Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

What is your latest QB update number? I have updated and it still doesnt work.

Thanks for chiming in, @Crisg1.

I’m happy to hear that you tried all the troubleshooting steps provided above. To ensure you get the best support you need. You’ll need to request a call back with Desktop Support as they have the tools to look further into the issue.

Feel free to come back to the Community anytime. I’ll be happy to assist you.

Does anyone have the answer to this yet? This is January 14th and we are all doing payroll incorrect according to the new w-4...

So you still don't have an answer to everyone's question about how we are sup[osed to process payroll and enter the dependants?

Let's try a couple of troubleshooting steps to get this fix, Crisg1.

First is to uninstall and reinstall QuickBooks through a clean install of a selective startup. Make sure to secure a backup copy of your company file prior from doing this. Second is Update Quickbooks Web patch and restart computer.

Once done, download the latest tax table updates:

If you're still unable to enter 2020 W4 in QuickBooks, it would be best to get in touch with our Technical Support Team. They have all the tools needed to perform extra steps to fix the issue.

Thanks for dropping by. Visit us again if you have other concerns.

RE: 4. Select Download Latest Update. A window appears when the download is complete.

After downloading the update, restart QuickBooks and, if prompted, apply the patch.

If not prompted, you didn't get anything new.

Hi!

I've been having the worst time trying to get the 2020 W4 option to pre-populate in QB Desktop even after doing all the payroll updates. I finally got in touch with someone at QB that was able to help me! Passing the info along, just in case it can also help you out.

Step 1: Close QB

Step 2: Copy and paste this link into your browser & click on "Get the latest updates" link & select run:

Step 3: Open QB

Once I completed the above, the Form W-4 option appeared along with a drop box to select 2020 and Later.

Hope this helps you as well!

Hi!

I've been having the worst time trying to get the 2020 W4 option to pre-populate in QB Desktop even after doing all the payroll updates. I finally got in touch with someone at QB that was able to help me! Passing the info along, just in case it can also help you out.

Step 1: Close QB

Step 2: Copy and paste this link into your browser & click on "Get the latest updates" link & select run:

Step 3: Open QB

Once I completed the above, the Form W-4 option appeared along with a drop box to select 2020 and Later.

Hope this helps you as well!

Hey there, @ESirianni.

Thank you for following the thread.

I appreciate the time you took to provide those helpful steps on getting the W4 option to populate in 2020.

I hope that you have a great rest of your week. Feel free to reach back out anytime!

I have Quickbooks Desktop Pro Plus 2020 and have done all updates and the new W4 is still not available in the drop down. How can I make it show up?

Hello there, @jk333.

Let me guide you with the information on setting up the W-4 in QuickBooks Desktop.

Here's how:

Meanwhile, you can read these guides to learn more about the new W-4 2020:

Drop me a comment below if you have any other questions. Take care.

I use quickbooks online and have a new employee that started 2020. I entered his W-4 into quickbooks. We have had two payrolls since he started and zero Federal tax has been taken out. This can't be right!!

Thanks for joining on this thread, @ADB74.

