Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Thanks for dropping by the Community, williamslaw25.

The Sales Tax feature calculates the rate based on the following factors.

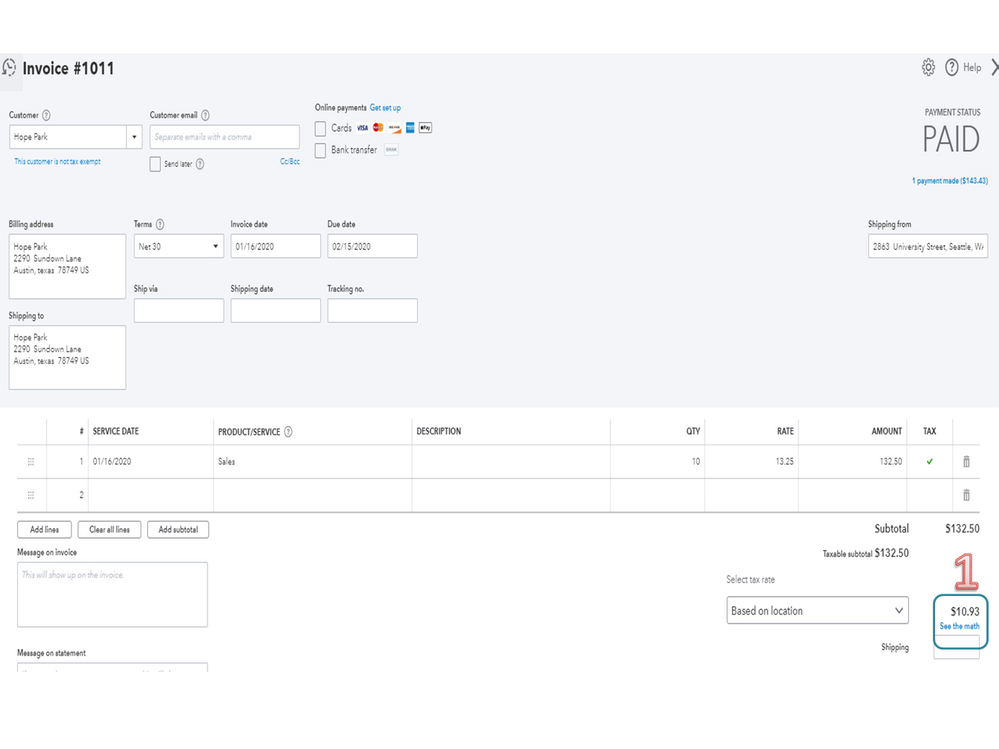

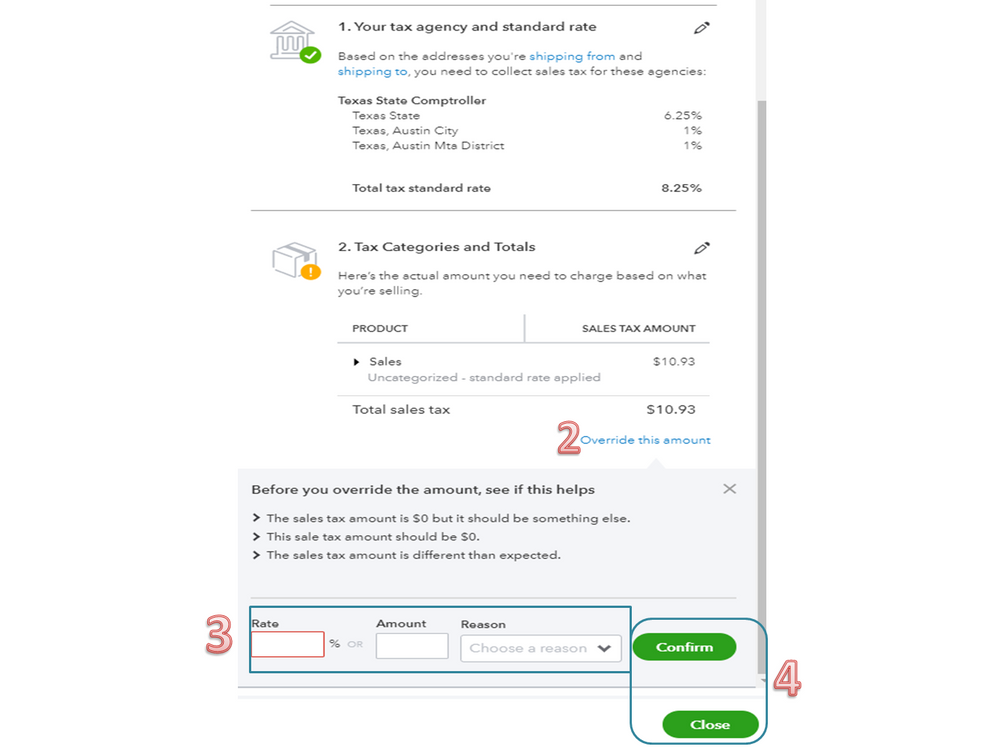

If the local tax rate is incorrect, edit it and enter the right one in the invoice. Here’s how:

The following article provides an overview of how the sales tax feature works: Use automated sales tax on an invoice or sales receipt.

