Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowGood afternoon, @hammertime! Hope your day is going well so far. :)

I definitely want to help you with this reimbursement but I have a few questions to start. Are you doing this on QuickBooks Online or Desktop? Are there any other earnings or items filled in beside the reimbursement?

Looking forward to your answer so we can continue to troubleshoot!

I understand how to create the employee reimbursement via direct deposit, but how do you expenses it to the correct category?

we use QuickBooks desktop - can I reimburse an employee for an expense (non-payroll transaction)?

do I enter a check (from Banking icon then 'Write Checks') and select the employee and code to an expense account? I would like to be able to process the reimbursement via the direct deposit bank account already in our system for payroll.

Please help - many thanks.

Thanks for joining this thread, ShulyM.

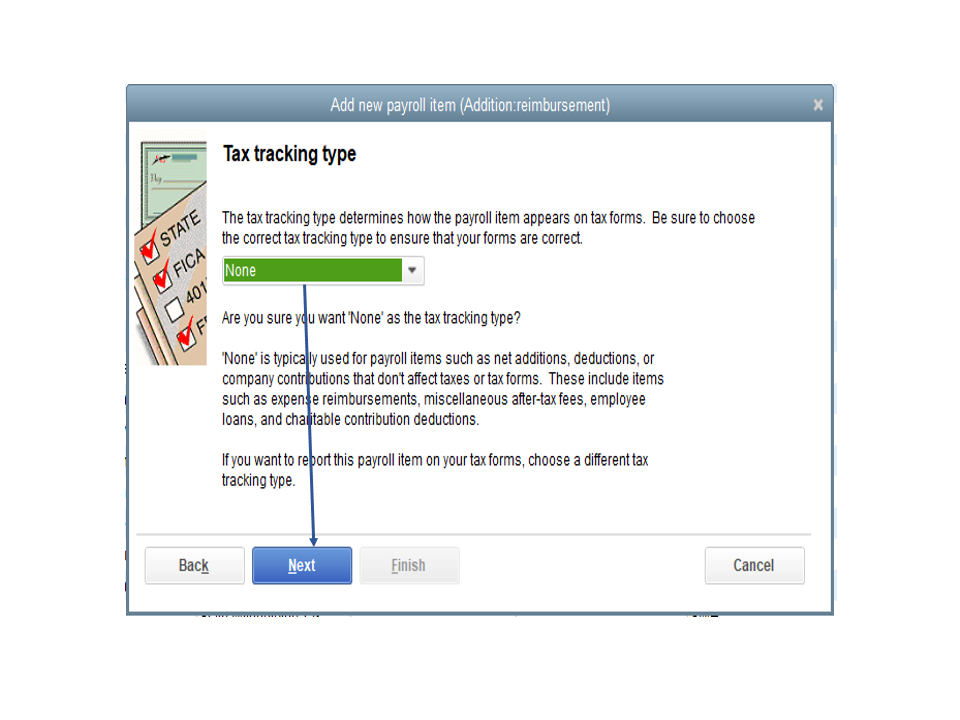

In QuickBooks Desktop Payroll, we use a non-taxable addition payroll item to track the employee’s reimbursement. I’ll help and make sure the process is a breeze for you.