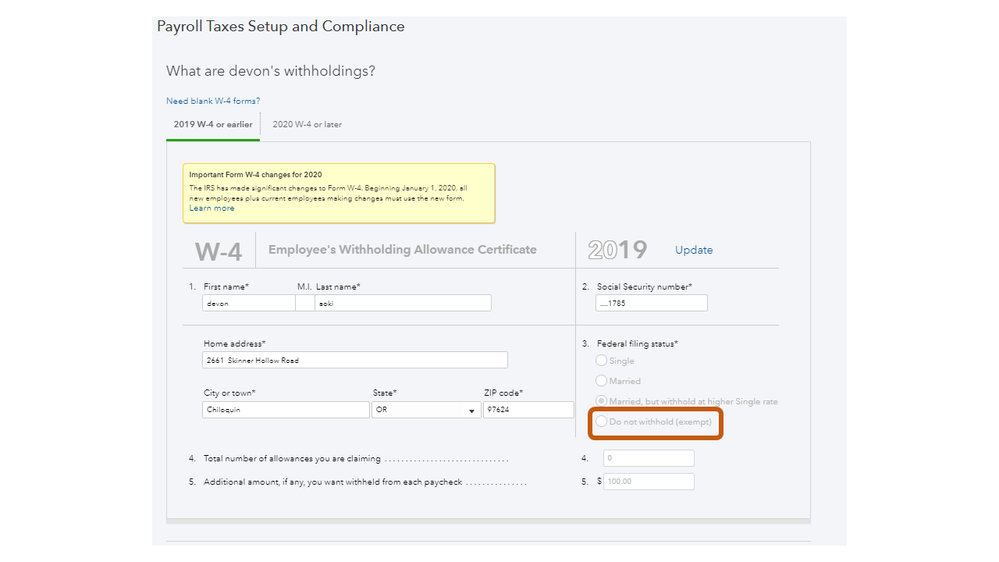

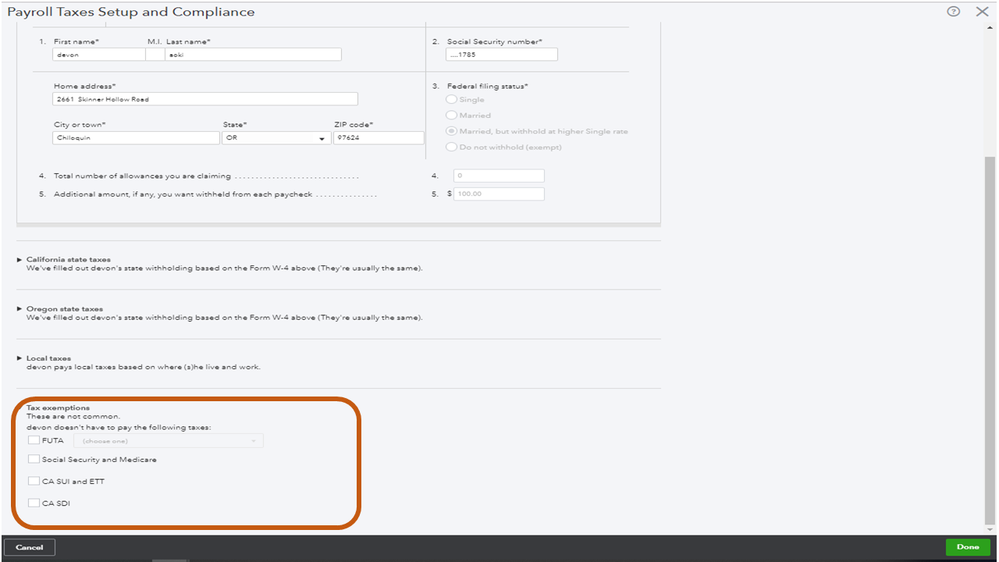

QuickBooks Online computes federal taxes based on the employee’s taxable wages, number of allowances/dependents, pay frequency, and filing status. Let’s open the W-4 information of your worker and make sure it’s set up correctly.

When taxes aren't taken out from your previous paychecks, QuickBooks will automatically do an auto-correction on the next payroll. This is to ensure the employee's payroll information is correct.

For additional information, the following article provides an overview of how the federal taxes are calculated: Employer's Tax Guide.

Stay in touch if you need further help while working QBO. Please know I’m always here ready to assist further. Have a good one.

Thank you for the information. I have updated and am still having trouble with the state withholding. I am in Utah and it is still asking for my employees allowances on the state tab. How can this be fixed. I have Quickbooks Desktop Pro 2019

The thread you've jumped in is for QuickBooks Online, welovemilk.

Once you've updated and corrected the employee's information, the data should already flow when running payroll, filing forms, and paying taxes. I'd recommend reaching out to our Payroll Support Team to further investigate it. They'll be able to pull up your account and provide the necessary troubleshooting steps to fix this.

Please let us know what are the results so we can review what other things we can do.

Good day, vef21769.

Since you already have the latest tax table installed in QuickBooks Desktop, I recommend reaching out to our Payroll Support Team. They have the tools to check why the Form W-4 is unavailable in your QuickBooks company file.

Let me share this article about the new changes to the Federal W-4 and how to enter information in QuickBooks.

Reach out to us if you have any other concerns. We'll be here to keep helping.

This did not work for me on QuickBooks Premier Contractor Edition...

Hi there, @vanidosa27.

The link provided by my colleague above works with all QuickBooks Desktop (QBDT) version.

Since you have the QuickBooks Premier Contractor Edition, you can select the Pro or Premier section from step 4 above.

Once done, you can proceed to steps 5 and 6 above.

Also, visit this article to learn more about the 2020 form W-4: FAQs on the 2020 Form W-4

Do leave a comment below if you have other questions. We're always around to help.

When entering W4 information and the employee asks for $2500 to be deducted do I enter the total amount or divide it by pay period?

@AileneA wrote:Hi there, @binks.

Thank you for posting to the Community.

I can help you with information on setting up the W-4, 2020.

- Go to Employees, and then Employee List.Select the name of the employee.

- Select Payroll Info, and then select Taxes

- On the W-4 Form drop-down, select 2020 and Later

- Make sure your employee complies with the points on the Federal W-4 form popup, and then select OK.

- Enter the employee's W-4 information into the form

- Select OK to save.

This will give you the opportunity to set up W-4 2020 for employee. Once you update an employee's W-4 to the 2020, you'll not be able to go back to the 2019 version.

Let me know how it goes. I'm here to lend a hand. Have a great day!

Sorry this doesn't answer my question.

Good morning, @infleet.

Thanks for chiming in on this thread. I hope your day is going well. Allow me to give you some information to help answer your question about your employee's deduction.

Entering the full amount ($2,500) into their W-4 would be the best way to input this information. Here's a guide that can provide some additional details if needed: W-4.

Let me know if this helps or if you need any more assistance with your QuickBooks Desktop account. I'm always here to lend a helping hand. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here