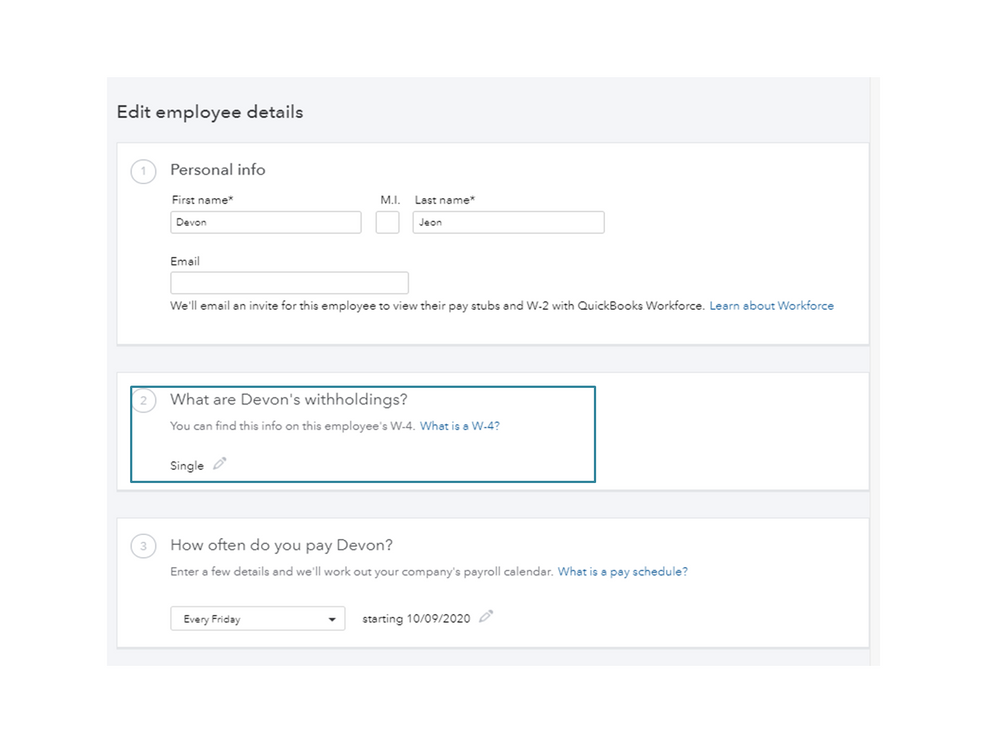

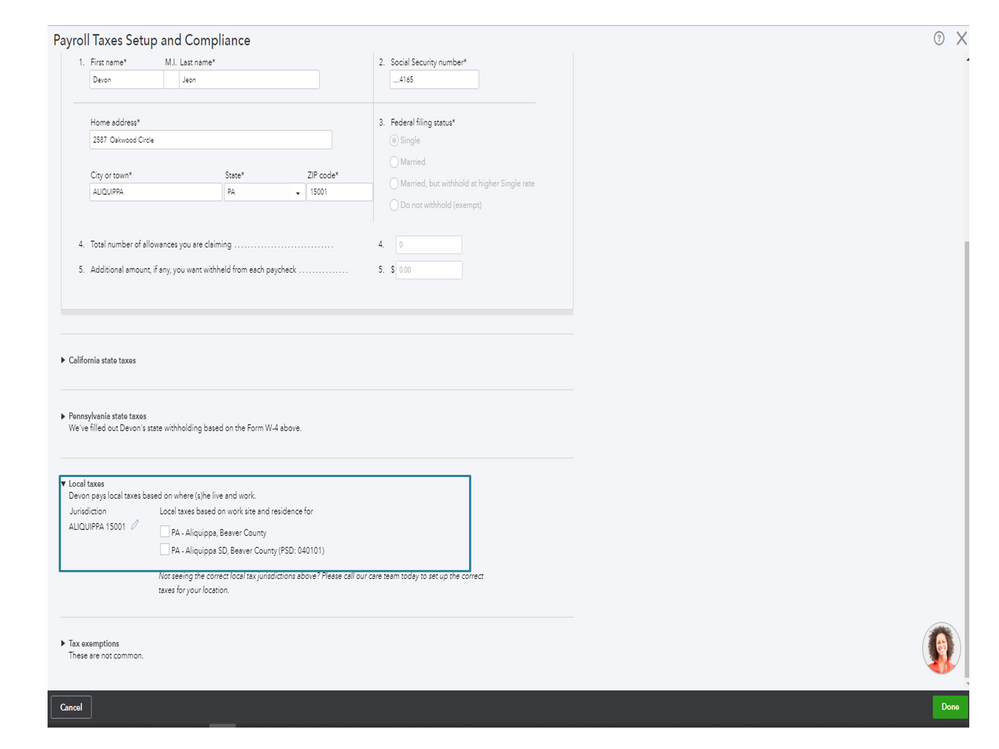

However, if you’re referring to the local tax rate for payroll, make sure to select the right county. This is to ensure QuickBooks will calculate the correct rate. Let’s open the employee’s profile to edit the information.

For your other concern, the option to only keep the payroll and cancel QBO is unavailable at this time. This is because payroll is an add-on service and you’ll not be able to use it without the online program. If you still wish to cancel the account, here’s a guide that covers all the instructions: Cancel your QuickBooks Online subscription or trial.

Alternatively, you can consider subscribing to QBOP standalone feature. Check out this link for more details: QuickBooks Payroll.

Reach out to me if you need help while working in QuickBooks. I’m always here to assist further. Have a good one.

On our receipt, Reference #[removed], we were charged $450 for the Intuit QB Payroll Annual Fee. It states this includes sales tax on the invoice. We are non-profit and should not be charged sales tax. How do we get this resolved so we are credited for the $27 sales tax? My phone number is [removed] and email [email address removed]. My name is Tina [removed] from [removed].

Hello @cefdauphin,

Here in the Community, we're unable to contact you directly for security reasons. With this, I'd recommend contacting our Customer Care Support directly from the Help menu.

With their tools, one of our specialists can pull up your account on file and discuss how it is charged based on your receipt. Please be informed that we've removed your personal information as it is displayed in a public space. And to avoid being used for fraud events.

That being said, here's how you can contact our dedicated support:

On top of that, I've also included this reference for a compilation of articles you can use while working with us: Account Management for QuickBooks Online.

If you have any other questions, please let me know by leaving any comments below. I'll be here to lend a hand.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here