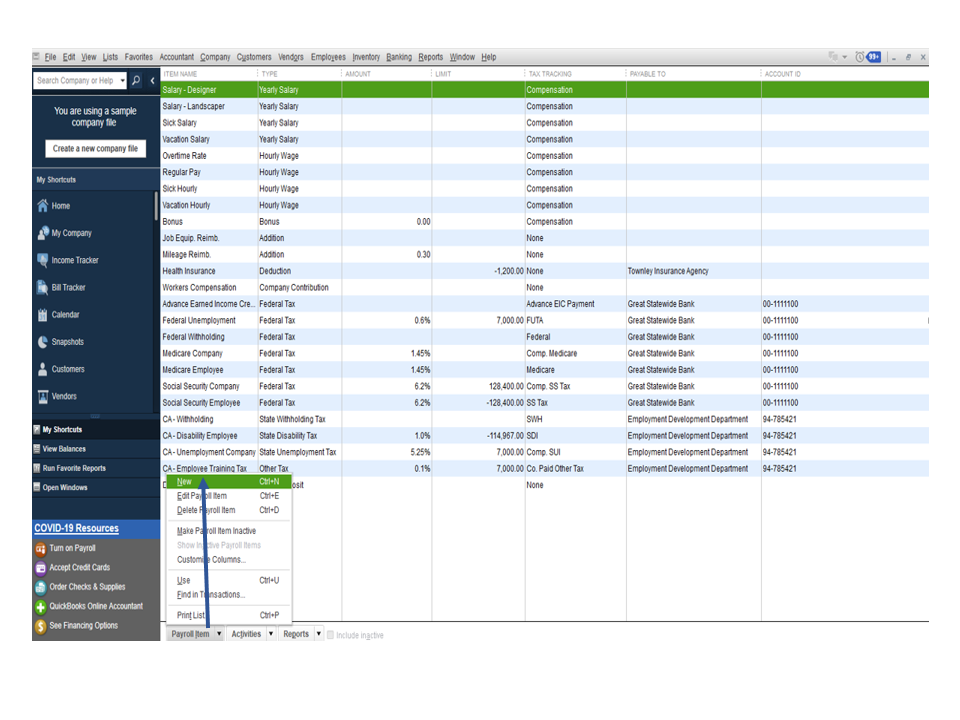

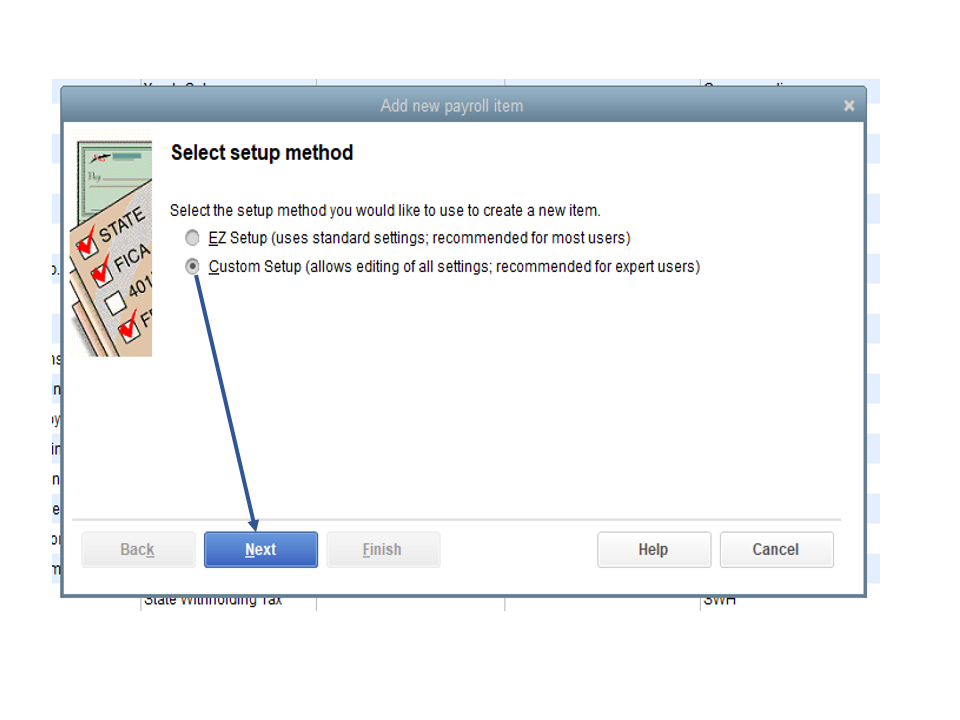

To add the payroll item:

Now that we’ve added the reimbursement pay type, link the item to your worker’s profile. For detailed instructions, go to the Add the item to the employee's record section in this article: Create a non-taxable reimbursement payroll item.

When you create paychecks, the addition item will appear in the Other Payroll Items area of the Preview Paycheck screen.

Do you need assistance performing any payroll tasks in QBDT? No worries, here’s a link that lists all our self-help articles. They’re grouped by topics so you can view each one seamlessly: QBDT payroll.

Stay in touch if you have additional questions or other concerns. I’ll get back and answer them for you. Enjoy the rest of the day.

Appreciate the detailed reply.

At times we do those reimbursements with our payroll runs.

Is there a way we are able to only run reimbursements via direct deposit?

Hi there, ShulyM.

Welcome back to the thread. I'll ensure you're able to run reimbursement for your employee through Direct Deposit in QuickBooks Desktop.

You can and reimbursement to your next Direct Deposit payroll schedule by adding an item for reimbursement.

Here's how:

Once done, you can now pay/run your scheduled payroll. To see additional information, you can click this article: Set up and pay scheduled or custom (unscheduled) liabilities.

Please refer to this article to see different information on how various payroll tax forms work in QuickBooks: Payroll 101.

Let me know if you have other questions about reimbursing your employee through Direct Deposit. I'm always here to help.

Let me help you reimburse an employee via direct deposit, maksengineers.

If you are using QuickBooks Online (QBO), just access the Payroll menu to route you to the Employees page. From there, you can set up the Reimbursement item. Here's how:

When you're ready to pay your employee, just follow the steps below:

If the same thing happens, let's try signing in to your QuickBooks Online (QBO) account using a private or incognito window. This mode doesn't use the existing cache data and helps us confirm browser-related issues. Here's how:

If it works, go back to your regular browser and clear the cache to delete those temporarily stored files and browsing history. The overtime collection of data can create corruption, however, removing this should fix the issue. You can also use supported, up-to-date browsers to roll out the possibility of a browser-related issue.

Feel free to visit our Payroll page for more insights about managing your payroll in QuickBooks.

