Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowSolved! Go to Solution.

Hello there, @sharingsunshine.

Let me route you the best support group available to get this fixed.

Since your payroll account needs to be check, I highly recommend contacting our Payroll Support Team. This way, they can further check on the notice you've received from the IRS and help you sort it out.

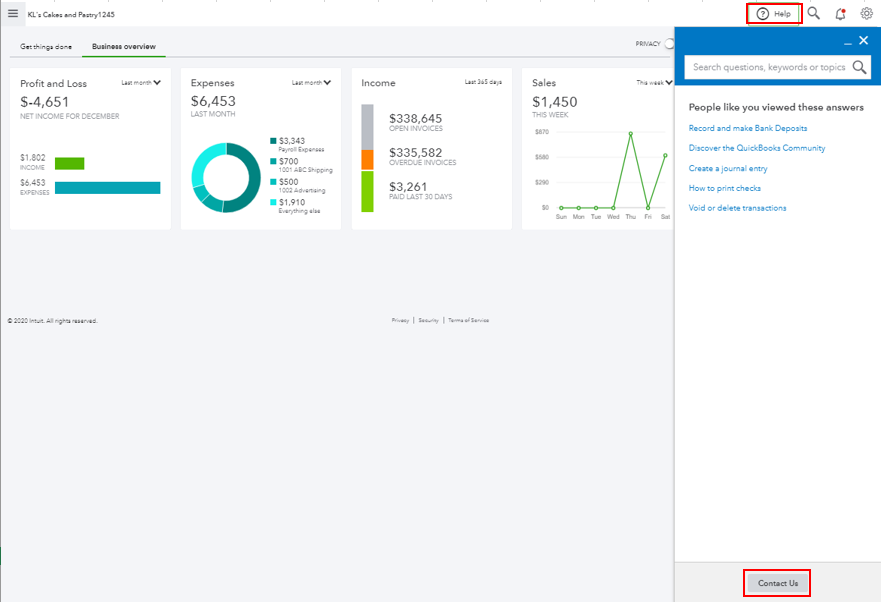

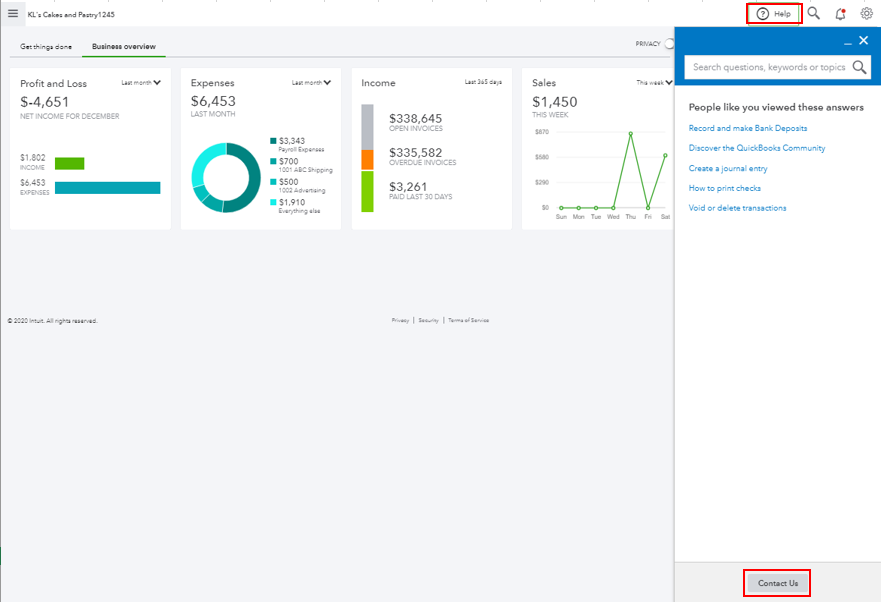

To reach them:

To know more about the Federal and State Tax Letters or Notice, please feel free to read this article: Federal and State Tax Letters or Notices.

Please know that you can always get back to this post if you have any other questions. I'm always here to help. Have a good one.

Hello there, @sharingsunshine.

Let me route you the best support group available to get this fixed.

Since your payroll account needs to be check, I highly recommend contacting our Payroll Support Team. This way, they can further check on the notice you've received from the IRS and help you sort it out.

To reach them:

To know more about the Federal and State Tax Letters or Notice, please feel free to read this article: Federal and State Tax Letters or Notices.

Please know that you can always get back to this post if you have any other questions. I'm always here to help. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.