Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowWe want to reward our employees who have good attendance by giving them 8 extra paid time off hours each quarter. I am calling these hours Eureka hours and I have created a PTO call in TIME call Eureka. I didnt created this code in QB online payroll.

I want them to be able to request this PTO from their workforce APP whenever they want to use ir for time off.. Just like vacation.

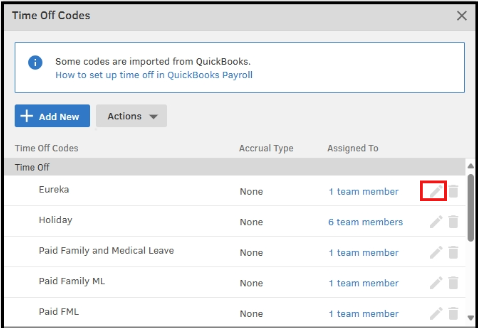

I created the code but I don't know how to enter a balance for this code in TIME. Not all employees qualified so I will need to pick and choose employees.

Thanks

I think i may have found the place where I add balances, but when I try to save the balance it says:

"you need to configure Accrual Settings for this person before you can adjust their ledger"

Thanks

laura

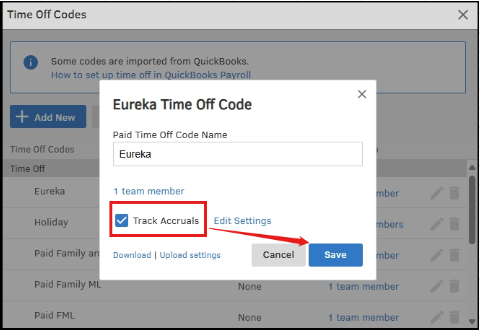

We can easily streamline this process by enabling the Track Accruals option, LDO.

Here's how you can do it:

If you have additional questions, feel free to leave them in the comments, and we will assist you promptly.

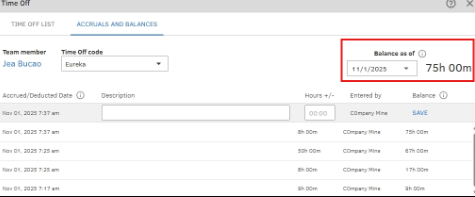

Not yet! Are the PTO codes you show in your example supposed to show up on an employees stub?

I want the employees to see how many Eureka hours they have taken.

Thanks

LDO

Good evening, @LDO.

Thanks for checking back with us. I hope your day has been great so far.

Since you have your Eureka hours set up in QuickBooks Time, you'll need to set up the Eureka policy in QuickBooks Online (QBO) Payroll and link the time tracking in QuickBooks Time.

In QuickBooks Online Payroll:

Once a time off policy is correctly set up and used during payroll in QBO, the used hours, accrued hours, and available balance should automatically appear on the pay stub.

For more information about this process check out these help guides:

That should do the trick. Please let me know if there is anything else I can assist you with. Have a good one!

Will the fact that I originally set the Eureka PTO code up first in Time before I entered it in Payroll have any adverse effects?

Thanks

LDO

Hey there, LDO. Hope you're doing well!

To answer your question, no, having the Eureka time set up in QB Time first won't matter. As long as it is also entered in QBO Payroll you'll be able to link them.

You know where to come if you have any other questions. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here