Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI've set up a child support garnishment for an employee of mine and it is deduction from his check, and I know that the company is responsible for sending this payment out. However, I am un able to find how to create a check in the quickbooks subscription that I have. I am using Quickbooks online payroll premium. Would I need to upgrade my subscription in order to create a check in quickbooks or how would I go about this? Or is there another way to get the payment?

There isn't a need to upgrade your payroll subscription in order to create a garnishment check in QuickBooks Online Payroll (QBOP), @raylynn_e. I'm here to guide you how.

Child support is a type of garnishment that you can withhold from your employee's pay in QBOP. QuickBooks calculates the amounts (given that you've already set it up on employees' accounts) on employee paychecks as part of your payroll service. Then, manually make the payment directly to the agency creditors as instructed in the garnishment order or tax levy.

The QBOP system does not create the check to pay non-tax liabilities such as Health Insurance premiums, 401(k) contributions, and Child Support. You'll need to create these payments from the Check screen

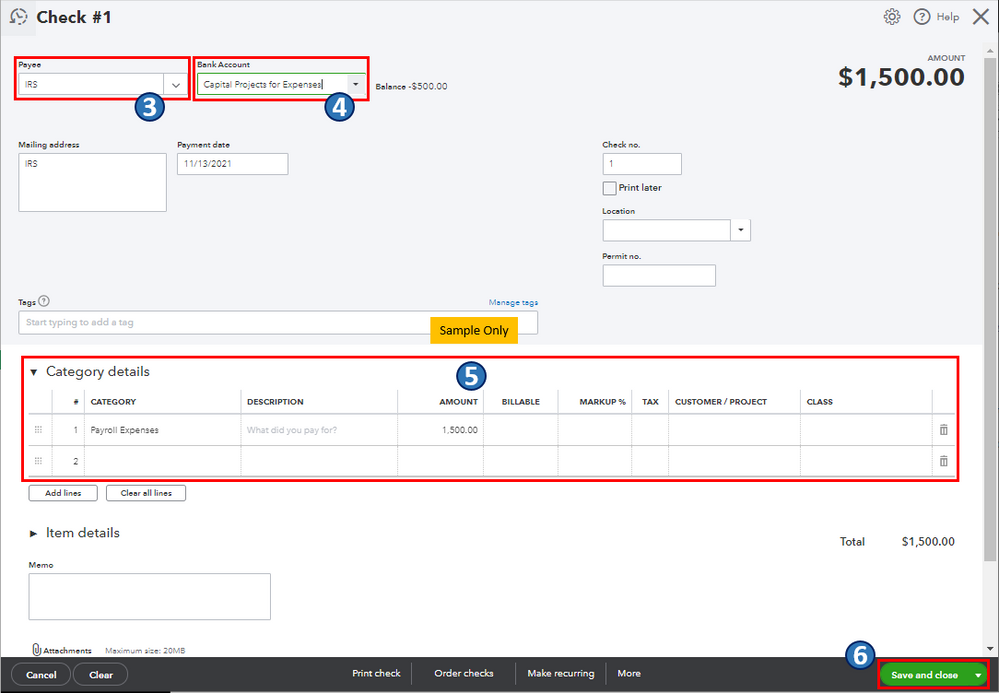

With this, you'll have to manually write a check from the + New button. That way, the payment to the tax levy officer will reflect into the system and you'll be able to reconcile.

Before doing so, make sure to create a new account in your Chart of Accounts to track your payroll expenses. To do this, go to the Chart of Accounts page and select the New button. Make sure to choose the appropriate expense account details in the Account and Detail Type fields. Please see the screenshot below for your reference.

Once you're done, you can pull up a payroll report (i.e., Payroll Deductions and Contributions) to verify the garnishment amount that you need to pay. Then, go to the + New button to create the check. For the step-by-step guide, here's how:

For the detailed steps on how to create a liability check, as well as its printing options and setting up recurring transactions, you can refer to this article: Create a payroll liability check.

In keeping with this, you can run a variety of payroll reports in QuickBooks to check and monitor your current liabilities and expenses. For the complete list of reports, you can refer to this article: Run payroll reports. It also includes topics about customizing, printing, and marking them as your favorite.

Let me know in the comments if you have other concerns about garnishment checks and managing employees and payroll account in QBOP. I'll gladly help. Take care, and I wish you continued success, @raylynn_e.

Can you tell me when the programmers are going to update the Quickbooks Online Payroll to the level of the Quickbooks Desktop Payroll? The online version is subpar compared to the desktop.

With the online version, you can not do half of what you could do with the desktop version.

I understand your expectations regarding the functionality of the Desktop Payroll feature in QBO. Let me impart a few details about this, @Julie_M.

Currently, we don't have specific information on when QuickBooks Online Payroll (QBOP) will be updated to match the features of QuickBooks Desktop Payroll (QBDTP), as only our product developers have access to that information.

Additionally, QBO focuses on automation and the capability to access files from anywhere as long as you have an internet connection. In contrast, the Desktop version offers more features but limits access to the company data to the computer or network where the file is installed.

For more tips and other resources you can use in the future, I recommend visiting our website: Self-help articles.

If you have any further questions about QuickBooks Payroll or Desktop Payroll, feel free to ask me. I'm here to help you, @Julie_M. Take care!

Clark,

The program can still be updated and have automation. You should not have to enter liability checks manually!!

This program is inadequate on so many levels. Intuit Quickbooks can and should do better! They should not force their clients to use an inadequate online system!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here