Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI'll make sure you're able to import your payroll info, @ksstoner26-gmail.

To verify, are you using a third-party application for your payroll? If so, I recommend contacting their support so they can assist you with the import process. The same goes if you're migrating from other programs to QBO. It is best to consult their payroll support to walk you through the steps.

Additionally, here's a link that covers all the tasks you can do when using QBO. It has topics with articles that'll guide you along the way.

I'd appreciate it if you can provide more details, as I want to ensure this is resolved for you. Just click the Reply button below and I'll get back to you as soon as I can. Take care always have a great weekend.

The issue is that none of my historical data from Desktop can be transferred. I just got off the phone with support and they say it cannot be done. I don't understand this. I can't lose all of my historical information because I refer to it often. I also requested a refund and was told no. I asked if the Desktop version, once upgraded, would retain the historical date and he could not answer that. I am so frustrated.

If I were on your shoe I would feel the same, @ksstoner26-gmail.

Let me share some information about converting your historical data from QuickBooks Desktop (QBDT) to Online (QBO). To begin, you can transfer much of the information from your company file without having to re-enter it manually. However, some pieces of information won't convert or transfer automatically with your file.

In this case, some payroll info doesn’t transfer because QBDT has more payroll features. This is how your payroll data will convert in QBO.

You can learn more about it in this article: What to expect when you switch from QuickBooks Desktop to QuickBooks Online.

With regard to upgrading your QBDT, you can restore a backup copy of your file to the new version. This way, you won't lose your historical data.

To create a backup, here's how:

After that, refer to this guide for the steps to restore a backup of your company file.

Additionally, you can visit our website so you can choose which QBDT suits your business. Here's the link: https://quickbooks.intuit.com/desktop/.

Please know that you're always welcome to come back to this thread if you have other questions or concerns about the program. I'll be happy to answer them for you. Take care and have a good one.

I have been dealing with the same problem for the last few days. I followed the phone instructions by Intuit personnel to Export and Upload our Quickbooks Desktop data to Quickbooks Online. Everything seemed to transfer fine except payroll information. Employee Direct Deposit information (bank routing and account numbers) and any Year To Day payroll did not transfer. Just a few minutes ago I was informed by Intuit personnel over the phone that this is a known problem. I could have saved myself hours of stress and suffering if I had known that.

We've decided to go back to Quickbooks Desktop. Quickbooks Online is not ready for primetime for companies switching from Quickbooks Desktop. I am going to let all of my collogues know of this deficiency.

I am having the same problem after being on the phone with them from sales, to migration to Desktop tech help for 3 1/2 hours. Online QuickBooks is definitely not ready for prime time. All employee payroll history has to be manually entered as well as vendor history. Totally not worth switching. I wish i had known this before I wasted all this time.

super frustrating, I am going through a worker's compensation audit and just migrated over from quickbooks desktop and have wasted at least 25 hours in the painstaking process, now I find out that all my payroll historical filings are not accessible, at least they show as gone, only this quarter. WTH is this CRAP I am so mad and disappointed and frustrated and feel trapped with quickbooks online, I can't imagine migrating back to desktop...

I wish you don't have to feel like inside a box, @Sam. Since QuickBooks products are different from one another, there are some features or details that won't transfer.

Importing the payroll details from QuickBooks Desktop into QuickBooks Online is currently unavailable. That's why you're unable to access them including worker's compensation.

For now, the only option is to enter prior payroll information manually. This way, it'll only carry over company and employee information. See this article for the detailed process: Set up a Prior Payroll.

To know which data you can transfer from QBDT to QBO, check out this guide: Learn how features and data move from QuickBooks Desktop to QuickBooks Online.

I've included our Year-End guide for reference. This article contains information that'll help you in filing your taxes.

Please let me know if you have any other questions in the comment section below. I'm always here to help.

We have some special reimbursements (employee share of SS/Medicare taxes) but when I enter the YTD payroll summaries into QBO it refuses to allow me to save the information bc it's not calculating a flat percentage of total pay toward Medicare/SS taxes.

We have our accountant adjust the W2s as needed at the end of the year. We're happy to go with another method of reimbursing employees, such as a year-end bonus, but in the meantime QBO won't save our YTD history of payments, and we can't start using payroll until the historic YTD payments reflect inaccurate pay histories.

