Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It's my pleasure to assist you, @wtcans,

QuickBooks is compliant with the IRS rules and regulations. Our Team works directly with the agency to ensure forms are updated based on the new mandates released.

Our developers will roll out a new payroll update when the revised W-4 form is available in QuickBooks Desktop. Make sure the software is updated to download important patches in the program.

To download the latest tax table version, check that by following these steps:

If this topic additional help, notify me by clicking the Reply button below. I'll be right here to provide further assistance and insight. Have a wonderful day! All the best.

The OP asked about desktop, and your answer is for online.

Also, they are asking about next year, with the new W-4. Not the existing W-4 settings for 2019 which are different.

How is California payroll withholding entered in 2020

Thanks for joining us here in the forum, JDH52.

You'll have to set up a payroll item to add the withholding. Let me walk you through the steps.

You can read more about the state withholding set up in this article: Set up payroll items for new state taxes.

I've also added our page about QuickBooks Desktop 2020 What's new and improved for additional information.

Please know that we're always here for you whenever you have payroll questions. Have a great day!

I have Desktop 2017 and have all the most current payroll updates. There is no tab for 2020 w-4. When will that be available.

I can see that you've already updated the payroll tax table. Good job for doing that, jackieborella.

For now, setting up the 2020 W-4 is unavailable. I'm unable to set a specific date when it will be available.

The system will automatically prompt you once it would be available. We'll have to update the tax table again once the 2020 W-4 is available.

Still, I'll provide you the steps on how to do it. Here's how:

You may want to visit here for more information about getting the latest payroll tax table update.

Just mention me if you have other questions, I'd be glad to help you figure them out!

Has QuickBooks payroll been updated yet for 2020 W-4?

Hi there, @kstag511.

Awesome to have you in the Community. I can assist you with information on the update for the W-4, 2020 update.

The update was released in December. You will need to run the QuickBooks Desktop and Payroll update. Then this will be available for you.

Follow the steps below to access the W-4 2020 form:

Please know I'm always available here to lend a helping hand.

I purchased qbo and all my employees are existing. However, the only option to enter their w-4 is for the new form for 2020. My existing employees as long as they don’t make any changes ARE NOT required to fill out the new form. When will this issue be fixed?

Hello there, @amanda71.

Currently, we have an on-going issue where users are unable to enter 2019 W-4 or earlier in QuickBooks Online. Rest assured that our product engineers are diligently working on a fix, and we're going to roll it out as soon as possible.

To ensure you'll get an update about the resolution status, I recommend contacting our Support Team. This way, they can collect your personal data to add your company and product to the list of affected users

Here's how to contact them:

Also, feel free to visit our QBO Community help website for tips and related articles in the future.

We appreciate your patience while we look into this. Please don't hesitate to click that Reply button if you have any other questions. Wishing you and your business continued success.

RE: Currently, we have an on-going issue where users are unable to enter 2019 W-4 or earlier in QuickBooks Online.

Wow! This means it's not possible to set up a new payroll properly. And at just the best time of year to do it!

RE: Rest assured that our product engineers are diligently working on a fix, and we're going to roll it out as soon as possible.

This is one of your favorite things to write. I hope it is actually the case this time.

Can anyone tell me if the 2020 W-4 can be entered in the desktop version of QB payroll. I can only enter the 2019. I have been on the phone with support and they keep thinking I am asking about a W-2. I double checked my updates and they said that I was correct on the version.

Yes, it can be. You'll need to patch QB to the latest release and get your payroll updates as well.

Thanks for your reply. I confirmed with support that I had the latest update and version and they said I was good. I am using QuickBooks Accountants version 2018. Which they said was fine. We confirmed the tax table version of 22002 and payroll version of 12292129. Any thoughts? I just recently purchased the payroll end but have had QB forever.

Hi there, @binks.

Thank you for posting to the Community.

I can help you with information on setting up the W-4, 2020.

This will give you the opportunity to set up W-4 2020 for employee. Once you update an employee's W-4 to the 2020, you'll not be able to go back to the 2019 version.

Let me know how it goes. I'm here to lend a hand. Have a great day!

Thanks for the reply! I did find those steps and but when I go to that section there is nothing to select. I can only enter the 2019 w-4 information, there is no drop down menu …….

