Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHello, spmorin!

Thank you for reaching out to the Community. I'll make sure that you can record an employer 401k.

Here's how:

You can also check this article for more details about 401k: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.)

Please let me know if you have additional questions or concerns. I'm always here to help.

Thanks for the reply!

I've already set up the 401K account and have been making regular deductions from payroll during the year. The question is how do I record this one-time contribution by the employer in QB online?

Glad to have you back, @spmorin.

I'll help record your one-time company-paid contribution in QuickBooks Online (QBO).

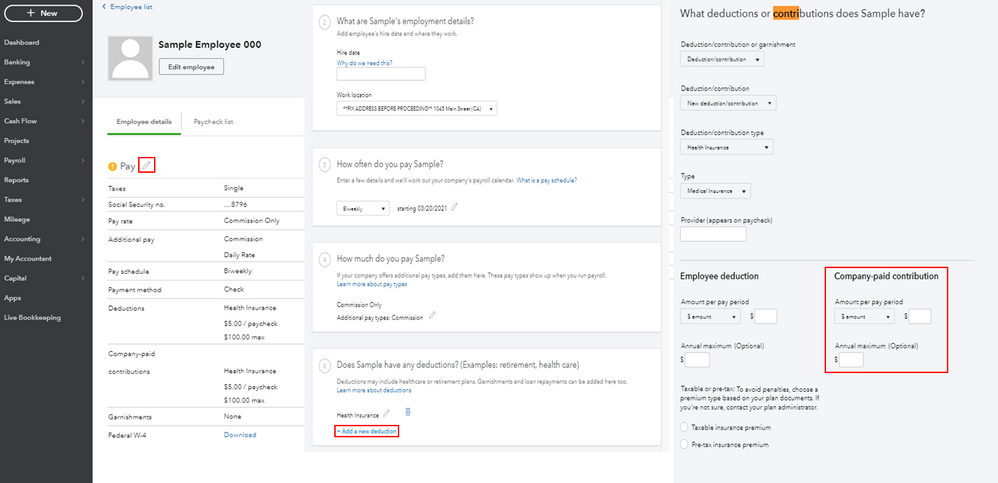

You'll want to add the contribution to each of your employees and run a one-time paycheck. This way, the item (401K) will affect the employee's W2 and payroll reports. After processing the payroll, you can manually remove the contribution. Let me guide you through the process.

First off, let's add the company contribution to each of your employees. Here's how:

Once done, you now create a one-time paycheck for your employees. After processing it, delete the contribution by going back to the Does this employee has any deduction? section and clicking the trash icon.

I'm adding this article to learn more about adding a payroll deduction or contribution in QBO: Add or edit a deduction or contribution.

Please know that I'm just a reply away if you need any further assistance processing payroll. Have a good one.

Thanks Mark for the reply, much appreciated.

I was able to complete the first 7 steps successfully, however when I go to the part about issuing the employees a "one-time" paycheck it didn't let me create it. While I was able to click "issue paper check" instead of direct deposit, I was unable to adjust the employees pay rates. If I click on the "pencil" icon it does not allow me to adjust the rate. If I click on their salary, it only allows me to decrease their amount of hours. Please let me know if I am missing something.

Thanks again!

I appreciate the steps you've taken, spmorin. I'll help you fix this.

We can only modify the pay rate of your employees on their profile temporarily. Once done, we can edit them back to their original rate. I'll show you how:

Right after, create the one-time paycheck for your employee again.

Keep me posted on how the steps work. I'll be around if you need further help.

Thanks GlinetteC for the reply.

When I follow the steps you suggest, then run a one-time paycheck I am unable to delete the employee taxes from the check. An employer contribution to 401K account is supposed to be pre-tax. Is there a way to zero out the taxes?

Thanks in advance for any suggestions!

I appreciate your prompt reply and for going through the steps shared by my colleagues above, @spmorin.

Allow me to add additional steps on how to exclude the 401k tax in your employee paycheck.

You’ll want to remove it in your employee profile to exclude it from their paycheck. Let me show you how.

On the other hand, if you only want to zero it out, you can follow these steps instead:

You can also check this article for more details about the process: Change or delete a payroll deduction item.