Is there a workaround, or do we need to find another payroll provider?

Thanks for joining this thread, @sue11111.

This appears to be a duplicate post. My colleague has already provided an answer for you. You can refer to this link for your reference: https://quickbooks.intuit.com/learn-support/en-us/employees-and-payroll/migration-from-desktop-can-t...

We're always here if you have further questions about managing your employee taxes in QuickBooks. Stay safe!

I sit here and just realized the exact same thing! I'm in the middle of a workmans comp audit as well and have absolutely NO idea how to proceed. Just numb and sooooo pissed!

Gee thanks QB team. Since this is a KNOWN problem, how about you give your customers a heads up before they migrate from QB Desktop to QB online so we can make an educated decision on when do to the migration so we aren't wasting time trying to figure out the problem and then spending hours manually typing in the data in order to file our payroll tax returns.

You are in such a rush to score the upgrade/migration that no one cares to provide any warnings. QB needs to do better!

Gee thanks QB team. Since this is a KNOWN problem, how about you give your customers a heads up before they migrate from QB Desktop to QB online so we can make an educated decision on when do to the migration so we aren't wasting time trying to figure out the problem and then spending hours manually typing in the data in order to file our payroll tax returns.

You are in such a rush to score the upgrade/migration that no one cares to provide any warnings. QB needs to do better!

You can use the trial version to access your historical payroll data for good if required.

My issue is I now have to manually add every check in Q1 to QBO so I can have a full payroll report. I would have wanted 2 more weeks and made switch on 4/1 had I known. So this is incredibly time consuming and another way in which QB scares us over.

*screws

I got an error message that indicated an issue occurred and my payroll information was not transferred. I got this message when I tried to print my quarterly reports.

Good afternoon, @judyc2.

Thank you for following the thread and for sharing your concerns.

As my colleague ShiellaGraceA mentioned earlier, you can view a detailed list outlining how different payroll items are handled during migration.

If you're experiencing issues with manually entered items, I recommend reaching out to our Payroll Support Team. They’ll be able to review your account and take a closer look at what’s going on.

In the meantime, we encourage you to share your feedback with our Product Development Team. All suggestions are carefully reviewed and considered for future updates. We understand how important certain features can be to your daily workflow, and we’re committed to making continuous improvements to better support our customers.

Thanks again for reaching out, and don’t hesitate to contact us if you have any more questions. Have a great day!

Tori

You state - "In the meantime, we encourage you to share your feedback with our Product Development Team. All suggestions are carefully reviewed and considered for future updates. We understand how important certain features can be to your daily workflow, and we’re committed to making continuous improvements to better support our customers."

This is a KNOWN problem (original post started in 2021 and here we are in 2025 with the same customer complaint/frustrations). So the Product Development Team either did NOT "carefully review" or they deemed the issue not worth future updates as of 2025.

We'd really like to know if this will be addressed before I recommend any other clients upgrade from desktop to online.

How do I enter the l year to date pay roll info- there is no manual entry for just the paystubs

