Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, christinelynn16,

Let's download your W-2 data and file it to the state agency.

There are states that QuickBooks supports W-2 filing. To verify if your state is included, I recommend checking out the Payroll Tax Compliance article.

If your state is included, you can choose to have it filed electronically or have the signature-ready form to be printed, signed, and mailed to tax agency.

Since you want to independently upload the W-2 to the local tax site, you can view, print, or download the copy of the form by following the steps below:

You can also pull up the Tax and Wage Summary Report or the Payroll Details report for further reference in filing the W-2 form to the state agency.

Once you have all the needed resources, you're now all set to file/upload your W-2 form independently.

For additional information, you can go through these articles:

Please don't hesitate to leave a comment if you have further concerns about filing W-2 form in QuickBooks. I'm just around if you need help.

While I appreciate the response, it wasn't terribly helpful. I have already tried to download the PDF of the W2 forms and upload those and the Ohio RITA will not accept that format. They specifically ask for a "EFW2 format" (which is created by the SSA -https://www.ssa.gov/employer/EFW2&EFW2C.htm).

As I mentioned in my original post since QBO does not support LOCAL tax filings, we have to file those independently (so no QBO cannot do that electronically as much as I would love that). Hence my request - the Ohio local authority RITA wants the W2 data to be uploaded in EFW2 format. I am assuming that since QBO does electronic filings with the federal government, it has the capability to create a EFW2. I would like to be able to download that format NOT a PDF.

Hello there, @christinelynn16.

Thanks for getting back to us. Allow me to join this thread and help provide some insights about W2 form in QuickBooks Online (QBO).

Intuit wants to make sure our customers are compliant with their state guidelines. However, in QBO, there's isn't an option to download the W2 data in EFW2 format. I can see how this feature would be helpful, you may want to submit this idea to our product developers so they'll be able to include this in their next product update.

Here's how you can send feedback:

You may also check the articles provided by ReaM on her post above to learn more about W2 in QBO.

Please know that you're always welcome to post if you have any other concerns. We're always here to help you out. Have a good one.

This is totally ridiculous and unacceptable.

I have clients in Idaho and Colorado. Not having an EFW2 file means that I'll either need to hire a person to manually enter all of those W-2s at the state level or mail them.

This isn't a "feature request": this is core product functionality. In these states the preparer has to submit the W-2s electronically if the form is submitted electronically. You can't honestly claim to provide e-filing of the Idaho Form 967 if you don't give me the file to upload!!!

I thought Intuit wanted *accountants* to see QBOA as a viable alternative to Desktop. How could that be when things like this come up? How could I possibly look another accountant in the eye and honestly suggest they move to this product from one that offers what they need to do their job (like QB Desktop)?

The answer isn't to have accountants beg for the minimum viable product. The answer is to apologize and fix it.

*BUMP*

It's now January of 2020; has QuickBooks fixed this yet? I have a bunch of W-2s that can only be uploaded in an EFW2 format, not PDF.

Just sending this as a last-ditch hope that QBO will step up and get something right.

For any accountants out there, make sure you read the new TOS (spolier: they aren't responsible if all of your data gets deleted or stolen; see (A)(8) and (A)(9)). You can find that here.

It won't matter next year: we're switching all of our clients away from QuickBooks Online. What with the regular service outages, no SLA (service level agreement: they aren't required to keep the software up and running), and unwillingness to add vital features, we can no longer serve clients reliably with this software.

I know where you're coming from, AltCPA. It's convenient to download the correct W-2 format.

Although, QuickBooks Online provides the PDF format only.

I've checked our records and already saw a submitted request for EFW2 format. I'll help you by sending another feedback to our management team. This way, it'll be prioritized.

If you have more concerns, don't hesitate to leave a comment below. We're here to help you.

Is the format available in QuickBooks Desktop? This will be my first year using the EFW2 format. Thanks in advance.

Hi jusdaraq,

It's nice to see you here again in the Community. You can follow these steps if you want to use the text file or worksheet format (EFW2) for your W-2.

Please check this article for more information about efiling state forms: E-file your state W-2s with Quickbooks Desktop Payroll Enhanced.

Reach out to us if you need anything else. I'll make sure to help.

What software program are you going to? Also ready to leave QBO

Hi there, @Katy_W.

Welcome to the Community and thanks for joining this thread. We have a variety of QuickBooks software to choose from. We have QB Desktop Pro, Premier, and Enterprise. For more information, see our price and pricing in this link: https://quickbooks.intuit.com/desktop/. It also includes answers to most of the common questions asked about QBDT.

You can also check out our comparison chart first should you decide to switch from QB Online to Desktop.

Just in case, here are our great articles for your reference. Read through:

Keep me posted if you have more questions about the process. We're always delighted to be your guide. Have a nice day.

I agree that this is totally unacceptable, Wisconsin requires the file in efw2 too.....to pay someone to sit and recreate our w-2 is unbelievable, such a disappointment in the online product.

QBO has to get this resolved. Every state is requiring information to be electronically filed. It's unacceptable QBO hasn't given us a way to generate an EFW2 file. EFW2 files have been around forever and it's crazy QBO has not implemented this yet.

