direct deposit it instead. I don't have the paper checks for the new account yet.

- The new bank account is setup and fully functioning with Intuit direct deposit. This has been fully tested.

When I saw this older thread, I thought it would be the solution I was looking for but it did not work as described. I assume it may be a difference with the older vs new version.

I appreciate the detailed information regarding the transition from paper checks to direct deposit in QuickBooks Desktop (QBDT), @ChrisW115.

Choosing how to pay employees doesn't depend on the version of the application you're using. Rather, my colleague in this thread is correct about voiding the paper checks you have created and re-running the payroll through direct deposit. Here's how you can void it:

Once done, re-run the payroll and ensure to click the Use direct deposit option in the Preview Paycheck.

Additionally, QuickBooks offers several payroll reports that provide a comprehensive view of your employee's gross pay, deductions, and tax data. To learn more about these reports and how to access them, you can visit this article: Run payroll reports.

Please don't hesitate to add a comment if you have additional questions about managing payroll transactions. Take care!

Correct. Voiding the check was always an option. I was looking for a solution that did not require voiding the paycheck(s).

Thanks

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here