Thanks for visiting the Community today, Danbury.

I’m here to ensure your payroll data has the correct information. Let’s record the tax payment to remove it from the Pay Taxes & Liabilities screen.

The mentioned entry will show up again when the liability check was deleted or there’s data damage. We’ll have to pay the liabilities or perform a prior tax payment to resolve the issue.

To input the payment:

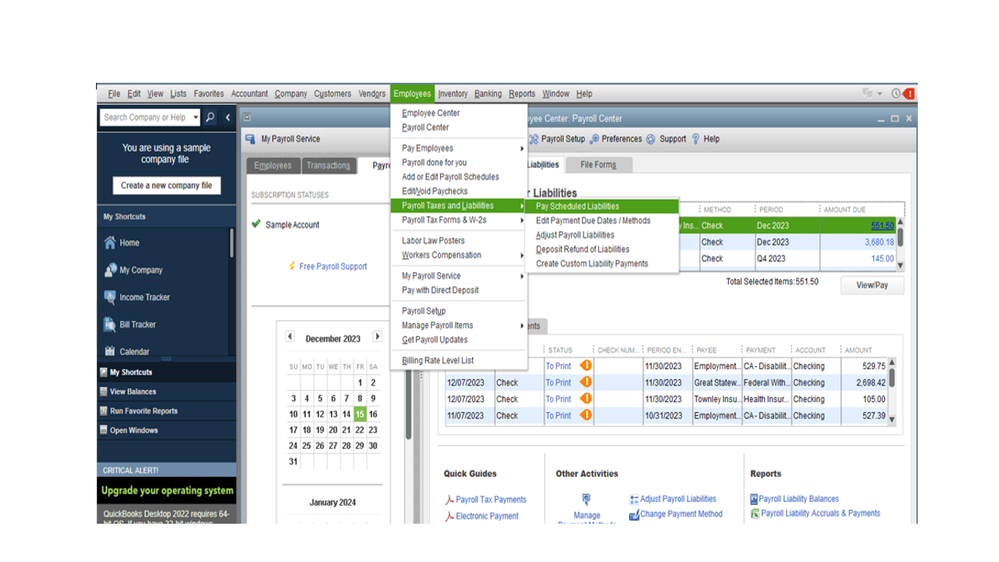

- In QuickBooks Desktop, press the Employees menu at the top bar to choose Payroll Taxes and Liabilities and Pay Schedule Liabilities.

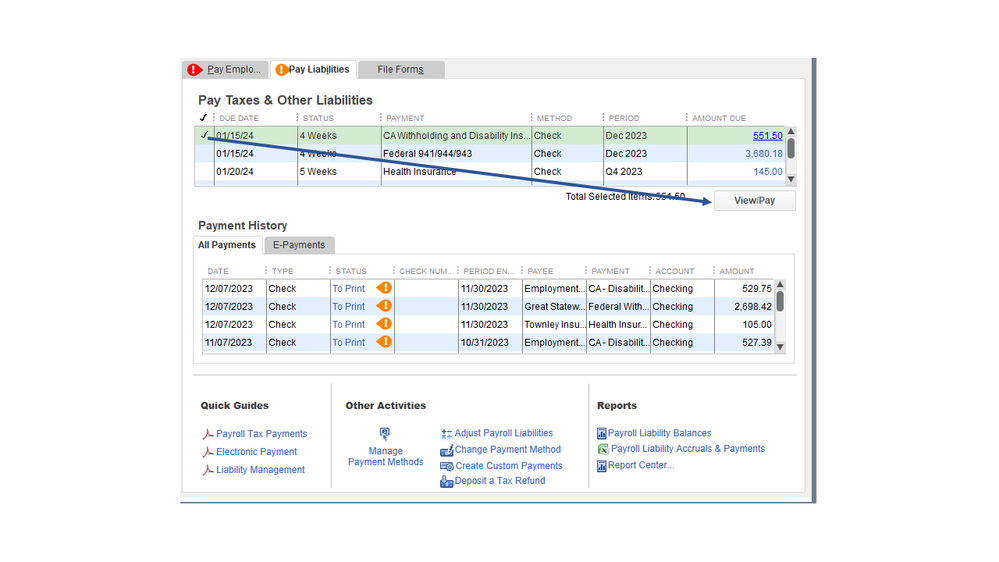

- On the Payroll Center, tap the Pay Liabilities tab to access the Pay Taxes & Other Liabilities section.

- From the list, tick the box for the liability you’re working on and click the View/Pay button.

- In the Liability Payment-Checking window, enter the correct check date in the Date field.

- Press the Save & Close button.

Here’s a reference that provides information on how to pay your tax liabilities manually or electronically. You’ll also learn about setting up a scheduled tax payment as well as troubleshooting common tax errors.

Additionally, this article outlines the complete steps on how to handle overdue taxes: Fix overdue or red scheduled liabilities in QuickBooks Desktop. The solutions are scenario-based, I suggest you choose the one that best fits your situation.

Feel free to add a comment below if you need still need help with handling your overdue liabilities. I’ll be right here to assist further. Enjoy the rest of your day.