Welcome to the Community, @mccarley-jeff.

Yes, the box 12 of the W-2 form is for retirement contributions. And resubmitting corrected forms depends on their submission status. Let me discuss this with you in detail and help you from there.

Let's first check the e-filing status by going to the Archived Forms page. Here's how:

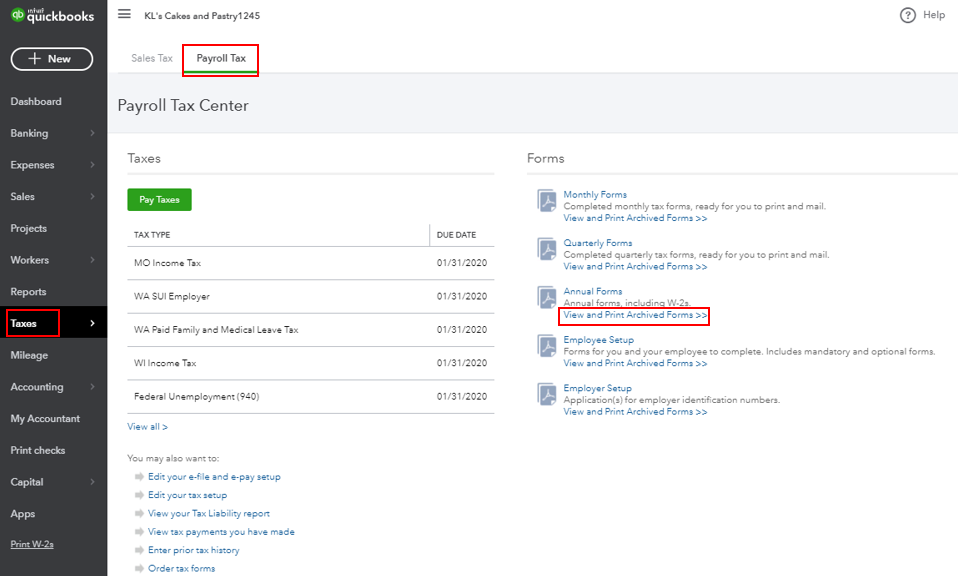

- In your QuickBooks Online, click Taxes from the left panel.

- Go to the Payroll Tax tab, then select View and Print Archived Form >> under Annual Forms.

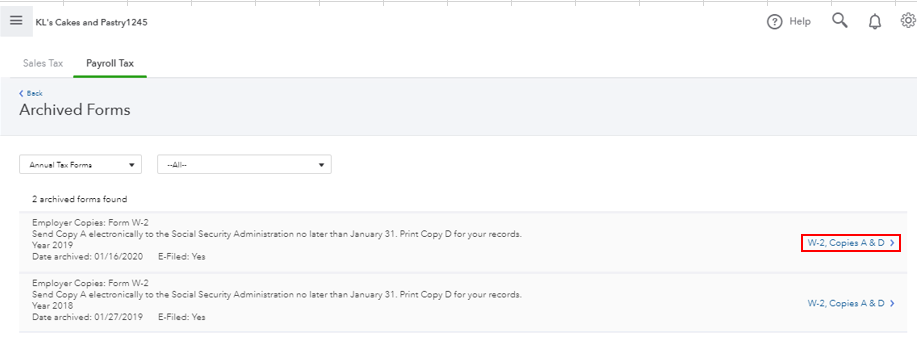

- Select the submitted W-2 form, then click the W-2, Copies A & D > link.

- Check the E-file status from there.

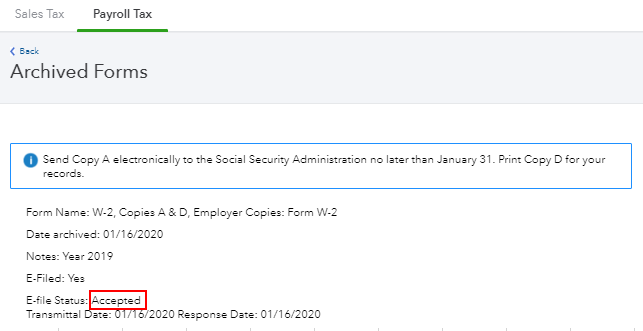

If the status is Not Transmitted, you can still delete the form by clicking the Delete button, then resubmit it with the correct data.

However, if the status is Transmitted or Accepted, you'll have to file a W-2c (Corrected Wage and Tax Statement) form manually to the IRS. You can get the form from the IRS and fill out the information, then submit it to them.

Also, please make sure that when the W-2c form is sent to the Social Security Administration (SSA), it must be accompanied by Form W-3c (Transmittal of Corrected Wage and Tax Statements).

You can read these articles for more information:

You might also want to check out this article to know how to print W-2s forms.

If you need any additional assistance while filing W-2s forms, you can leave a comment below. I'll be sure to get back to you. Have a good one.