We're taking note of your feedback and suggestion, @CEC86.

I know how important it is for you and your business to generate an EFW2 format in QuickBooks. As mentioned by my colleagues above, this option isn't available yet.

Please know that this request was already been submitted. And I personally want to make a follow-up to our engineers on your behalf.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one.

I have the same problem. Our city passed a new ordinance that requires all employers with 25 or more w-2's to file them electronically using the EFW2 format. My business is located in a tri-state area and we have employees that live in 3 different states, so creating a state e-file does me no good for the city filing.

***I am using QB Desktop Premier 2018. Sorry, I forgot to mention that in the last post.

Thanks for following on this thread, @SIX.

The functionality to file the W-2s using the EFW2 format is unavailable at this time. I suggest checking for a third-party application that integrates with QuickBooks and does the e-filing for you.

We treat all businesses fairly and know that each one has different needs, so I’m unable to recommend one. However, the Apps Center has all kinds of third-party software to choose from.

Simply enter a keyword in the Find Applications field box or select the category in the Featured Applications section.

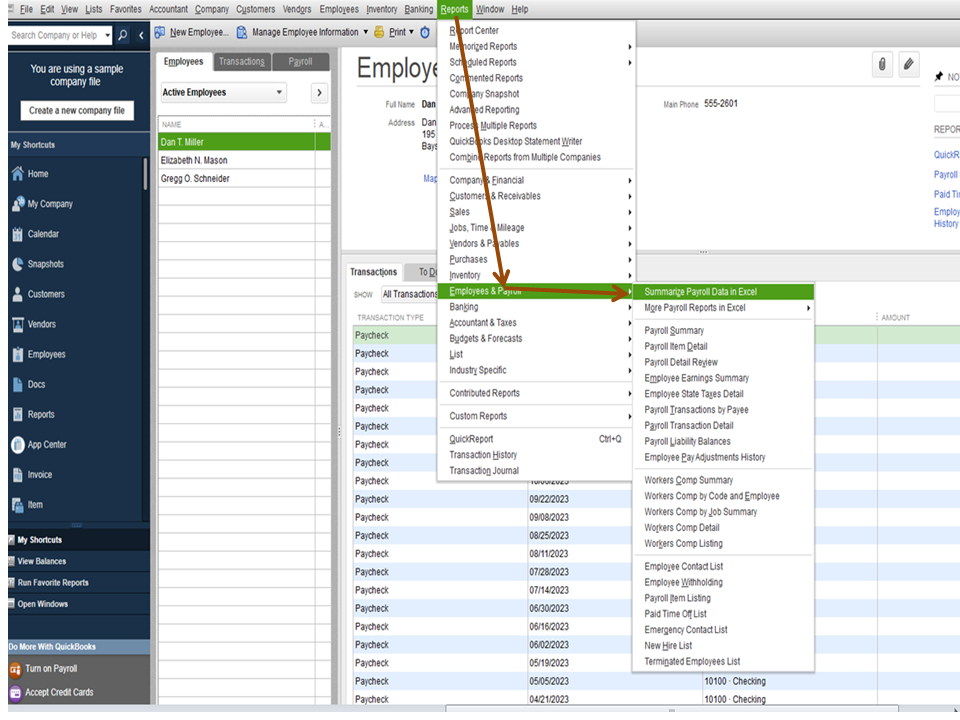

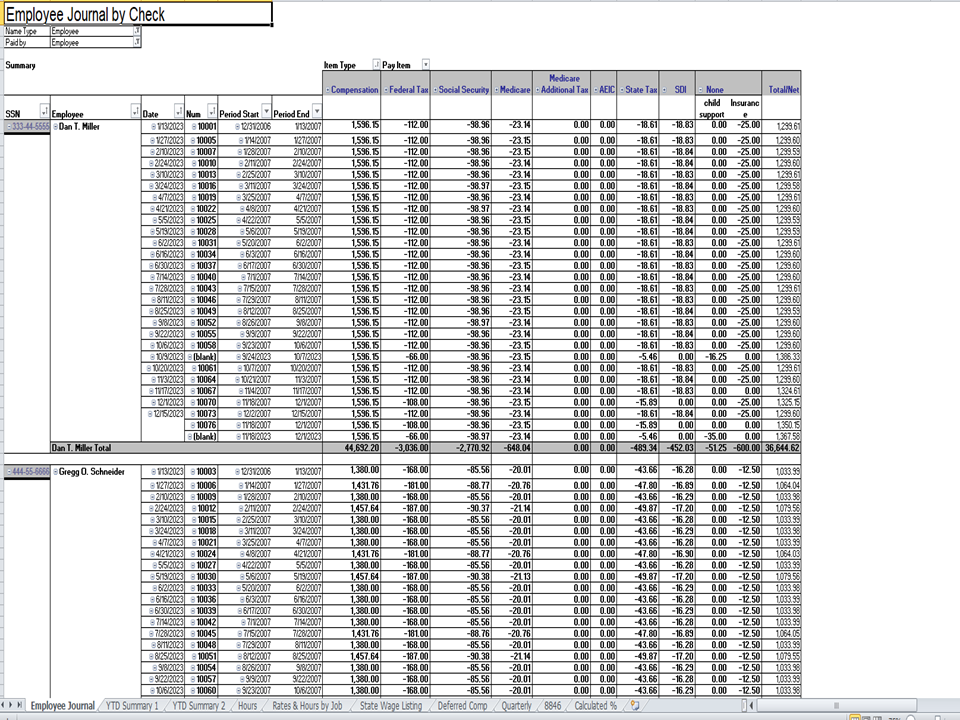

To get the payroll information, pull up the Summarize Payroll Data in Excel. Here’s how:

