Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI see where I can set up one WC Class per EE but our EE's work across classes on a daily basis. Is there anyway to assign different classes and then different hours per pay period to each class?

A warm welcome to the Community, @N2TRIS.

I'd be happy to lend a helping hand in setting up and assigning different classes to your employees.

Before you can set up and assign different classes to your employees, you'll need to turn on this feature in your QuickBooks Online Account. Please know that this feature is only available in QuickBooks Online Plus.

To turn on:

Here's how to set up classes:

To add class tracking to payroll:

To know more about class tracking, here's a recommended article: Set up and work with class and location tracking.

Should you need further assistance, please let me know. Have a great day.

Thank you for your reply but my question was how do I assign DIFFERENT class codes to the same EE? They work across class lines. There is not one class that suits one EE.

We added TSheets to QBO in order to track time worked in various workers comp classes.

Hello,

Our company is non-profit organization and every staff spend daily hours on different classes. Ex: today I spend 2 hours on class A, 2 hours on class B and 4 hours on Class C. And the following days may have different hours to different classes. How to add each staff's daily hours to different classes in payroll please? It is important to our payroll.

we just subscribed QBO Payroll and unfortunately, It shows that QBO currently allows to add only ONE class to each employee.

Much appreciate your help.

Thanks

Anthony

You can use the timesheet feature, Anthony. This lets you set up different classes and add the hours.

I'll guide you how:

Here's how it looks like:

When you pull up the Time Activities by Employee Detail report, you'll see the hours spend on each class. Here's how:

Refer to my screenshot below.

I'll also add a reference about setting up timesheets for better guidance.

Don't hesitate to drop a comment below if you need more help with tracking your payroll.

Thank you very much for your tips.

My next question is: If hours cross various classes the way you advised, will payroll expenses (wages, taxes and benefits) proportionally cross various classes, too?

Thanks you very much

Anthony

That would be a great feature, Anthony.

As of now payroll expenses doesn't cross various classes. We're unable to add classes when running payroll.

I'll be sure to send this feedback to our product engineers. We want to improve the class tracking feature with your help.

We'd love to hear more feedback from you. Just let us know by leaving a reply on this thread.

Thank you for quick response. Please improve payroll expenses tracked by classes. It is very important to a non-profit organization like us.

For now, I have to manually enter a payroll entry by classes after processing payroll in QBO. It duplicated work, but no choice at the moment!

Look forward to your improvements

Thanks for your efforts

Anthony

Anthony,

We are a non-profit with the same issue. You said, "For now, I have to manually enter a payroll entry by classes after processing payroll in QBO. It duplicated work, but no choice at the moment!"

How are you doing this? We can't figure it out. Thanks

Hey, @CATNP.

I can show you how to manually enter a payroll entry by classes after processing payroll.

It’s just a few clicks away.

Here’s how:

I’m providing an article below about manually entering payroll:

If you have any other questions, please comment below. I hope you have a great Thursday.

Thank you, Emily.

That's what I am doing. I was hoping QBO will improve tracking payroll by classes soonest so that we don't have to do manually.

One important thing that you should emphasize with the others when you show them how to do manual entry is that they have to do a reverse entry to offset the payroll processed by QB before doing manual entry by classes.

Anyway, thank you very much

Best

Anthony

Thank you for reaching back out, @BookkeeperASK.

I’m going to submit feedback about tracking payroll by classes for you. Our Development Team regularly reviews our customer feedback and is always working on creating easy to use financial tools that will help you.

I’ll also provide a link below about reverse journal entry for others.

Just know that if you have other questions, feel free to come back to the Community anytime. I hope you have a wonderful weekend.

We are a nonprofit having the same issue. I would imagine this is true for most nonprofits. Of course we need to allocate payroll across class codes! I am shocked that QBO does not offer this feature. It is making for a very challenging situation.

Please make this a high priority fix. It is very difficult for the many organizations who need this feature.

I am unable to find a report that will provide me with the data I need in order to create the journal entry. Reports have hours broken out but not dollars. Can you assist?

Hi cbkamma

You have to run Time tracking by employees report for the payroll period and export to excel, then run pivot table report to get the hours by classes that you need. Remember that your employees have to enter hours by classes in their timesheets in order that you can run this report. If they do not add classes to their hours, there is no way to run hours by classes in QBO.

Hope it helps. Please let me know if any questions

Best,

Anthony

Hi CATNP,

Sorry for late reply. Have you figured out how to allocate payroll cost by classes? Please do not to hesitate to let me know if any questions

Best

Anthony

This is what we do as well. We use TSheets for employees to track time by job and class. Time is exported to QBO but in some cases the fractions of hours are calculated differently.

