Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, bdaba.

There's no specific pre-set up deduction item for Roth IRA. However, you can select or use the Other after tax deductions and name it Roth IRA.

Here's how:

I'd also like to share this article for additional reference: Add or change pay types.

You can always count on us if you ever need help with QuickBooks. We're always here to assist you.

Hello there, amanda-armofcare.

In QuickBooks Online, you'll only need to follow these steps to add a retirement plan mandated by your state. Here's how:

If you want to run payroll reports in QuickBooks Online, you can check these articles for additional guide:

Please visit again if you have other questions. I'm right here to help anytime. Take care and stay safe always.

There is NO OPTION for Roth IRA or if you choose "other deduction" you are not able to choose "after-tax" option which is what is needed. This seems to be a major problem. Anyone know a solution??

Hi there, bdaba.

There's no specific pre-set up deduction item for Roth IRA. However, you can select or use the Other after tax deductions and name it Roth IRA.

Here's how:

I'd also like to share this article for additional reference: Add or change pay types.

You can always count on us if you ever need help with QuickBooks. We're always here to assist you.

"Then select the type of Retirement plan."

What plan should be selected for CalSavers?

"Enter the name of the provider and the amounts per pay period."

Doesn't the employee select the amount they want to contribute? How do we (as the employer) know what to enter in here?

Hello, @Marc101. I can share some articles where you can check the supported boxes for the Calsavers.

To assign a retirement plan deduction or contribution to an employee in QuickBooks Online Payroll, here's how:

Since you're wondering what to select for CalSavers in the retirement plan deduction type, you can refer to this article.

I've also added the following articles about the retirement deductions and the state-mandated Savers programs and how to set them up in your payroll service:

If you have any other concerns or any additional information about retirement plan deductions or contributions, I'll be here to guide you. Stay safe and have a good one!

I appreciate the response but I don't see how it relates to my questions. You seem to have simply duplicated the steps @SarahannC outlined already?

"Since you're wondering what to select for CalSavers in the retirement plan deduction type, you can refer to this article."

My question is what retirement plan should be selected for CalSavers. That article also makes no mention of CalSavers. So I am not clear why that article was was provided? It seems to provide an explanation of how to setup deductions/contributions for a retirement plan. Please know that I am already aware of how to do that. I will repeat my question again:

"What plan should be selected for CalSavers?"

I appreciate your prompt reply and for sharing some clarifications, Marc.

I'll make sure you get the right help in choosing what retirement plan to select for CalSavers.

I recommend seeking assistance with your tax adviser or with your accountant. They'll be able to guide you in selecting the best plan and ensuring the accuracy of your accounts.

Once you're all set, you can now run your payroll whenever you're ready. Please feel free to utilize this link for reference: Create and run your payroll.

If you have any further questions about managing your payroll in QuickBooks Online (QBO), you can always count on me to assist you. Keep safe and have a good one!

You need to select "None"

You need to retrieve the selected rates from the CalSavers web site dashboard for each employee.

Hello Amanda;

I had the same problem, but after searching for information regarding the type of retirement plan CalSavers offers it came out to be post-tax basis and tax free. Then I search for the types of Roth Retirement Plans and their description, the best results to set-up in QuickBooks was Roth 403(b) and once prompt to choose if the deduction is Gross or Net I choose net.

This is what I came up with after searching, however there is not a lot of information regarding the exact retirement plan CalSavers uses.

What type of retirement plans are available? CalSavers is available as a Roth individual retirement account (IRA). This means that employees contribute to the program via payroll deductions on a post-tax basis, but when they retire, their income from the savings account is generally tax free. (https://www.adp.com/resources/articles-and-insights/articles/w/what-is-calsavers.aspx#:~:text=What%2....)

Roth 403(b) option offers tax-free retirement income. Page 1. An additional way to save in your plan. Unlike a traditional pretax 403(b), the Roth 403(b) allows you to contribute after-tax dollars and then withdraw tax-free dollars from your account when you retire. (https://www.google.com/search?q=what+is+roth+403(b)&rlz=1C1CHBF_enUS983US983&oq=what+is+roth+403&aqs...)

.

For anyone looking to setup CalSavers & Quickbooks, the article here was the most helpful one I have found:

However you will find that the Excel export of the "state-mandated retirement report" that QBO provides (Step 4) is not compatible with what CalSavers requires. You will have to export the report and then manually update it to fit the CalSavers template. QBO if you are going to create the report, why not make it work?! So frustrating.