Once done, you can now create a paycheck for your employee without the contribution tax. Let me also add this link that you can use for guidance in running your payroll reports efficiently in QBO: Run payroll reports.

I’ll be around to help you if you need further assistance managing your payroll and employees. Lay down the details in your reply and I’ll swing back into action. Have a great week ahead!

Hi @JasroV thanks for the reply.

I took the steps you advised and I was able to set most deductions at $0, but I am unable to edit employee taxes (for SS and Medicare) and employer taxes (for SS and Medicare). Is there any way to edit these items?

Thanks!

Thanks for coming back, @spmorin. I'm glad the steps shared by my peer help.

I want to make sure I'm meeting what you're trying to achieve today. If you're trying to edit the rate of the employee and employer taxes (SS and Medicare), we're unable to edit it.

However, if you're trying to correct the amounts deducted, I'd recommend you contact our QuickBooks Payrolls team for further assistance. You can also contact us through chat. Here's the link:

https://help.quickbooks.intuit.com/prechats/offerings/QBOP-CHAT/15024/view.

I've also attached this article for your future reference in case you'll need to take a closer look at your employee's reports: Payroll Reports in QuickBooks Online.

We're always here to lend a hand if you need more help, @spmorin. Take care!

I am having the same issue. A 401k payment should be SS and Medicare deductible, no taxes paid. Is this how QB works? I'm gettting the same problem but on QB Desktop. How can I make a one time contribution? Also, does the paycheck have to clear with QB?

Good morning, @axwack.

Thanks for chiming in on this thread. Allow me to point you in the right direction to make a one-time contribution.

Since you're having the same issue, I suggest contacting our Customer Support Team like my colleague stated above. They'll be able to use a screen share to help walk you through some steps to help resolve this problem. Here's how:

That's all there is to it!

Let me know how the phone call goes. I want to ensure that you're able to get all of your concerns taken care of today. I hope to hear good news in the future about your call!

Not my question. I need to remove a deduction for retirement contributions before I do w2 deducted for a plan that the employee was not qualified to participate in. I refunded the deduction to the employee but don’t know how a correct records in QB

Hi Go6!

Thanks for joining this thread. Let me share some details about this removal of deduction.

Yes, there's a way to correct your W-2 before you file it. Our Payroll Team will make an adjustment to your payroll to remove the deduction. This means I recommend you to contact them so they can make the correction on your behalf.

Also, these are the articles you can check on how to correct filed W-2 and understand its figures:

Keep on posting here if you need more help in preparing your tax forms. Take care!

Not sure if you got a response. There is not away to make that correction yourself through QBO. IMO QBO payroll is the worst payroll software out there, as you can not make adjustments without having QBO do it on the back end and it can take months! Hopefully QBO support was able to adjust this for you.

OP: Was the QBO helpdesk able to resolve this for you when you called? Extremely frustrating that the world's largest bookeeping service doesn't have a feature that is super common to S-Corps built in. Wondering if it is worth my time to call and try to get a resolution through whatever hacks or backdoors they can do on the call.

LOL this thread is an absolute joke. Why anyone choose to use QBO for payroll is beyond me--absolutely awful.

What is applicable Retirement plan option from Drop down for Solo 401K?

Good afternoon, @Asp2023.

Thanks for joining in on this thread.

Before going further, can you provide me with the version of QuickBooks your using? (Online, Desktop, or Self-Employed)

In the meantime, review this guide below to help you out in the future:

I'll be waiting for your response!

Old thread but for those looking at it, from the IRS' website:

The amounts deferred under your 401(k) plan are reported on your Form W-2, Wage and Tax Statement. Although elective deferrals are not treated as current income for federal income tax purposes, they are included as wages subject to Social Security (FICA), Medicare, and federal unemployment taxes (FUTA).

You can't set these taxes to zero because the IRS does not allow it.

Did you get a fix for this issue ? I am trying to do the same exact thing and its been 2 hours with multiple reps and they don't understand the problem!

Did you get a fix for this issue ? I am trying to do the same exact thing and its been 2 hours with multiple reps and they don't understand the problem!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here