Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello. We have our budget set up with accounts and classes. The classes are the different programs and major events our nonprofit has.

So for example we have an Office Supplies account code, but it can be office supplies for any one of our various Classes (programs/events).

My question is how to I split a staff members paycheck between classes? One staff members salary is budgeted between two different classes: Admin and one of the programs.

Additionally, each employee is assigned a class, so can their pay be split among two classes if they are assigned only one (see print screen)?

I already have it in the budget split between the two classes, but when i ran a P&L I realized it was not set up in Payroll, and I am not sure how to go about this.

Thanks for your help!

-Melissa

Thank you for providing us details of your concern, @MelissaC.

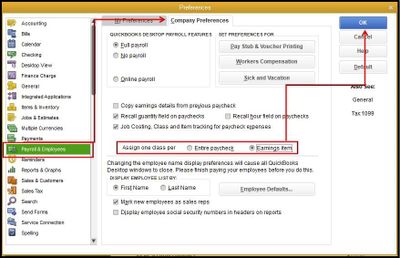

To split the pay between classes for your employees, you can have a 2 line item for earnings with 2 different classes when creating a paycheck.

Here's how to set up a salary payroll item:

Select Next.

Hit Next.

Next, you can add the new payroll item to the employee's set up so that it automatically shows when creating paychecks. For the detailed steps, please see this article: Set up payroll item in QuickBooks Desktop.

Then, to split the earnings when creating paychecks let's turn on this feature on the Edit menu:

To learn more, please visit this article: Tracking payroll expenses by class.

Also, if you want to have the payroll summary report by class, please follow the steps below:

Please let me know if there's anything else I can do for you about recording paychecks in QuickBooks. I've got your back and am always willing to help. Stay safe.

Thank you for the helpful response. I set up the salary payroll item as you demonstrated.

However, how do I actually split the salary? When I enter the new payroll item in Earnings under the employees Payroll Info, QB requires the two be the same amount, but one item needs to be more annually, and the other will be considerably less. The two will total the annual salary.

Also - When I am entering payroll for direct deposit, will I manually enter the amounts for each payroll item?

I can clear things out why QuickBooks requires you to enter the same amount for those earning items, MelissaC.

You can only have one rate for all salary payroll items. The workaround is to delete the other item. Then, enter it as a commission or add it manually when you create a paycheck.

To set up a commission item:

Once done, you can then add the item to your employee's profile. Check out this article for more details: Set up commission payroll item and reports.

Let me know if you have follow-up questions by leaving a comment below. I'm always right here to help ensure you're able to pay you employees.

Can this be done in QBO payroll?

Thank you for joining this thread, Admin242.

You can assign a single class to all of your employees in QuickBooks Online (QBO) Payroll, or set different classes for different workers. Also, the class tracking feature is available only in the Plus and Advanced versions.

The option to split your employees' paychecks between classes is currently unavailable. As an alternative solution, you can create another pay type. Allow me to walk you through the process of adding one.

Here's how:

Once completed, you can now use the newly created pay type when running payroll for the employee. Here's an article that explains how to manage payroll items from your employees' paychecks: Add or change pay type.

Furthermore, these resources provide an overview of when to use the class tracking feature, set up your class list, and create a budget for each segment, to name a few:

Let me know if you have any further questions about the class tracking function or other QuickBooks concerns. I am always available to help. I wish you continued success with your business.

I am interested to hear if setting up as commission worked for MelissaC. We also have splits between classes in our non-profit.

For example, we have 6 employees split by a percentage between classes...

Hi there, @GWNWUPDF.

While waiting for the confirmation coming from @MelissaC, may I ask for a few verifications about your initial inquiry? Have you tried setting up the employee payroll settings based on how the suggestion is discussed in the thread?

I also recommend consulting your accountant for suggestions in setting up your employees' payroll settings. Keep me updated in the comments below. Hope to hear from you as soon as possible. Stay safe!

I am need help with splitting employees between 2 different programs. We have each program set up with its own classes. But we must track our payrolls for each program (grants funded) seperately including PR taxes.

Any suggestions?

We also use QBO.

I am need help with splitting employees between 2 different programs and grant funds. We must track our payrolls for each grant program seperately, including PR taxes.

Any suggestions on how to seperate the payrolls but at the end of the year ALL the employees wages report together on the w2?

Hello there, usercheryle.

Splitting employees between two different programs in QuickBooks can be done by assigning each employee per class. I'll show you how:

Then, run a payroll. We can use this reference for further guidance: Create and run your payroll.

On the other hand, if you want to run a payroll with a different class each time, we can send this feedback to our Product Development Team. Gear icon> Feedback.

We can visit these articles for additional information when filing your W-2 form and generating reports:

Let me know if you have more concerns about running payroll in QuickBooks. I'll help you in any way that I can. Take care.

Our organization works from Grant funds and we can not co-mingle grants funds. Therefore I need to figure out how to set up employees in PR to be able to track each grant.

Example of what I'm looking at: Staff 1 works 26 hours a month on our CSRAE grant and she will be working 8.5 hours a month on the new DOJ grant, and Staff 2 will be working on both grants as well. So I will be processing 2 payrolls at the end of the month for them. How do I set this up in PR to be able to track and record the separate PR and the PR taxes?

And how can I run my month end reports showing each grant program expenses ?

Thanks for following up with the Community, usercheryle.