For future reference, let me provide you this guide on how to electronically file tax forms. It also includes a list of states that require W-2 filing: E-file.

Let me know if you have any other concerns or questions about QuickBooks. I’ll jump right back in to answer them for you. Enjoy the rest of the day.

Does QB generate an EFW2 file when we electronically file our W-2's with the Social Security Administration? If so, is there any way to access that file so we can just forward it to our local tax office? They have told me the SSA e-file would be fine as long as it is in the EFW2 format.

Hi there, @SIX.

Thanks for posting again in the Community. Let me share ideas about the EFW2 file format in QuickBooks.

We can follow the steps provided by my colleague @MariaSoledadG on how to create an Excel File W-2 format. This way, you'll be able to forward it to your local tax office.

For further guidance about the steps, you can click this article: E-file your state W-2s with Quickbooks Desktop Payroll Enhanced.

For future reference, I've provided these articles about W-2s that might help you:

I'm just here to help with all your QuickBooks needs. Take care.

I agree to not have this option is utterly ridiculous. I also want to electronically upload to the Ohio RITA. We pay so much for this payroll service, that to be able to create the file in the proper format should be included.

I am following this conversation.

What other options are available to send to RITA? And, the Ohio School Tax Reconciliation in Ohio Business Gateway?

Thanks,

Jean

Thanks for joining this thread, Jean.

At the moment, the option to generate a EFW2 format of your W-2 in QuickBooks is still unavailable. We wanted to make sure you get the support you need to file your form.

For now, we recommend that you reach out to your agency for further advise and instructions. They are the ones who can provide options for you, while the format you're looking for is still unavailable. Another option is manually filling out the information on the form based on the information you get from QuickBooks.

Post here anytime if there's anything else you need help with QuickBooks. I'll be right here to help you out.

Rasa,

I am unable to find a third party app that converts the data to EFW2 format. What do I need to search for to find such an app on QBDT Enterprise?

Hello there, @charodie. Let me share with you some insights about converting your W-2 format.

I try searching on my end for a third-party app that can help you convert the format of the W-2 form. You can click on this link to see the apps I can search to help you.

I would also recommend calling your state agency to get suggestions from them.

Also, here are some articles you can check to learn more about W-2s:

Let me know if you need additional assistance with W-2s. I'm always here to help.

Hi Christinelynn16,

I just successfully uploaded my W2s to RITA, however I spent about 7 hours modifying both the spreadsheet and notebook files that come from QBDT.

First, are you able to create an E-file State W-2, you should have done this to upload your W-2s to the Ohio Business Gateway.

I am on Right Networks, so I first have to save a portable copy of my Quickbooks company and then open that portable company on my local desktop. After that I am able to create this E-file State W-2.

On this excel spreadsheet under column S labelled School District Wages I put my local wages from box 18 on my W2s.

Then under column T labelled School District tax I put my local income tax from box 19 on my W2s.

Under column U you can put the localities name, but I don't think that is necessary.

Under column V you have to have an entry or the interview will not work. If you have no local tax taken out put 9999.

If you have a RITA municipalities put the 3 digit code associated with that municipality preceded by R0 (that is R zero).

https://www.ritaohio.com/TaxRatesTable

For any other municipalities I simply put the name followed by 0000.

*Note if you have school district tax taken out as well as local tax, it is more involved. For this file I did not worry about the school district taxes as RITA does not deal with them. Also, if you have more than one local tax withheld you need to create another row with that persons info, but $0.00 all the way across until you get to column S.

Now go to add-ins and create you EFW2.

Not done yet!

Take note of the notebook file, now you need to change that file as well. On that file there are 2 rows for each employee, the first row you will not be changing.

The second row after the RS39 you need to add that RITA code beginning with R0.

*Note there will be no spaces between the RS39 and the end of the persons name. For example John Smith had Cuyahoga Falls local tax withheld. His second line would be RS30R0220#########John (the #s are his SS#).

Next in that same row in the middle of all the numbers there will be an E, change that to a C for any employee that had local tax taken out.

Ok, you are ready to parse your file to see if it worked. Use RITA's file test application to check your file. https://cdn.ritaohio.com/Media/700630/Mmref.FileTester.Installer.msi

If all the numbers look good, you can go to RITA and upload. It is involved, and YES Quickbooks should be creating this file for us!!!!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here