Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowTo any having a similar issue: this may all have to do with the "Working Address" that has been set. If your company moved or changed its address, it is very possible that changing the"Working Address" has been neglected (that's what the situation was for me) -- and you won't see the old address until you prep W-2s or run Payroll.

My fix was as follows: to remove the "Primary" status of Working Address, I had to go into each employee profile and change them temporarily to Not on Payroll (making them inactive employees). Then go into main settings (the gear icon upper right), Payroll Settings, Manage Working Addresses, and edit them or add new ones -- and remove the ones that are no longer current. Now go back to all of your employee records and individually edit their profiles to make them Active once more AND check the address setting for working address -- where that employee does his/her work for your company. Once all that is done, if you go back to Company Settings (gear), Payroll Settings, you should see that the "Primary" designation is showing on the working address that you set for the employees.

Now any W2's and Payroll Checks should show the correct Company / Employer address. That is what did the trick for me. Good luck!

-- R o n

If your company moved or changed its address, it is very possible that changing the"Working Address" has been neglected (that's what the situation was for me) -- and you won't see the old address until you prep W-2s or run Payroll.

My fix was as follows: to remove the "Primary" status of Working Address, I had to go into each employee profile and change them temporarily to Not on Payroll (making them inactive employees). Then go into main settings (the gear icon upper right), Payroll Settings, Manage Working Addresses, and edit them or add new ones -- and remove the ones that are no longer current. Now go back to all of your employee records and individually edit their profiles to make them Active once more AND check the address setting for working address -- where that employee does his/her work for your company. Once all that is done, if you go back to Company Settings (gear), Payroll Settings, you should see that the "Primary" designation is showing on the working address that you set for the employees.

Now any W2's and Payroll Checks should show the correct Company / Employer address. That is what did the trick for me. Good luck!

-- R o n

I wish this would have worked but the old address is still showing as the primary even though no employees are assigned to it. Because it is the primary I can't delete it.

We understand that deleting the primary location under the Work Location is a convenient option for you, Sarah. We will ensure that your new company location is correctly assigned for your employee records.

Please know that the primary address in the payroll serves as the main business location for tax and payroll reporting in QuickBooks Online Payroll. This address cannot be deleted or made inactive because it is essential for calculating taxes, filing tax forms, and issuing payroll notices.

When assigning a new company address for your employee, we can add them to the Employee Profile as a workaround.

Here's how:

