Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowQuickBooks Desktop Pro 2018: When editing a workers comp code, I put the start date 7/17/18 and hit ok. Then I realized this was the wrong date. When I go back into that same code to fix it, I can't change the date to 5/17/18. Is there anyway to fix this date?

Solved! Go to Solution.

Thanks for letting me know about this, lsx3.

I can provide some insights about editing the Worker Compensation Code date in QuickBooks Desktop.

The program allows you to modify the Workers Comp Code settings once, which is why the start date can no longer be changed to 5/7/18. It's only the name and description you're able to alter multiple times.

Check out this article for further details:

Set up and edit Workers' Compensation

To make new changes to the date and code, please contact us. One of our specialists can securely access your account and modify the date for you.

You'll want to reach us through this link: http://payroll.intuit.com/support/contact/ and select your Payroll Subscription Type.

Don't hesitate to update me as to how things go. I'm still be here if you need anything else.

Thanks for letting me know about this, lsx3.

I can provide some insights about editing the Worker Compensation Code date in QuickBooks Desktop.

The program allows you to modify the Workers Comp Code settings once, which is why the start date can no longer be changed to 5/7/18. It's only the name and description you're able to alter multiple times.

Check out this article for further details:

Set up and edit Workers' Compensation

To make new changes to the date and code, please contact us. One of our specialists can securely access your account and modify the date for you.

You'll want to reach us through this link: http://payroll.intuit.com/support/contact/ and select your Payroll Subscription Type.

Don't hesitate to update me as to how things go. I'm still be here if you need anything else.

Thank you for replying. I called in to the payroll help desk but they said they couldn't change it. :( The customer service guy was connected to my QB on my computer but said there wasn't a way to change the date back to 5/18/18. Do you know of a way to change it?

Hi there, @lsx3.

I appreciate you reaching back out to us here in the Community. Allow me to provide additional information about changing Workers Compensation Code's date in QuickBooks Desktop.

As mention by my peer @VivienJ above, the program will only allow you to modify the Workers Comp Code settings once. This means that changing the date on your set up from 5/17/18 to 7/17/18 isn't an option for us. However, I'd suggest sending feedback to our Product Developers so they'll be able to know those features/options that your business needs the most.

To do that:

This way we'll be able to determine how we can help you run your business easier.

Please know that the Community has your back should you have any other concerns. Have a good one!

Did you ever find a solution? I have the same issue. The date is set, and Quickbooks will not allow me to correct it, making an already frustrating situation even more so.

Let me help you with this, @SaraBee.

You can update your Workers Compensation Setup to remove the assigned code. This way, you can enter the correct date in QuickBooks. I'll guide you how:

For more information, please click this article: Manual Workers' Compensation in QuickBooks Desktop.

I'm adding some articles about workers compensation that you may find helpful in the future:

Leave a comment below if you have more QuickBooks concerns. Take care.

Thank you for responding, @JoesemM. I think I understand the steps you discussed, but I have some additional questions:

I appreciate any additional help you might be able to provide. Thank you again!

Thanks for adding more details about your concern, SaraBee.