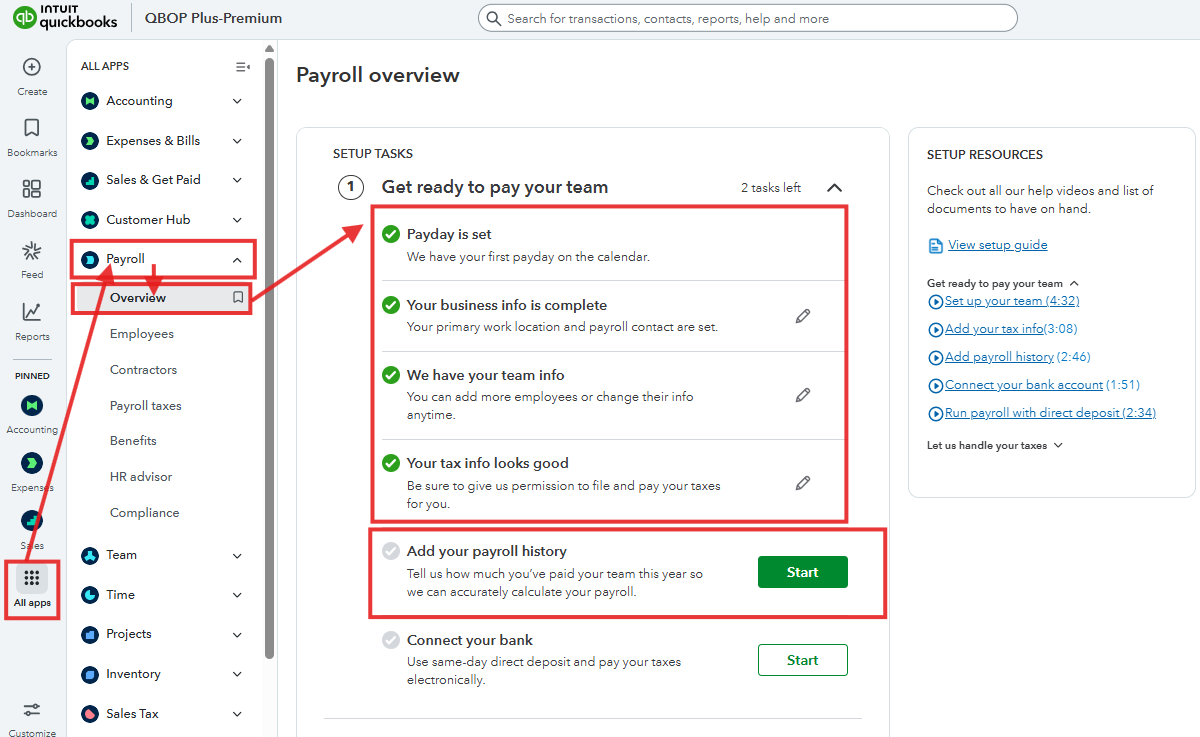

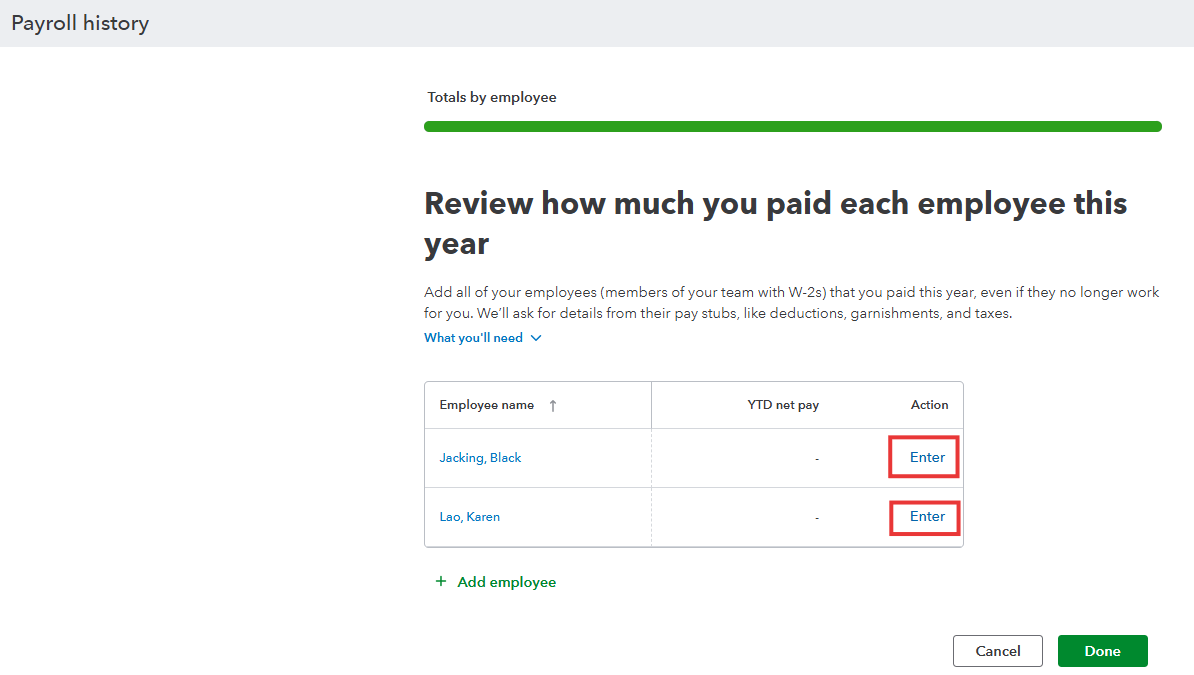

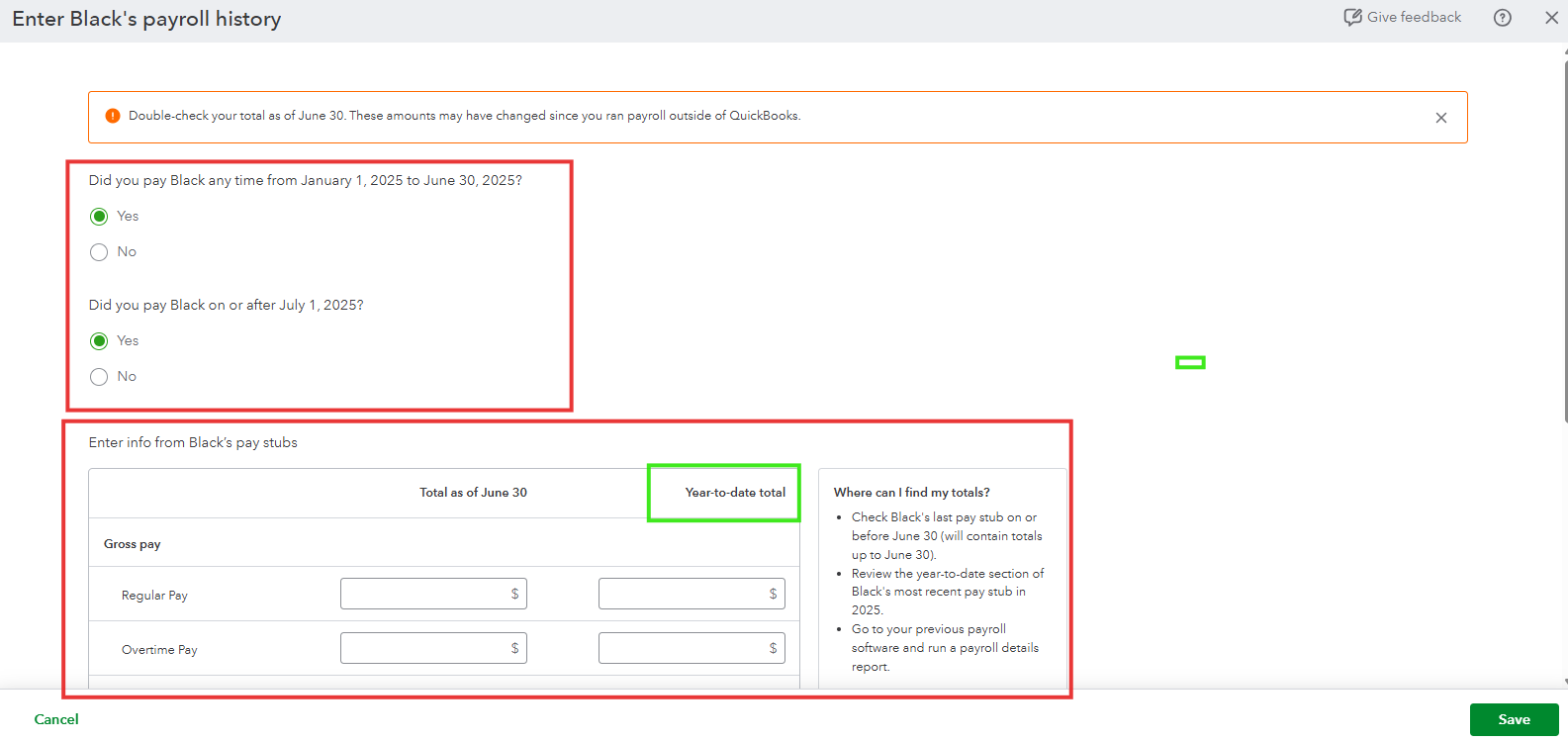

Here’s how:

Take a look at the screenshot below for visual reference:

For more information about adding prior payroll, I recommend checking this article: Add pay history to QuickBooks Online Payroll.

However, if you have already run payroll after completing the setup, it is not possible to enter prior paychecks into the system. We recommend reaching out to QuickBooks Live Support for further payroll assistance.

Please let us know if you need more assistance.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here