Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for visiting the Intuit Community, leanne6.

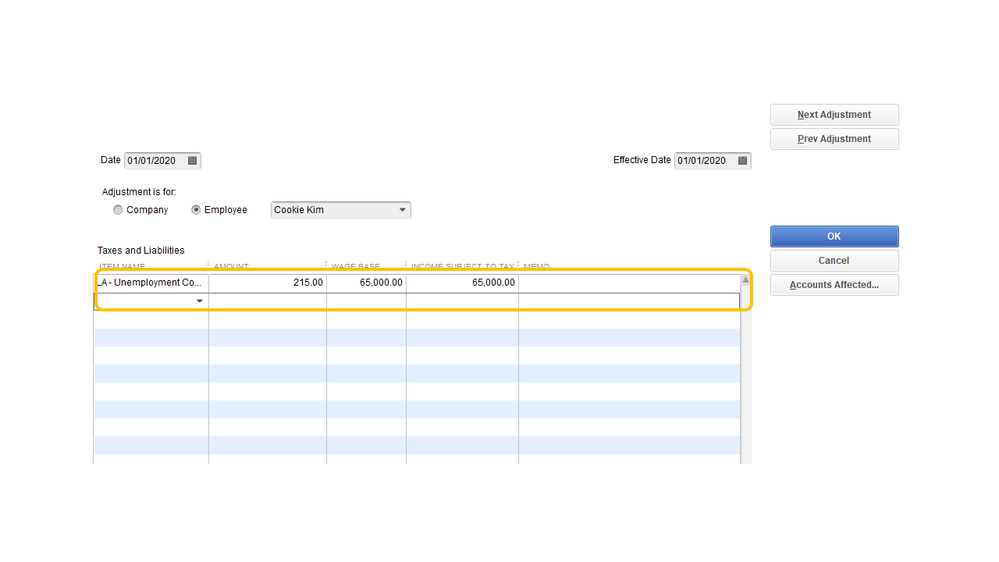

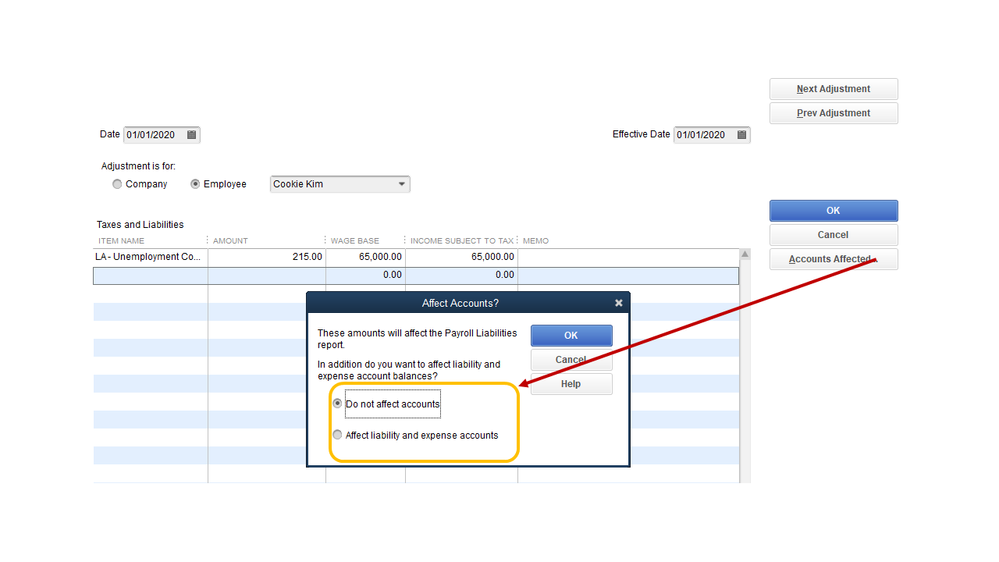

To correct your employee’s W-2 information, we’ll have to create a liability adjustment for each state. Let’s run the Payroll Summary Report for the quarter you need to adjust. This report includes employee wages, taxes, adjustments, etc.

Once you have the information handy, enter a positive adjustment to the state where the employees’ should be paying the taxes. Please know we’ll have to perform this action for each worker.

To set up a negative adjustment, follow the above process except for the amount’s sign. There should be a minus symbol beside the number since you’ll be deducting it to the paycheck.

After following the resolution, you can start pulling up the W-2 forms for your employees. The following links provide an overview on how to fix incorrect tax forms and steps to process them.

Stay in touch if you need further assistance while working in QuickBooks. Please know I’m ready to help and make sure you’re taken care of. Have a good one.

I have previously corrected the payroll tax liabilities. My problem is that it did not fix the earnings portion of the W-2 form. On the bottom of the W-2 (line 15 & 16) for the employee in question it lists Arizona earnings. There is a portion of line 1 broken out and listed as Arizona earnings. This is what I would like to correct. I know I can override the State to Nevada, however that makes is look as though only a portion of the earning are Nevada instead of the full amount of line #1. In addition quick books has created an A1-QRT (quarterly withholding tax return) for Arizona showing those earnings. There is no tax liability, just an amount in payroll for the quarter. I appreciate your assistance.

Thanks for providing an overview of what happened to your W-2 form, leanne6.

QuickBooks populates the total stage wages, tips, etc., in Box 16 that are subject to state income taxes and paid to the employee during the reporting year. Some deductions like 401(k), pre-tax medical, fringe benefits, etc., are not taxable to state income tax, however, they can affect this box.

For more details about this one, please refer to the Taxability of pay types article on how they affect this box.

The tax tracking types on your deductions/additions can affect the reported earnings if they are incorrect. With that said, let's review the deductions and check the tax type to correct this.

Here’s how:

If you’re unsure which tax tracking type to use for each deduction item, please reach out with your accountant for recommendations.

Then, to verify if you have the correct state withholding earnings, just follow the steps below:

On the other hand, Arizona form A1-QRT will show the liability amount in the Part 2 section under section A or B depends on your deposit schedule. Also, it will appear under Part 3 Tax Computation in Line 1.

Since there's no liability amount reflected, I'd suggest consulting our Payroll Support Team. They'll pull up your account in a secure environment. Then, they'll help you review the transactions and trace why the liability amounts are not posted on the state form.

Here's how to reach them:

I've got some articles here about correcting W-2 form boxes information and state payroll tax regulations:

Visit us again if you need a hand with filing the W-2 form or any payroll related. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here