Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGlad to see you here in the Community, feparaschuk.

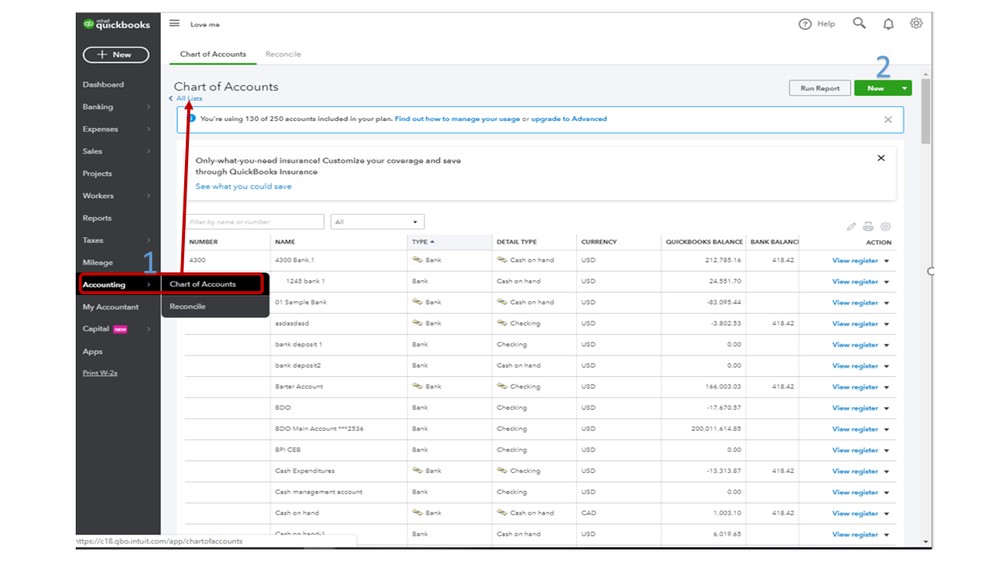

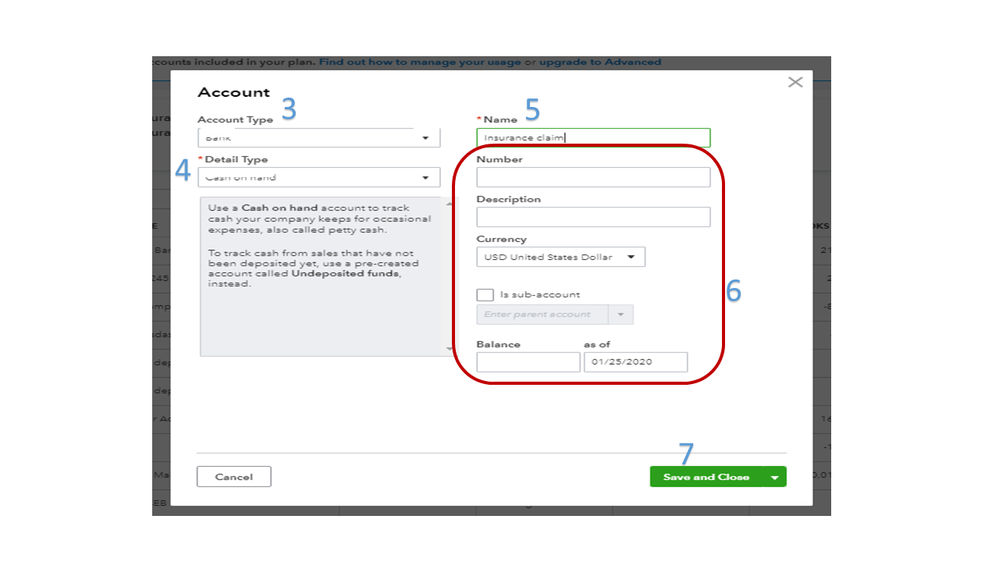

To record the payment, let’s create an account to track the entry and then make a deposit. The steps are easy to follow.

Here’s how:

Since every business has a different structure, I recommend consulting with an account of the specific account to use in tracking the insurance claim payment. This is to ensure the transaction is properly categorized.

To deposit:

For future reference, I’m adding a link where you’ll find resources that wil help grow and manage your business: QuickBooks.

Stay in touch if you need any assistance while working in QuickBooks. Please know I’m here to help you. Enjoy the rest of the day.

How do I set -up a Payment received for a insurance claim?

Deposit the payment and use Other Income as the source account for the deposit

You expensed, or should have, the damages. The other income entry will be offset by those expenses on the P&L

Is there a way to attach that insurance claim "other income" to a job? My new client has QBO but does not have his jobs currently set up as subcustomers. I will be working on getting a better job costing system going for him, but at the moment, he has been using classes for his jobs and does not have estimates in the system yet.

He received an insurance claim on one of his jobs and would like to attribute that "other income" to that job. Is there a way to show that?

Yes, there is, BlinkBookkeeping.

I'm here to help you link the Other Income account to a job.

Here's how:

For more information about class tracking, I suggest browsing this article: Class Tracking Overview.

