Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

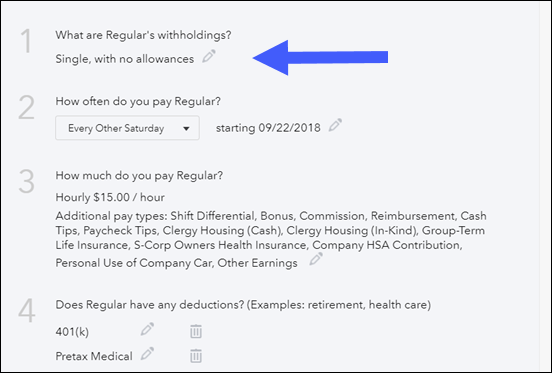

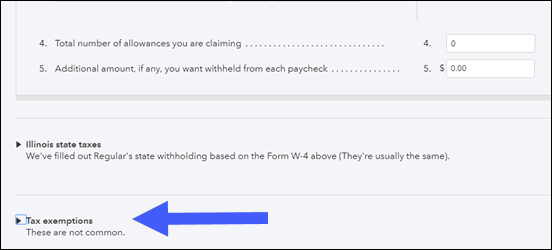

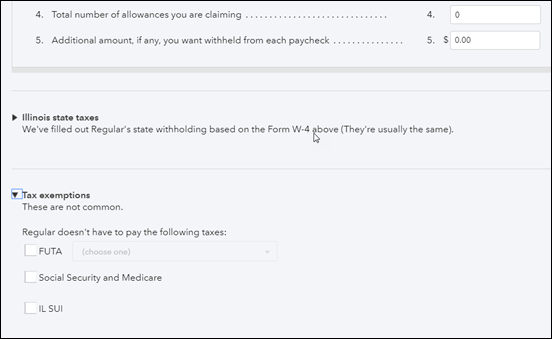

I'd be glad to help you set up an employee that do not hold federal and state tax withholding in QuickBooks Online, str_dsgn.

You can mark them as tax-exempt in the employee's profile. Let me show you how:

To know more about this process, check out this article: Employee payroll tax exemptions. On the same link, you'll find some pointers about the exemptions status of foreign employees as well as filing W-4 in QuickBooks Online.

I'll be sharing with you this article: Payroll 101. It contains more information about the different types of compensation as well as on what are the types of federal forms you need to file. Also, this will provide you a sample breakdown of a paycheck.

I'm just a few clicks away if there's anything else you need. I need to make sure able to exempt your employee. Have a good one.

I don't see the tax exemptions you mentioned at step 6. see screenshot attached.

https://www.screencast.com/t/iX7SaoCAdEGI

Thanks for keeping us updated, str_dsgn.

Base on the screenshot you've provided, it looks like you're using QuickBooks Online Payroll Full Service. That said, you'll need to get in touch with our Full Service Payroll support to help you with the payroll setup.

Before that, you might want to check out this article for a list of related links that can help you set up and process payroll: QuickBooks Online Payroll Full Service Hub.

Here's how you can reach us:

You can check out this article for our contact information. Click on the QuickBooks Online (QBO) drop-down to see the most updated support schedule: Support hours and types.

Get back to me if you need further help while working with W2's or anything about QuickBooks. Have a nice day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here