Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Under CARES, an employer can now make tax free contributions to an employee's student loans, up to $5,250 a year. I would like to input this in quickbooks online but it does not appear possible.

The only screens on the deduction/contribution screen, that allow for employer contribution, are those that are pre-assigned by Intuit, like 401k. If you go to other contributions/deductions, for "other," it will only allow deductions from the employee payroll. I would like to make the contribution on behalf of the employee, we are not trying to have it deducted from their bi-weekly pay.

Are there any suggestions on how to get this done, or is Intuit going to be adding Student Loans as a contribution option?

Hello, @LawPro90740.

Intuit is working diligently to get all the CARES Act updates included in QuickBooks. I'm glad you're wanting to do more for your employee by contributing to their student loan debt. However, there's no current way to input the tax-free contribution to employee's student loans. Rest assured, when we have more information on this topic; I'll gladly provide an update here. In the meantime, you can check out our blog page for any new updates to QuickBooks Online.

Thank you for reaching out and having patience with us during this tough time. Take care!

Thank you for the response, Anna.

Hi Anna. any update on this? Estimated date that it'll be implemented?

Hi there, LCD2.

Thanks for joining us in the QuickBooks Community!

For now, there's no date yet when QuickBooks Online Payroll will have this option. As shared by Anna S, you can visit always our QuickBooks Blog for the new updates and innovations.

I've added these links for more details about payroll:

I'll be glad to assist you if you need anything else. Wishing you all the best!

Any Updates on this?

Hello there, gb95,

This type of employer contribution is still unavailable in QuickBooks Online.

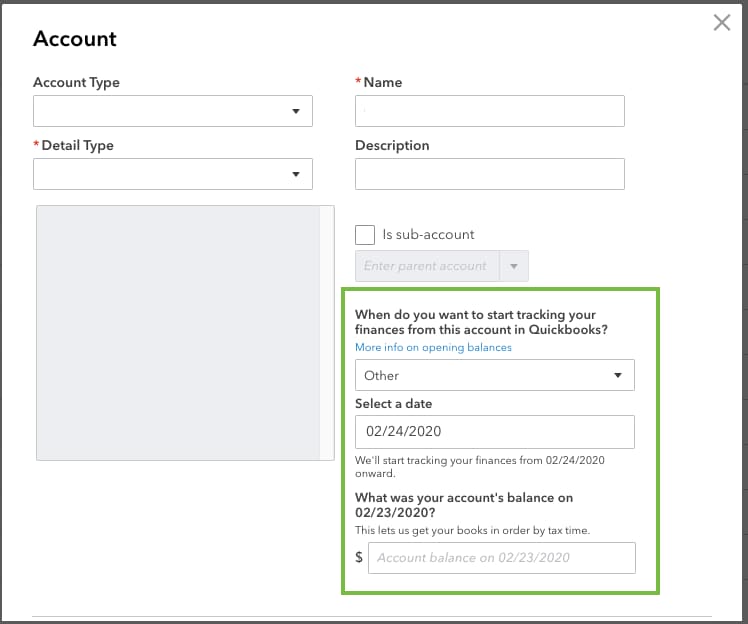

You can add an account in QBO instead. However, you're unable to add it on the employee's payroll. Thus, it'll be manual tracking. You can check with your accountant on how to do this correctly.

Here's how to add an account:

Check this article for reference: Understand the chart of accounts in QuickBooks.

Let me know if you need further assistance.

hi

I don't think this is a good solution because I need to be able to display the benefit on my payroll reports. Especially for purposes of the PPP Loan Forgiveness and as support to show funds being used for payroll and benefits for the stimulus loans (EIDL).

When will QB have this field available?

We are in the same boat, any update or timeline when this will be complete? When the whole PPP loan deadlines approaching I’d imagine a lot of people are looking for this functionality

Thanks for joining the thread, @mavergara25.

Allow me to provide an update on entering student loans as employee contributions.

The ability to add student loans as employee contributions would be a great option to add to QuickBooks. However, we don't have an estimated time as to when our Engineering team will add this feature. I will personally submit feedback to them in hopes of getting an update or an estimated time on when the feature will be added.

In the meantime, I suggest following the steps provided by my colleague @MaryLurleenM above to manually track the amount you've paid towards your employee's student loans.

Feel free to hit the reply button if you have any other questions or concerns. I'm always here to lend a helping hand.

Any updates on having this added to the QB payroll functionality? This is a pretty big issue that QB Payroll engineering team should be focused on.

Anna, what is the update on this? We are nearing the end of the year and we need to get this paid out under payroll. It's been months since this was enacted.

Anna, is there an update on this? It has been months since the legislation was enacted, we're nearing the end of the year, and all the other payroll providers have this feature. This is a huge tax loss if we can't make this contribution for employees simply because QB isn't adding it to their feature base. As the other poster noted, it's something that needs to be run on our payroll reports.

I'm here to help enter student loans in QuickBooks Online Payroll, LawPro90740.

Tracking the employer student loan contribution needs to be done manually in QuickBooks.

Hence, creating a liability account is the first step you'll want to set up. This will track the loan taken by the student. You can refer to the instructions provided by my colleague @MaryLurleenM.

