You can create a backdated payroll as long as it falls within the current quarter and the tax forms have not been filed, uccgaylord. I'd be glad to share all the steps on how to create the paycheck for October 30.

Before we begin, I recommend consulting with your accountant before backdating or creating an unscheduled payroll. This is important because the paycheck date will be different from withdrawal date on your bank statement. Aside from that, please note that this transaction can only be processed as a paper check.

Here's how to backdate a paycheck in QBO:

- Go to the Payroll menu, then proceed to the Employees tab.

- Click Run payroll.

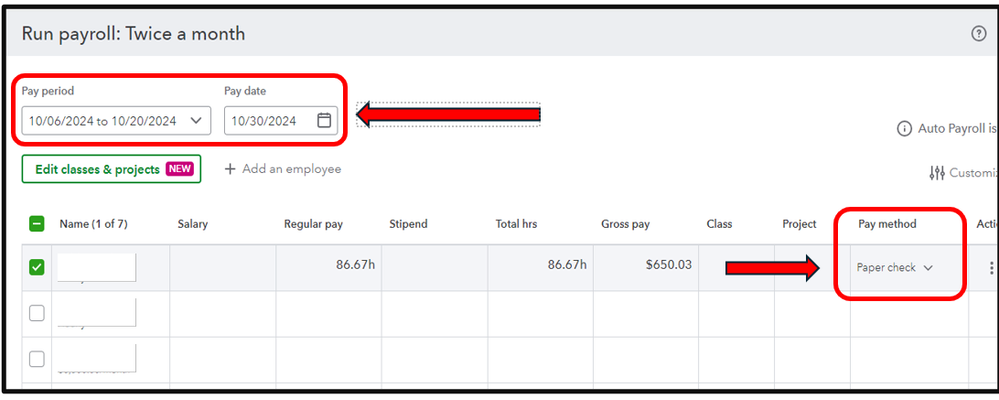

- Change the dates in the Pay date and Pay period sections.

- Select the employee and then add any other additions or deductions.

- Change the pay method to Paper check if it's set to Direct Deposit.

- Click Preview and submit payroll.

Once done, you can follow the steps in this article on how to print the transaction: Print or reprint paychecks and pay stubs.

Let me also give you this article that provides more details about this process: Create a late (backdated) paycheck in QuickBooks Payroll.

Additionally, you can use these articles if you need more guidance when managing paychecks in QBO:

Please feel free to reach out if you have any further questions or need additional clarification about paying employees or any other payroll tasks in QBO. We're here to support you every step of the way.