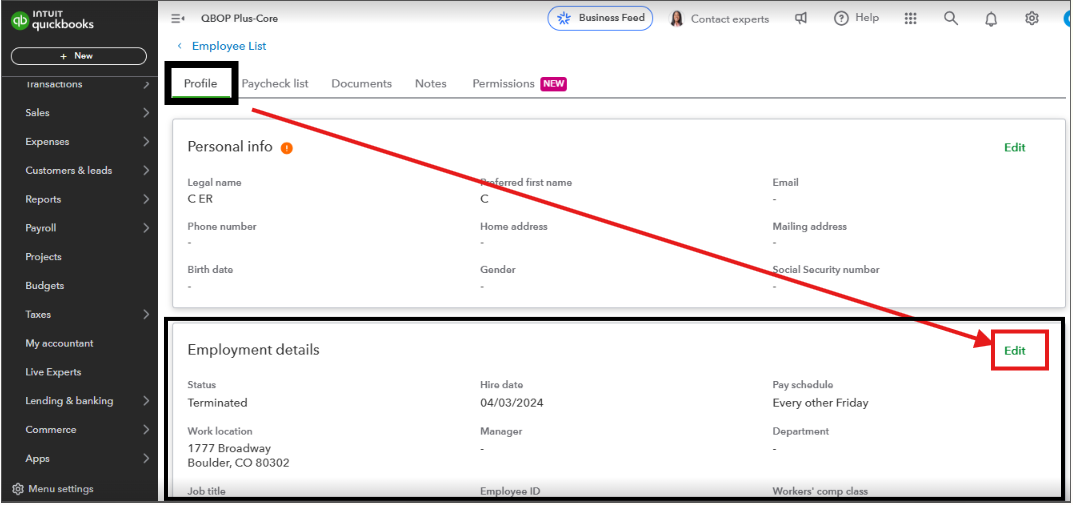

1. From the Employee List, choose your employee.

2. Click the Edit under the Employment details.

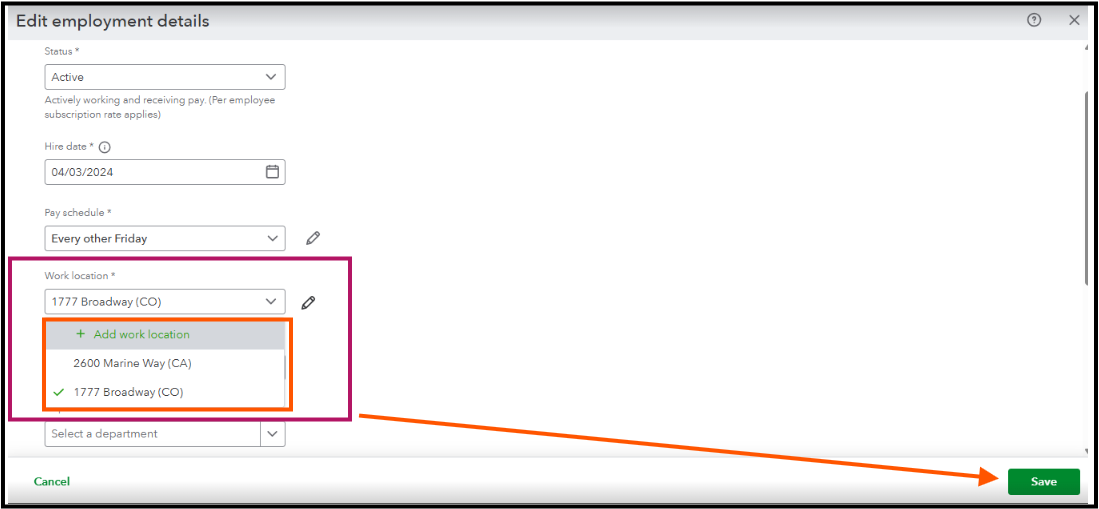

3. Navigate to the Work Location section to enter a new location or select an existing one.

4. Once done, press the Save button.

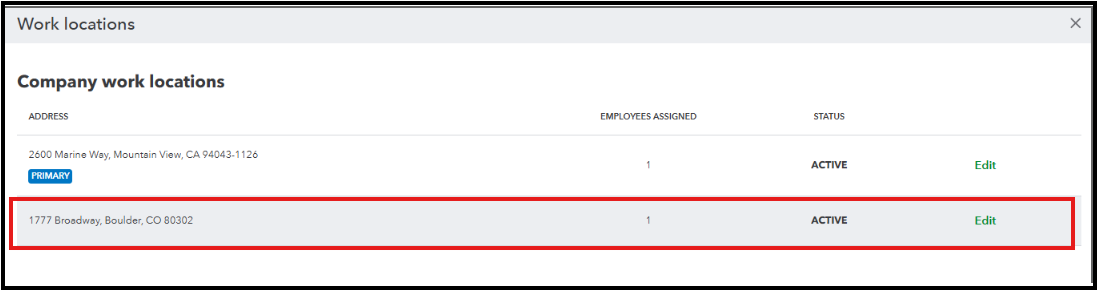

Once you add them, this will show within the Company work locations. See this sample illustration below:

Furthermore, for assistance in setting your current address as the primary one, you can reach out to our QuickBooks Online Payroll phone support team. They are available to provide step-by-step guidance and ensure your information is updated accurately in the system.

On the other hand, if you handle payments and submissions directly to federal and state agencies, please visit this page to update your business information: Update your legal business name and address.

Furthermore, you can review these articles whenever you want to modify your pay schedules or electronically pay and file your payroll taxes and forms.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here