Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHi everyone,

This is my 1st time trying to do payroll with my company paying an employee's 401k. I have it all set up in payroll & followed an online tutorial for set up so I think I've done it ok. Here's my issue. I sent a test $10 deposit to the 401K bank account. I can see the transaction when I run a payroll report as a payment of $10 to the employee. When I open the pay check detail I can see the test $10 & the account line I set up for it in the other payroll items & also in the company summary showing the company match. My issue is when I go to reconcile, that $10 debit is not showing as a debit from the company bank account. Instead it's showing as a zero'd out transaction in the credits/deposits window of the reconcile. So my reconcile is off.

How do I fix this? Can anyone help me please? Thank you in advance for any help in this matter.

Good afternoon, @KJS.

Welcome back to the Community! Let's work together to figure out why this is occurring in the system.

What tutorial did you use when setting up the information within your QuickBooks Desktop Payroll? In addition, can you provide us with a screenshot of you reconciling?

In the meantime, I recommend reviewing these guides as a future reference for your business:

This will help us determine the next steps you need to take to get this taken care of. I'll be right around the corner when you're ready with those details!

Hi Candice, Thank you for reaching out to me. I followed this Youtube tutorial to set up the company match for a 401k:

https://www.youtube.com/watch?v=4rDng3Dii9U&ab_channel=LanceWilkins

Here is a screen shot of the paycheck detail showing the $10 test deposit set up in the pay check:

Below is how that $10 deposit shows under Deposits & credits in my reconcile window in the bank account I used to debit the $10 & send to the 401K account.

If anyone can tell me what's going wrong & how to fix this it would be most helpful. Thank you!

I appreciate you providing detailed information on your concern with your 401(k) contributions. You've put considerable effort into setting up payroll correctly. Let's collaborate to ensure that your records are accurate, KJS.

Your setup is already correct. When you use direct deposit to pay your employees, the paycheck will appear as $0, but the amount will be reflected in the direct deposit liability check. Please know that this amount represents the net pay for the employee and does not include any 401(k) contributions.

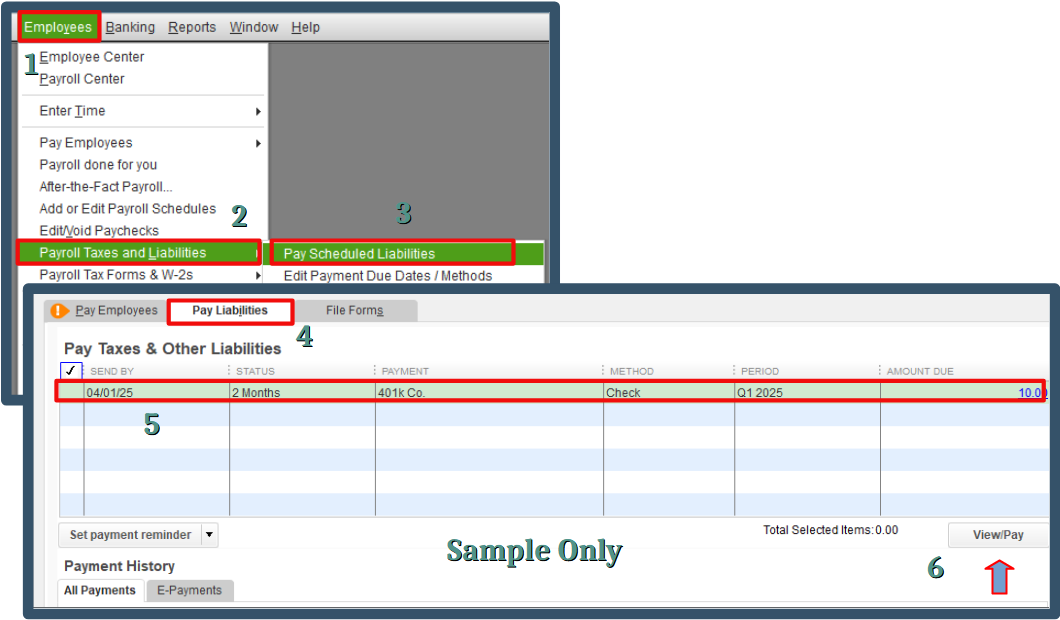

In your situation, we need to record your liabilities so that they will show as a debit in your bank account. Let's first set up a pay schedule by following these steps:

If you don't want to set a pay schedule, you can create a custom payment.

Afterward, let's pay your liability:

I would still recommend consulting your accountant. They can assist in making sure everything lines up with the company's financial records and guide your reconciliation process.

Moreover, I'm adding these resources as a guide in managing your employees and payroll:

Recording your liabilities and seeking advice from your accountant is the most effective approach in your case. I'm here to ensure you have the resources and support you need, KJS.

Hi ShyMae, Thank you for the detailed response. I am afraid this solution did not work. The company match 401k contribution is clearly on the pay check detail but it is not showing in the pay liabilities window. Nor is it showing in the payments history underneath the liabilities (I checked just in case I'd paid it from another account by accident). I also checked the payroll liabilities account under current liabilities & can see the test $10 401k company match there but it does not show up anywhere else that I can find. Any ideas?

Thanks for following up with the Community, KJS.

To properly identify why your company match isn't showing on the Pay Liabilities window, I'd recommend working with an accounting professional.

If you're in need of one, there's an awesome tool on our website called Find a ProAdvisor. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

Here's how it works:

Once you've found an accountant, they can be contacted through their Send a message form.

I've also included a detailed resource about working with retirement plans which may come in handy moving forward: Set up or change a retirement plan

I'll be here to help if there's any additional questions. Have a wonderful Tuesday!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here