I'd like to know how you get on after trying the steps as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

Did you ever get an answer to this Hammertime? I am getting the same error message as you did...zero net income even through it was not zero. I just need to run a direct deposit for an employee for mileage reimbursement. Thank you!

Thanks for checking in with us, HRG2021.

I've checked our records and there's no reported case about the Net pay must be greater than 0 error message. If you are using QuickBooks Online (QBO), let's try signing in to your account using a private or incognito window. This mode doesn't use the existing cache data and helps us confirm browser-related issues. Here's how:

Then, try reimbursing the employee through direct deposit by following the steps below:

When you're ready to pay your employee, just follow the steps below:

To learn more about this one, see the Reimburse an employee article. If it works, go back to your regular browser and clear the cache to delete those temporarily stored files and browsing history. The overtime collection of data can create corruption, however, removing this should fix the issue. You can also use supported, up-to-date browsers to roll out the possibility of a browser-related issue.

If the same thing happens, I'd suggest contacting our Payroll Support Team. They'll pull up your account in a secure environment and help you with this one. You may call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one.

Feel free to visit our Payroll page for more insights about managing your payroll in QuickBooks.

I want to make sure everything is taken care of for you, please let me know how it goes or if you have any other issues or concerns. Just leave a comment below and I'll get back to you. You have a good one.

If I pay my employees a reimbursement this way will it be reflected on their W-2s?

Hi there, SashaTHPLaw.

The reimbursement pay won't show up on the W-2 and other federal forms.

Here's an article that describes each pay type in QuickBooks: Supported pay types and deductions explained. It also tells you how each impacts federal taxes and forms.

If you see that amounts on the W-2 form are incorrect, here's how to fix them: Learn what to do if you or your employee finds a mistake on their W-2.

Let me know if you have other payroll concerns aside from knowing if a reimbursement will appear on the W-2 form. Just leave a comment below, and I'll get back to you.

I have followed the steps to process a reimbursement direct deposit for an employee. However, when I select "Preview Payroll" I I keep getting the alert - "Net pay must be greater than 0. To pay David xxxxx, increase the pay or decrease the deductions. To exclude David from this payroll run, clear the checkbox."

How do I clear the deductions for this pay only? I have already checked off the box for "Skip salary for this time only".

Hello, Rah4rah.

Let's work together and fix the alert, so you can process your employee reimbursement.

We'll want to delete the deduction temporarily from the employee's profile. This way, we can process the reimbursement normally.

First thing's first, be sure to take note of the deduction details before deleting it.

With that said, here's how to delete the deduction:

Now, process the payroll normally to pay the reimbursement to the employee.

After reimbursing, add the deductions back to their account with the same details and such.

For more details about reimbursing an employee, we can check this article: Reimburse your employee.

Need to review your employee's year-to-date payroll details? We can take a look at this article for a guide on how to run specific payroll reports: Run payroll reports in QuickBooks Online Payroll.

Let me know if you have questions about managing your payroll. If you have concerns about your taxes or any entries in QuickBooks, feel free to add them to your reply. I'm always here to help.

How do I only pay a reimbursement when employee is enrolled in autopay? I don't want to pay the wages, just reimbursement. I'm using QB online. When I go to Employees and then choose this particular employee, I don't see an option to do just a reimbursement or one time payment. Nor do I see the a small pencil icon beside the word Pay (as listed in these above instructions). Thanks!

I can provide some information about adding an expense using auto payroll, ARCbkp.

You may need to pause Auto Payroll for a period and pay your employee manually to add an expense reimbursement. Here's how:

Here's an article you can refer to for more details about turning on and managing your Auto Payroll. If you haven't already created the Reimbursement item, simply follow the steps below:

When you're ready to pay your employee, follow these steps:

Feel free to visit our Payroll page for more insights about managing your payroll in QuickBooks.

I'd like to know how you get on after trying the steps as I want to ensure this is resolved for you. Just reply to this post and I'll get back to you. Take care always.

How do we add the receipt for the expense that was reimbursed via QBO payroll? I can't seem to find a way to pull it back up so that I can attached the expense receipt.

Thank you Mary. I was having a hard time because I need these reimbursements to be attached to a job/customer. The expense option under the job doesn't give the option to direct deposit to the employee. But if I put it in as an expense, it would show up on my check register even though I reimbursed the employee through payroll. This journal entry allows me to record the expense on the job and reimburse through direct deposit.

Robbin

Thank you for posting your concern here in the QuickBooks Community,

@RobbinN. Let me share more information about reimbursement.

Putting the reimbursement as the expense will show in the check register even if we reimburse it through payroll. And yes, creating the journal entry will allow you to record and reimburse through direct deposit. The other way we can do this is through payroll. Follow steps:

To attach this to the job/customer, follow the steps: Enter the other information:

To run and add the reimbursement to your employees:

Moreover, let me share this article to learn about changing your payroll admin or contact: Change your primary principal, payroll admin, or other payroll contact.

Keep me posted if you still have questions about your payroll. Have a lovely day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here