Has this issue been resolved???

yes

Hello there, @binks and @amanda71.

To better isolate why the option to select the 2020 and Later when entering the W-4 details of your employee isn't available on your end, I recommend contacting our Customer Care Team. They have necessary tools like the remote-viewing session that can help determine the root cause of this issue. They can also open an investigation ticket if necessary.

Here's how to contact us:

I got your back if you have any other questions or concerns. Just leave a reply below, and I'll get back to you. Take care!

Unfortunately no.

we have this same issue - no 2020 W-4 details available on employee setup screen. when i go to the HELP memu and choose QUICKBOOKS DESKTOP HELP i do not get the screen shown above - just a list "people like you viewed these answers" but no CONTACT US button either.

why is there no information about this? i have not received a message that the W-4 details have been updated as we were promised.

Thanks for joining us here in the thread, @ruth101.

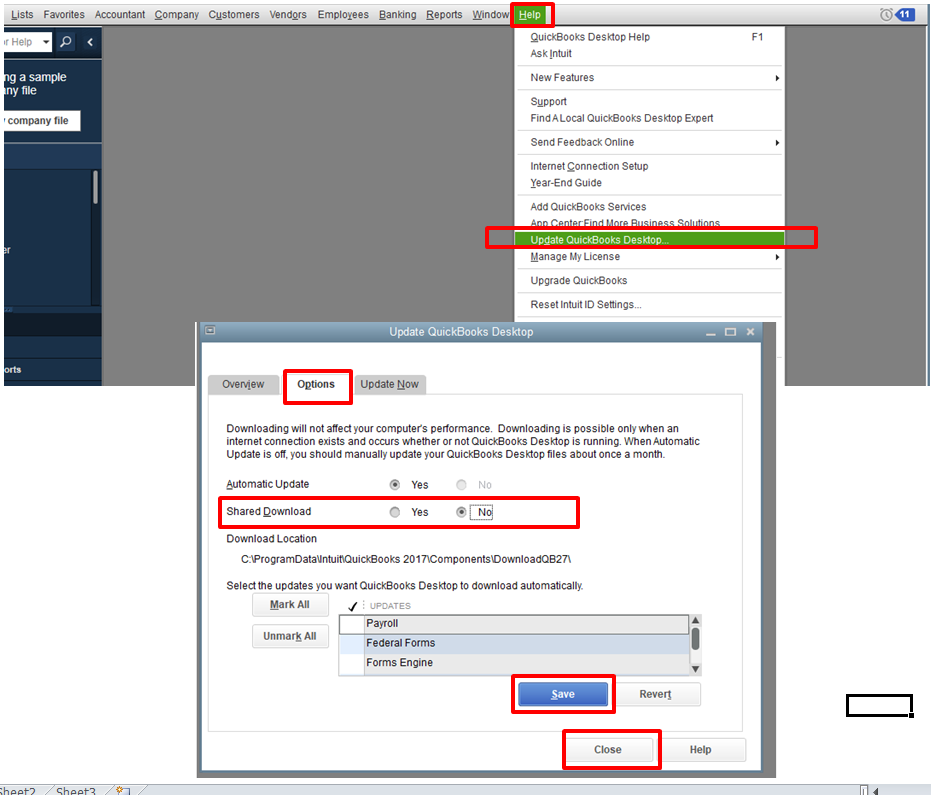

Like my colleagues @Jen_D, and @SarahannC mentioned above, I suggest running Desktop and Payroll updates. These updates will refresh the program and fix the Contact Us button not showing up under the Help icon. I've listed the steps below on how to check for both updates.

Desktop Updates:

Payroll Update:

If you keep hitting a snag, I've included an article about contacting our Desktop Support team for future help.

Please let me know if this gets you back to business. I'll keep an eye out for your response.

That did not work. Does anyone have a solution to how we enter the number of dependants now that the new W-4 does not allow you to enter a certain number? However, Quickbooks hasn't changed its software to match the new w-4 and it still has a box where you enter the number of dependants. This needs to be fixed and we need a solution in order to do payroll correctly for each person.

There isnt a path from the drop-down " Employees" to employee list...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here