The issue I have is CalSavers is supposed to be a ROTH IRA and that isn’t listed in drop down for type?

If the employee did not respond or register with CalSavers it is an automatic 5% you should log onto CalSavers and click on employees and then employee list and it will tell you what the deductions will be.

Hi there, @CalSaver confused. I'll be glad to share some details about your concern so you can get through this and finish setting up CalSaver in QuickBooks Online (QBO).

As I check here on my end, ROTH IRA isn't supported by QBO as of the moment. Since QuickBooks is for recording purposes only, the only suggested deduction or contribution type is the Other taxable deductions.

Feel free to visit this article for more information about the suggested deduction or contribution type in QBO: Set up state-mandated retirement plans in QuickBooks Payroll.

I'd also suggest reaching out to your accountant about it. This way, they can give you a piece of advice on what other types you can use to get through this and set up the item.

In case you don't have an accountant, I can help you find one. You can visit this page to find an accountant that can help you with this: Find an accountant in QuickBooks.

Additionally, I've got you this article in case you'd like to know more about supported deductions in QBO: Add or change pay types.

You may also visit this page in case you'd like to learn more about Roth 401(k) and more: Set up Roth 401(k) and Roth 403(b), and Roth 457(b) plans.

Know that our door is open 24/7 if you have any additional QuickBooks-related concerns. You can also click the REPLY button below if you need further assistance setting CalSaver in QuickBooks Online. Rest assured, Our dedicated experts are always around to help you. Take care, and enjoy your weekend!

I specifically asked for help setting up CalSavers in Quickbooks Desktop! When I click on the link that comes up everything is for QBO! How and where do I get help with Quickbooks Desktop?

Hi, @G S Bookkeeping. I'll make certain that you can set up your CalSavers in Quickbooks Desktop.

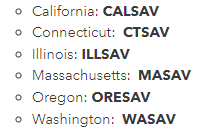

The following states mandate that employers either offer a traditional or enroll in a state-sponsored retirement program. Once you've selected your retirement plan, we can now set up the payroll items.

First, add a new payroll item. Here's how:

From there, add the retirement item to your employees. I'll show you how:

However, it's best to seek professional advice from your accountant to ensure the accuracy of your accounts.

For the detailed step-by-step process of setting up CalSavers, please check out this guide: Set up state-mandated retirement plans in QuickBooks Payroll.

Once you're all set, you'll want to utilize this reference whenever you're ready to run your payroll: Create and run your payroll.

If you have any further questions about managing your payroll in QBDT, you can always count on me to assist you. Keep safe, and have a good one!

I've set up everything for the retirement plan according to QB (for desktop). The payroll item is listed as "CALSAVE". I ran payroll last week and the paystubs show that an amount was taken out for CALSAVE. When I run the report for the dates covered by last week's payroll, I get nothing. I've tried different date ranges (to include the pay date itself), different Total By..., etc. Nothing shows up. I've looked for other employee/payroll reports to try to get the information needed but CALSAVE doesn't show up in any of those. Can't find anything in the Taxes reports either.

What do I need to do to get the CALSAVE State Mandated Retirement report to run?

Hello there, Sheena.

Appreciate you for trying multiple reports to get the CALSAVE State Mandated Retirement details. Can you share the specific reports you've pulled up in QBDT? If you haven't tried the Payroll Item Details report, I recommend opening this report to generate the information you need. Here's how:

If the thing happens, let's download the latest product updates to ensure you have the most recent update of QuickBooks. Then, run the Verify and Rebuild Data within your company file to fix issues you're experiencing in QBDT.

We can also restart your computer first and install the latest payroll tax table using the steps outlined in this article: Get the Latest Payroll Tax Table Update.

We visit and read this article for additional information about the report: Create a payroll summary report in QuickBooks.

Also, we can browse our guides if you need assistance managing your workforce or processing payroll: QuickBooks Desktop Payroll Help articles.

I'll answer any additional questions you have on payroll reports and anything related to QuickBooks. Just let me know in the comment section. Bye for now and stay safe always.

Quickbooks x CalSavers

I have spoken to two Quickbooks reps on the phone as of November 2022. Here's what they say about Quickbooks integration with CalSavers: Quickbooks does not support sending out employee contributions to the CalSavers site, you have to do it manually. If you have enrolled Quickbooks as a payroll provider, remove them first before you can process the contributions.

Helpful link:

Set up state-mandated retirement plans in QuickBooks Payroll:Go to step 3 for the actual instructions

This is all wrong. This is not correct. This system is soooo bad. I have called several times and no one can help,.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here