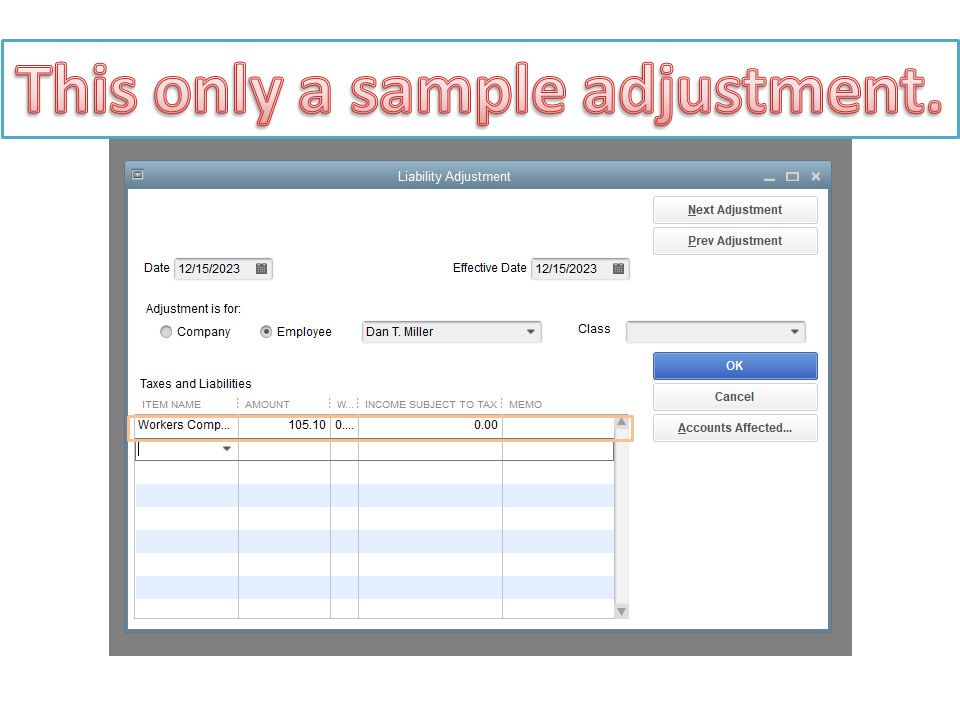

As mentioned by my colleague, recreate the code, and enter the correct one. This is to ensure you can enter the correct date. Then, perform a manual adjustment to keep your payroll records in order.

We’ll have to do this per employee to get an accurate amount. Also, the new rate will automatically apply to future payroll.

To start, pull up the Payroll Summary Report and select a per quarter date range to get the accurate amount for the employees affected. Here's how to open it.

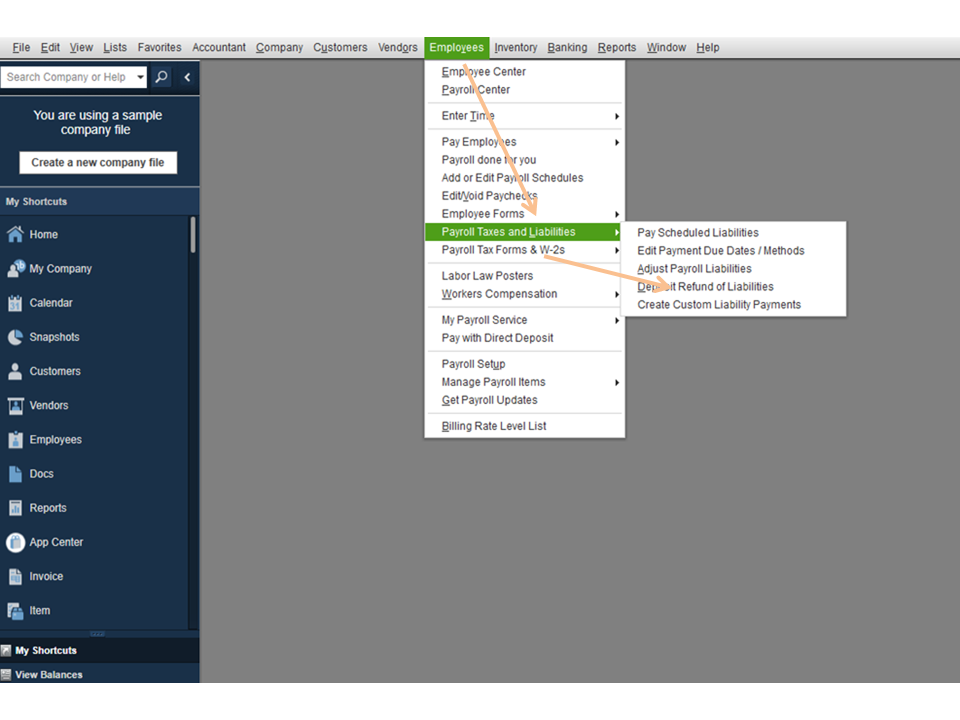

Once you have all the information, you can start creating liability adjustment. Here’s how:

For more insights into this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop.

Additionally, this guide provides tips to help resolve payroll tax returns issues: How to fix common Payroll errors in QuickBooks.

Click the Reply button if you need further assistance performing any of these steps. I’ll be glad to help and make sure you’re taken care of. Enjoy the rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here