Let's make sure that your next tax filing is correct and does not include SUI, heatherlewis.

Follow these steps on how you can exempt yourself from state unemployment insurance:

- Go to the Payroll menu and proceed to the Employees tab.

- Click your name to open your profile.

- Click the Edit or Pencil icon beside Pay.

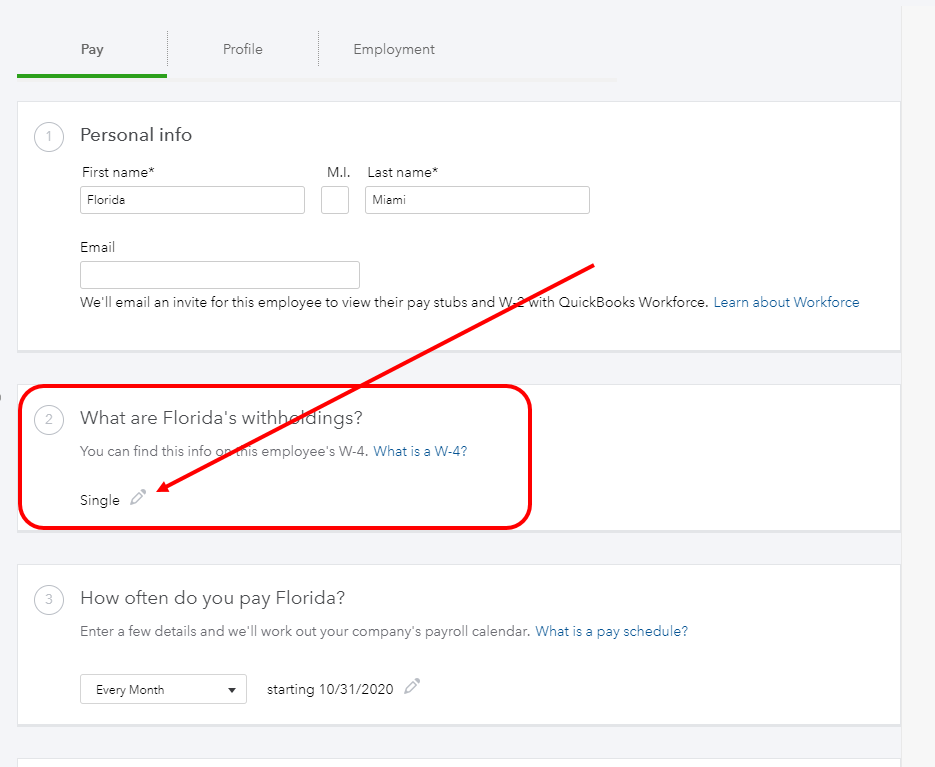

- Go to Step 2 What are (employee's name) withholdings? and click the Pencil icon underneath it.

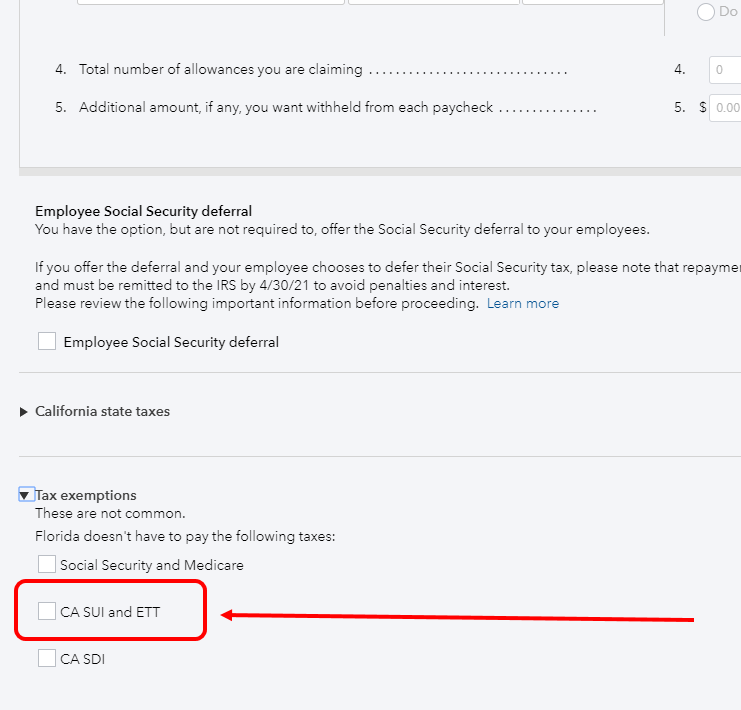

- Scroll-down to Tax exemptions and click on it.

- Uncheck the box for state SUI.

- Click Done.

More details about this are discussed here: Employee Payroll Tax Exemptions.

Check out these articles as well for more reference about tax exemptions and employee filing status:

You also mentioned that QuickBooks is filing the tax form on your behalf. If you're using the Full Service or Assisted Payroll, you'll need to reach out to them. They can pull up your account and make the changes for you. Here's how:

Option 1

- Go to the Help menu and click Contact Us.

- Type in the description box that you need help with your state unemployment tax setup, then click Continue.

- Select between Send a message or Get a callback.

Option 2

- Click the Help menu in the upper-right hand corner.

- Type in "Talk to a human", then press Enter.

- Look for I still need a human and click on it.

- Click Contact Us.

- Select between Send a message, Schedule an appointment, or Get a callback.

Please take note that their operating hours are limited at the moment due to the ongoing pandemic. You can see the full details here: Support Hours And Types.

The Community is always here if you have other questions. We're always here to help.