For example, an employee tracking 35 hours 53 minutes would show up as follows:

Tsheets Payroll report and job costing report: 35.88

QBO payroll detail preview report: 35.8 8 3 3 3 3 3 3 3 3 (see note below)

QBO payroll detail report (after submitting payroll): 35.88

After speaking with both QB and Tsheets support, there doesn't appear to be a workaround other than:

A - Automatically round hours to the nearest 15 minute increment

B - Be sure to run the payroll detail preview report in QBO. This report is only available after starting payroll but before submitting it. The report link can be only accessed at the bottom of the page just before clicking on Submit.

C - Spend lots of time later figuring out why your reports don't match.

When it comes time for workers compensation audits you need reports that match or an explanation as to why they don't. It would be great if we didn't have to pay for a third party module to manage split class codes or at least have an option to reprint the payroll detail preview report after payroll is submitted.

NOTE: Sorry for the number format. QB would not allow me to post the actual multidecimal number for some reason. [The message body contains (the number above with multiple decimal places), which is not permitted in this community. Please remove this content before sending your post.]

I also have multiple nonprofit clients that require class tracking for payroll. I see your responses to track it in T-Sheets and transfer it over. This is an issue as all of my employees are salary employees and are not hourly. There is no hourly time tracking. I simply have set amounts (that change each month, thus cannot be recurring) that have to be assigned to different classes. We have QBO Core Payroll which only allows 1 class assignment. At the moment, I'm not quite sure how to do this without doing a JE which will overinflate payroll expenses. Please fix this situation by adding multiple classes as a split to payroll. Thank you kindly!

I need payroll dollars by class and not hours. This is a common need for nonprofits and I am shocked that it is not an available feature.

We're taking notes of your feedback and suggestions, @cbkammar.

Our product engineers are considering all suggestions based on the number of requests and their impacts on the software before they're rolled out.

I know that adding classes when running payroll is beneficial to you and your business. This way, you can easily run reports with payroll dollars by class.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Thanks for dropping by.

I don't see

Hi there, @linda therrien.

I'd be happy to guide you through the steps on turning on the class tracking feature in QuickBooks Online (QBO).

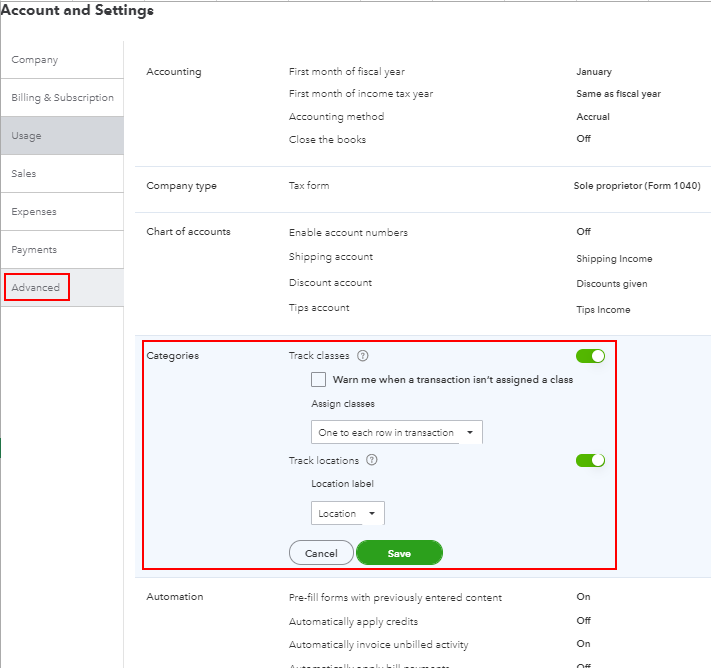

The Categories section is located on the Advanced tab from the Account and Settings menu. From there, you can turn on the class tracking feature. Here's how:

I'm adding this article for more guidance: Turn on class tracking in QuickBooks Online.

You might also want to utilize the location tracking feature in QBO. This helps you categorize your transactions from different locations, offices, regions, outlets, or departments of the same company.

It’s nice working with you, linda therrien. Please don't hesitate to leave a comment below if you need further assistance with setting up class tracking in QBO.

How do I filter my balance sheet by location/class in my company?

Thanks for joining the discussion, Amanda.

I'll walk you through the steps to filter you classes and location in the Balance Sheet Report. To do this, you need to access the customize option on the report. Follow the steps below:

See this link to learn more about customizing QBO reports: Customize reports in QuickBooks Online

Please visit this support page if you have other concerns for us. I'll be right here also if you need further help with the reports in QuickBooks Online.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here