To set up your books to track payroll expenses by class, you'll initially need to assign classes to each employee.

Here's how:

Next, you'll want to set your accounting preferences to track expenses by class.

In regard to a report you can use to show your expenses by class, I'd recommend running a Payroll Summary report by Class.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply if there's any additional questions. Have a lovely day!

Can you do this in QB online as well and if so how?

Thanks for reaching out back to us, @usercheryle.

Yes, we can assign a class to an employee in QuickBooks Online (QBO) so you can track payroll expenses as provided by ZackE above. However, let me provide you with screenshots to help you follow the steps better.

First, make sure to turn on the class tracking feature. Please note that this is only available in QBO Plus and Advanced.

To assign a class:

Currently, the option to assign multiple classes to an employee is unavailable in QBO. That said, I suggest recommending that feature to our product developers by going to the Gear icon and selecting Feedback.

As a workaround, we can set up different pay types for each worker. Here's how:

Once done, you may proceed with running payroll for the employee.

You might also want to set up a direct deposit for your company payroll to avoid the hassle of paying your employees with paper checks.

You can always come back to this thread if you have additional questions about running payroll. You're always our priority. Stay safe!

We do have classes assigned to employees. But we now have to set up another class for the new grant to be able to pay the employees for their hours worked on grant #2. The employees work on BOTH grants and their hourly wages are different for each grant.

I am open to processing 2 seperate payrolls but will I need to create different GL accounts for each such as: Wages - Grant A and Wages - Grant B? And then how do I insure the company PR Tax liab for each payroll is posted to the correct class (grant)

We have to be able to track each grants expenditures separately.

Creating separate payroll is a great idea, usercheryle.

Yes, we'll need to create separate accounts for the grants. Here's how:

To ensure the correct account is assigned to the class, let's set up your accounting preferences. I'll show you how:

Then, change the class on the employee's profile before running payroll.

Once done creating paychecks, I'd recommend running a Payroll Summary report to view the wages, taxes, deductions, and contributions totaled by class. Here's how:

Please know that I'm always here to help you if you have further questions about class tracking or any other payroll concerns. Just add a post/comment below. Have a great day ahead!

Hello!

I'm a new QuickBooks user, so I may be asking a question that just won't work in QuickBooks.

Would it be easier to create a recurring JE to redistribute from one class other classes at the end of each month? A JE won't affect anything other than the class.

I realize being able to use more classes per employee would be ideal and easier. This might be hard to do if you have a lot of employees.

Thank you,

Hello there. Welcome to the Community.

I agree that more classes per employee would be ideal and more convenient. However, QuickBooks Online doesn't have a feature that allows users to assign classes for each employee, as there is only one class for every employee. For now, we suggest submitting feedback directly to our software engineers. They may consider adding it to our future product updates.

To send feedback:

Moreover, you can create a recurring journal entry, then turn on class tracking to display it in your recurring template. Here's how:

To keep track and manage your classes in QuickBooks Online, check out these articles:

You can also visit this article to learn how to reverse a journal entry to swap the debits and credits of your entries: Reverse or delete a journal entry in QuickBooks Online.

If you need further assistance about recurring transactions or class tracking in QuickBooks Online, don't hesitate to click the Reply button below. We're always looking forward to helping you. Keep safe!

Thank you!

You’re always welcome, @maurice6168.

It’s our pleasure to know we’re able to address your concerns about creating journal entries for the classes for your employees. We want to ensure our users are on top of their business.

In case you have other queries about using classes or creating journal entries, you can always post a reply in this thread. I’ll be around ready to listen and assist you. Have a great day ahead!

Hi,

I am Using Quickbooks Desktop Premier Accountant and we are an overseas NPO and use classes and jobs for assigning Staff a percentage in payroll. This all works well, but in Dec we paid bonuses (bonus account set up as a bonus account in QB) and we wanted this to go to a different class and job for most employees. The bonus was allocated in the job and class account correctly but it also took a percentage of Health Insurance and Pension with it. We do not want the Pension and Health to be allocated to the Job or Class the bonus is allocated. What do you suggest to do to stop bonuses doing this? We are abroad and don't have payroll taxes to worry about. Would a commission item be better and map it to the bonus account?

Thank you

I am sooooo excited to learn this! I provide custom excel labor reports that are based on Payroll Summaries from QB. I was separating the wages by way of FOH and BOH Payroll items but that did not split the Employer Contributions (taxes). Then we started using Classes and Voila!, that did the trick...until I had a few dual Class employees. You solved the problem by pointing out that I could pay "by earnings item" instead of "entire paycheck". Thank you!!!!!!!

Why list classes under Workmans Comp?

Divina, N

Question on your reply Sept 8, 2020 about splitting PR accounts.

Can something like this be done in QB online?

Thank you for providing us details of your concern, @MelissaC.

To split the pay between classes for your employees, you can have a 2 line item for earnings with 2 different classes when creating a paycheck.

Here's how to set up a salary payroll item:

Select Next.

Hit Next.

Next, you can add the new payroll item to the employee's set up so that it automatically shows when creating paychecks. For the detailed steps, please see this article: Set up payroll item in QuickBooks Desktop.

Then, to split the earnings when creating paychecks let's turn on this feature on the Edit menu:

To learn more, please visit this article: Tracking payroll expenses by class.

Also, if you want to have the payroll summary report by class, please follow the steps below:

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here