Also, it's best to consult with your accountant or tax adviser before setting up the account. This is to ensure your books are accurate.

Once done, you can set up a cash advance repayment deduction and assign it to the employee. Then, link the liability account to the payroll item on your preferences.

Here's how:

Doing this will post the payroll transaction to the account you've created above.

Stay in touch if there's anything else you need concerning payroll. I'm always right here to help.

Here how to pay this going forward:

Create a new P/R Item - we used 2020-COVID Loan Assistance

Enter the Expense Account you currently use for Student Loan Assistance

Tax Tracking Type - NONE

Taxes - Nothing should be checked

Calculate based on quantity - Select "Neither"

Gross vs. net - Select Net Pay

Enter the Default rate and limit (if applicable)

FINISH

Then use this new code to reimburse your employees - TAX free for the remainder of 2020.

****PLEASE NOTE: This only applies to Student Loan Assistance give to employees AFTER March 27, 2020 and BEFORE January 1, 2021.

https://www.irs.gov/forms-pubs/exclusion-for-certain-employer-payments-of-student-loans

The only problem is if you have already reimbursed an employee and taxed them on the reimbursement, you need to contact Intuit to create a "Correction". This is the only way to receive your Employer portion of the taxes back.

I hope this helps at least 1 person.

How does this work on the self-employed quickbooks account?

How does this work with the self employed QB account? Is there an option to itemize that expense/deduction?

Hello there, cg101.

QuickBooks Self-Employed uses expense categories for the Schedule C form to report your income and expenses. A way to itemize or set specific accounts is unavailable. You can categorize a transaction and we ensure that we put it in the line item of your Schedule C.

You can use these articles for more details on how QuickBooks Self-Employed works:

As always, you can reach out to the Community if you have other questions in mind. You take care and have a great day!

Is there a category in schedule c to put this student loan payment? Can I just put it in other business expenses? or can a category be created that reflects it's for the student loan payment under the cares act?

I believe I figured out a work around for this. I didn’t use the suggested cash advance recommendation because it was still showing as an employee deduction which we don’t want. Instead, I created a “fake” insurance contribution. I had to do this because quickbooks only allows you to customize deductions, not contributions.

1. In your chart of accounts, make a Student Loan Assistance (or whatever you want to name it) Payroll Liability Account (I made mine a sub account under my payroll liabilities.)

2. Make a Student Loan Assistance Expense Account (I made mine a sub account under my payroll expenses.)

3. Go to an employee’s profile. Under deductions, select add new, then healthcare. Use any of the medical/vision/dental options (these are the only non-retirement accounts that allow this). I used Vision.

4. For provider, put Student Loan Assistance. Whatever you put here is what will show on the employee’s check. For example, I used the Vision account but on the check stub it reads Student Loan Assistance.

5. For employee contribution, put $0. I selected “pre-tax contribution” but I don’t think this matters since the employee isn’t contributing anything.

6. For employer contribution, choose if you want it to be a set amount or percentage of gross pay. Be sure to put the max as $5250.

7. Once you save the details, go to your Payroll Settings then Accounting.

8. Select the pencil by Company Contribution Expenses. Find the payroll item you created and select the payroll expense account you created in step 2.

9. Select the pencil by Other Liabilities and Assets. Find the payroll item you created and select the payroll liability account you created in step 1.

10. Done.

Even though you technically used a “healthcare” account, that doesn’t show in any of the reports. It’ll just show as whatever you name it, even when you run your payroll reports.

Hope this helps!

*Note that I’m not an accountant so please consult with yours. I was just someone looking to contribute to student loans and have accurate payroll records.

Since new legislation has extended this benefit through 2026, is Intuit going to create an item that tracks this correctly in Desktop and Online versions?

I've got some inputs about the student loan tracking item, @EA in Memphis.

Currently, our product engineers are all hands on deck in implementing all CARES updates both in QuickBooks Online and the Desktop versions. This way, you can track this student loan item seamlessly.

Meanwhile, you can follow the suggestions outlined by my colleague @MaryLandT or the workaround given by @TT1913.

Also, I'd recommend visiting our QuickBooks blog sites to keep you in the loop about the current news and product developments:

I appreciate your understanding and patience while we're working on this. Keep safe and enjoy your day!

When will this be updated? The year is almost over and we want to do this as a corp for a number of employees, but there’s no way to do it in online payroll.

Thanks for following on this thread, Maggiehollington.

As mentioned by my peers, our Payroll Compliance Team is working to update the Cares Act including the employer student loan contribution. This way, our customers can track the payroll item in QuickBooks Online (QBO). To record the employer student loan contribution, I still recommend following the solutions shared by my colleagues above.

I also invite you to visit the Community page for any updates about this one. You can go to the Resources tab to check the information.

For future reference, this link contains resources that will help make running your payroll smoothly: QBO self-help guide. The topics include payroll reports, processing payroll, taxes, forms, etc.

Don’t hesitate to leave a comment below if you have other payroll concerns. I’m always ready to help and make sure this is taken care of for you. Have a good one.

Has he issue of employer contribution to student loans been implemented in QBO Pyoll yet?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here