Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello, I've worked with QB Support on this and have done everything that they have suggested and some of the reps have said it is a bug and others are saying it is working as designed which I can't believe to be correct.

QB Desktop Premier 2019 running a weekly payroll.

Setup a new Wage Garnishment to be taken out of the paycheck weekly.

Setup the liability to Payment Frequency = Weekly on Friday for the PREVIOUS Week's liability.

When I run the payroll today for Pay Period 8/1-8/7, the liability comes out correctly. When I go to pay the liabilities, the liability states it should be paid by NEXT Friday (8/21) and is for the NEXT pay period (8/8-8/15). This has happened consistently 3 pay periods in a row. It should state that I should be paying by this Friday (8/21) and that the money is for Pay period 8/1-8/7.

Tech Support says I have to go in to Create Custom Payments and fix the pay period that the liability is showing each and every week while development looks at this.

Thank you for your help

How are others handling this? I know I've got a workaround but this can't be what everyone else is doing.

I appreciate your time reaching out to us here, Isaiah58Financial.

I'll share some details and steps about the liability schedule. The payroll tax payment schedule would depend on your setup. Creating Custom Payments provided by our Tech Support is used to fix the problem right away. For long term resolution, let's make sure that you have the correct payment schedule by following these steps:

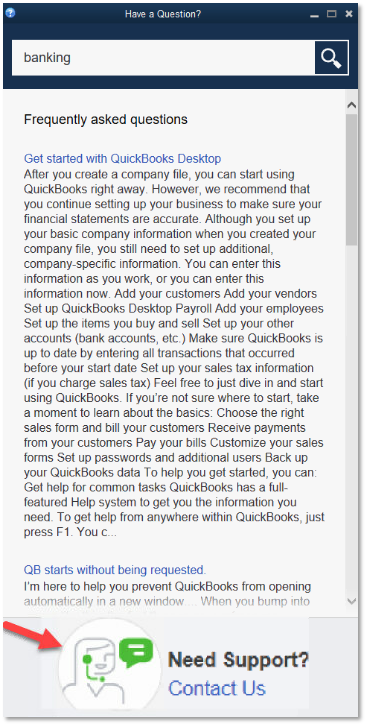

You can also set up a calendar notices to remind you of the upcoming payroll tax and liability payments. I've got this article for the instructions: Set up and pay scheduled or custom (unscheduled) liabilities.

If your tax information is set up correctly, then I recommend reaching out to our Customer Care Team. They can pull up your account and investigate what's causing the incorrect pay liabilities schedule. Before doing so, please check out our support hours here.

Should you have any follow-up questions or other concerns, please let me know. I'm here to help you some more. Take care and stay safe.

Hello,

As I had written, QB support has helped me and 2 of them believe this is a bug because I have it 100% set up correctly to pay correctly. There is an open bug for this issue that I hope will get looked at but other QB support reps said it is working as designed and as I said, that can't be correct.

I'm looking to see what others are doing to get around this problem. I have the workaround that QB support provided me but I can't believe I should have to do this every week.

@Isaiah58Financial I believe, unless your scheduled payroll has jumped ahead a week, that tge problem stems from you selecting a payment date (next Friday) that is exactly the same as the date of your next scheduled payroll. It may well be a bug but if you change the due date to Thursday for this upcoming payroll see what happens. The scheduling is only the reminder and due date and does not initiate payment.

Hello, I had been thinking the same thing and last week while QB support was on the phone with me trying to troubleshoot this, I said "for giggles, lets change the frequency setup from Friday to Monday and see what happens". I did and then ran a payroll and it still had the pay period as the FUTURE/NEXT pay period that the liability payment was for and not for the pay period that I just ran. Thanks for weighing in. Great minds think alike! LOL

My Pay Liabilities no longer shows the amounts to pay or any amount. If I run a Liability report there are amounts owed. Every time I try to enter payroll setup as you suggest above the system crashes Code: 11052200000. I email the report and do not hear back. I don't know what to do and the chat window seems to not be working.

Good afternoon, @srager.

Thanks for joining this thread. I'm here to share some information about the system crashing in QuickBooks Desktop.

If the system is crashing when entering the payroll setup, I recommend ensuring that QuickBooks Desktop and your payroll tax table are up-to-date. Below are several links I've provided for more detailed information:

Feel free to comment below if you have any more questions or concerns. I'm always here to help. Have a good rest of your day!

I tried that 1st. The system will not update the tax tables. I also tried to re-update the software 2nd.

Good afternoon btw. I tried all the updating before reaching out to you. I enter payroll manually and always have. The tax table update wants me to buy a subscription to QB payroll service 1st. I do not need the payroll service nor do I use the payroll tax tables/calculations to enter payroll. I already have the values to enter. I have been doing it this way for many years.

I appreciate you performing the troubleshooting steps shared by my colleague above, @srager.

In QuickBooks Desktop (QBDT), we highly recommend signing up for a Payroll subscription to make sure that you have the most current tax tables available.

Since you're entering payroll manually, let's perform another troubleshooting steps to get this fixed. To resolve issues that cause QBDT to stop working, let's run the Quick Fix my Program from the QuickBooks Tool Hub. Here's how:

I'm adding this article for more troubleshooting steps: Solutions for when QuickBooks has stopped working.

You might also want to check out this article to learn more about process manual payroll: Set up payroll without a subscription.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and stay safe.

Thanks. No luck. I am in payroll general preferences but "Manual Payroll" is grayed out (attached) and you can't get to it to click no matter how I try to click and unclick the other choices. Also the tool didn't work. I am still getting an error send report and no payroll liabilities showing up to pay. The system will not let me "update" as I do not have a subscription. I haven't needed one but I had one many many years ago. I have had no issues until now.

Hi srager.

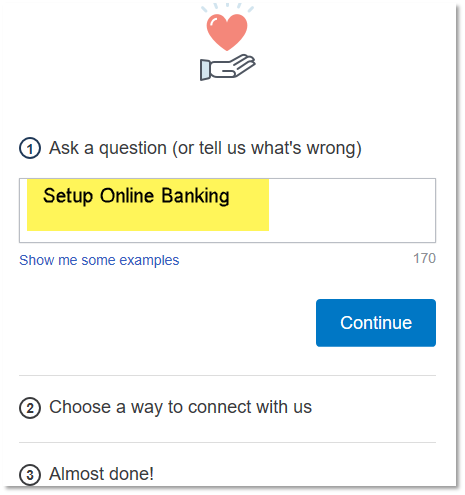

Thanks for stopping by the Community this afternoon. If you performed all the troubleshooting steps to no avail, I would recommend reaching out to our Support team, this is because they'll be able to guide you step-by-step on how to resolve your issue in a personal 1-on-1 setting in a screen share. To reach them follow these steps.

Check our support hours and contact us.

If you have any other questions or concerns, feel free to post here anytime. Thank you and have a nice weekend.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here