Additionally, I've included an article that'll help you check sales, expenses, or profitability by business segment: Run Reports by Class.

Get in touch with us if you have other QuickBooks related concerns. This way, we'll be able to assist you.

That does NOT answer my question. I can assign it a class. But can I attach it to a JOB. I need the JOB to show the funds are purposed for that JOB - NOT CLASS.

Thanks for following up with us, @BlinkBookkeeping.

I'm happy to lend a helping hand and get you back to business.

First, can you clarify how your client is currently tracking jobs and how you want to track? Knowing these details can help me to sort this out with you. I want to ensure I fully understand your end goal to provide the proper steps.

I look forward to your reply. Please let me know if you have additional questions or concerns. Chat with you soon!

Stop with the canned answer and answer the question. Sick and tired of you people saying "talk to an accountant" You know the answer, so give it. If you have to have that disclaimer, then add it at the end. Words cannot express how much I dislike your product, your company, and employees that work for Intuit.

This is hands down the biggest nanny company I have ever run across.

Did you ever get this answered by anyone?

I got on here to ask the exact question you did but I didn't see the answer I wanted

Under Received from I put the insurance company, but what do I put under "from Account"?

This is they way I recorded a recent payment from my insurance company for a auto body damage claim:

Click on new

Click on bank deposit

Go to "add funds to this deposit" section

For received from, choose the name of your insurance company.

For account, choose the account you will use to pay for the repairs. I chose "truck repair and maintenance."

For description, "proceeds from accident claim" or something like that.

Enter other fields as appropriate, including the amount, then save.

Does it really matter if you use an income account or an expense account to show this payment I received? My accountant may have an opinion, and I may ask him if I remember at tax time. But often we users of Quickbooks are much too concerned about these nitty gritty issues. I received roughly $1k from my insurance company, and paid the body shop $1.5k which included the deductible. No matter how I categorize what I received, I still paid out more than that amount, and thus I have a net expense. Some users will be concerned that the money received will show up as taxable income. It would, if you didn't have an accompanying expense, especially if you receive the money one year and get your vehicle repaired another year, and I guess that technically if you don't plan to get your vehicle repaired that there would be a more complicated treatment of the money you received since the value of your vehicle went down by the same amount that your income account went up. But since I did get my vehicle repaired, I matched both the income and expense in the same account.

I agree with Service's answer. Insurance proceeds are not income. We received a check for theft of a fixed asset - would it be proper to post it against that fixed asset account or against a "maintenance & repair" account? Should the fixed asset account be left alone for our accountant to apply depreciation to? I feel like it should be against the fixed asset as we no longer have it.

Here is the actual answer:

1. Record a Deposit of the vendor check:

a) Go to Make Deposits.

b) In the Received from drop-down select the vendor.

c) In the From Account drop-down, select Accounts Payable.

d) In the Amount column enter the amount of the refund.

e) Save & Close.

f) Note: If you need to group this deposit with others.

QB will not allow Undeposited Funds as the deposit to account when Accounts Payable is chosen as the from account in a deposit. Instead choose the Wash Acct as the Deposit To account, then make a JE from Wash to Undeposited Funds.

2) Record a Vendor Credit for the refunded amount:

a) Go to Enter Bills from the Vendors menu.

b) Select Credit and enter the Vendor name.

c) Select an Item or Account and enter the Amount.

d) In the Customer drop-down select the job.

e) Save & Close.

3) Link the deposit to the bill credit:

a) Go to the Vendors menu and select Pay Bills.

b) Select the deposit created in step 1.

c) Select Set Credits and apply the Bill Credit you created in step 2 then select Done.

d) Tap Pay Selected Bills and select Done.

Thank you for explaining this. I am a newb and have a few follow up questions. Here is the situation: I received an insurance claim check for damage to a property. The insurance claim check is more than the amount paid to repair the damages.

1. How/where do I categorize the deductible paid?

2. How/where do I categorize the claim check?

3. When payments are made for the repair, what is the entry for that?

4. How/where do I categorize the excess funds from the insurance claim check?

You’re help is much appreciated and thank you so much!

Did you ever get an answer to this? I too have an asset, a vehicle in which the insurance gave a 90% return on. I am trying to figure out if I can just post the deposit to the asset. There will still be a small balance, I am assuming this is what the CPA will mark as a loss and adjust the depreciation? If anyone knows, please feel free to reply with a simple answer .

I had this same issue. I had an insurance claim that was for a project, and I added the Project information to the "Received From" field. It then allows the income to appear on the project profitability report and on the P&L as income correctly. It does not appear to show as a payment from the customer, which is also important to me. I have not run this by my CPA yet, but this is the only workaround I can find.

I have a suggestion that I'd like to share, but please feel free to correct me if I'm mistaken. Based on the example provided in previous responses, I believe you can use "Tags" to track the job cost in order to demonstrate that the funds are allocated for that specific job.

Alternatively, you can create a Journal entry and assign it to a relevant account destination type for the job, such as miscellaneous expenses or receivable/payable. This way, you can link the job to the entry's name.

I'm offering this suggestion with the understanding that I may be incorrect, so please don't hesitate to correct me. I'm also here to learn.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here