Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHow can I print an employee report that lists the payroll deductions that are set up in QB Desktop?

Solved! Go to Solution.

He doesn't want to "predict" deductions, he wants a report that shows deductions set up for each employee like insurance, or wage garnishments, etc. Those don't change. Go to "employee withholding report" "customize report" about halfway down it says "Adjust 1/amt/limit" and so on through adjust 10. Click on those until you find what you want. It's under "Reports" "Employees and payroll".

Printing employee reports is a breeze, @Rover101. Follow along below to get them printing right away!

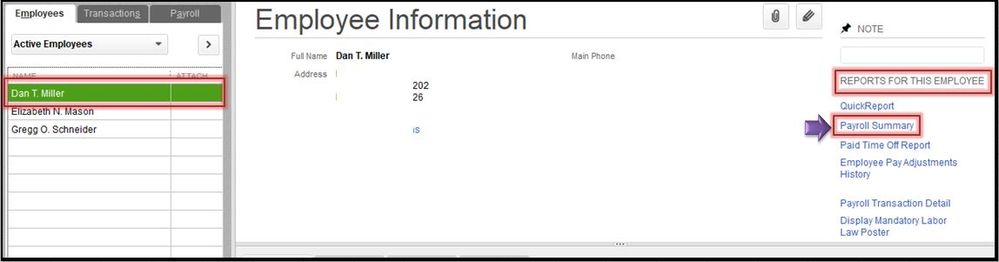

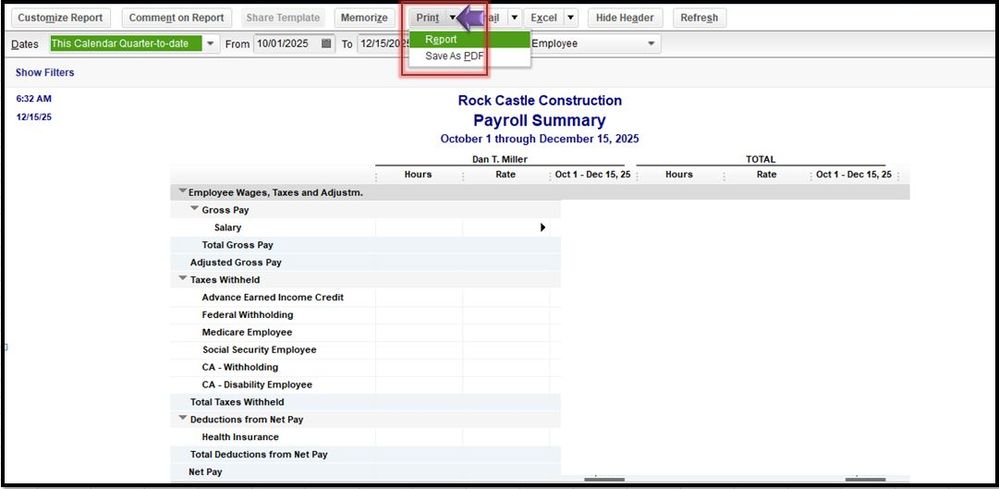

You can pull up the Payroll Summary by Employee report in QuickBooks Desktop (QBDT). This report shows the total wages, deductions, contributions, and taxes of your employees. Here's how:

For more info about payroll reports you can access in QBDT, please see this article: View and print payroll reports.

Also, to help you track your employees' wages and get the information you need, you may customize payroll and employee reports you open.

Keep me posted here if you have further concerns about printing payroll reports in QuickBooks. I want to ensure your success. Thanks for coming to the Community and take care.

Thanks for the quick response. Unfortunately, the payroll summary is not what I was looking for. I'm looking for a report that only shows me the deductions and contributions that are set up for all the employees.

Hello there, @Rover101.

Welcome to the Community. I'm here to help you run the payroll report you need in QuickBooks Desktop.

I recommend using the Employee Earnings Summary report to acquire the data. It'll show all the deductions and other necessary information you want from the employee paychecks.

Here's how:

I've also attached an article you can use to personalize reports further in QuickBooks: Customize reports in QuickBooks Desktop.

Drop me a comment below if you have any other questions related to your payroll. I'll be happy to help you some more.

This answer is the same as the first answer which doesn't answer the question.

How do you run a report that shows the deductions and contributions that are set up for employees. I don't want to see what happened in the past which is what the Payroll Summary shows. I want to know what is set up in the employee file. This would be very helpful during open enrollment to ensure the correct amount will be deducted from the employees paychecks.

Hello, @Rover101.

Thanks for coming back for more support. I appreciate you for simplifying what you want to achieve in a report.

We can run the Payroll Detail Review report to see employee records, payroll item set up, and wage and tax amounts. Here's how:

This report will also show you detailed information about how QuickBooks calculates tax amounts on employee paychecks and the wage base limit for each employee for each tax.

For future reference, read through this article to help verify your current setup or identify tax amount discrepancies and fix them: Run payroll checkup.

Let me know if you have additional concerns. I'm always here to back you up.

That report also tells me what happened in the past. I don't want to know what came out of their last check. I want to know what will come out of their next check. Changes in deductions have been entered due to new rates for 2021 and I would like to double check the entries. Is there a report that will show me current employee deductions, not past deductions?

Thank you for getting back to us and providing us with more information about the report that you'd like to have, @Rover101.

There are lots of reports that are available in QuickBooks. That is based on the data that you've entered on the account when you run payroll like the Payroll detail review report and other reports that we're mentioned above.

However, a report that'll predict upcoming deductions to your employees is currently unavailable. For more information about the wage caps and tax rates for 2021, check this article: Payroll 101.

It's also best to keep your software up-to-date by updating QuickBooks Desktop to the latest release to have the latest features and fixes. Also, the latest payroll tax table updates to ensure that you have the most recent QuickBooks Desktop Payroll.

If you have other questions, I'm happy to answer it for you. Just post it here as a reply and I'll take a look at it. Have a good one!

I was wondering if you ever got a response on this. I needed the same information as you.

Hey there, aquinones.

Thanks for dropping by the Community, at this time, a report that will predict upcoming deductions to your employees is still currently unavailable. I'm going to go ahead and suggest this feature to our product engineers to see about getting it implemented in a future update. You can keep an eye on the QuickBooks Blog for information on changes and updates made in product. If there's anything else I can do in the meantime, feel free to post here anytime. Thanks and I hope you have a lovely afternoon.

He doesn't want to "predict" deductions, he wants a report that shows deductions set up for each employee like insurance, or wage garnishments, etc. Those don't change. Go to "employee withholding report" "customize report" about halfway down it says "Adjust 1/amt/limit" and so on through adjust 10. Click on those until you find what you want. It's under "Reports" "Employees and payroll".

Thank you I was wanting the same thing. You are the bomb....

OMG Thank you for this so much, you just saved me so much work. I was struggling needing this info. The auto answering bot apparently can't read lol.

I hope that the OP hung on to see your golden-ticket answer. Thx.

This is how I have been getting the information as well. It's a shame though, that Quickbooks doesn't have a better report than this. I have employees who have more than 10 deductions, so this report doesn't give me everything I need. And I also hate that the description and the amount are in the same "cell". When I export to Excel, I have to do a lot of unnecessary formatting to get the data in the form I need. Things such as this are primarily why we are moving away from Quickbooks payroll!

AMOORE1987,

What I found I had to do is put a "place holder" in line

and then make sure that each line was the same on every employee like:

1. Place holder such as: Employee Deductions (Or garnishment OR training tax etc...)

2. AFLAC (Post-Tax)

3. AFLAC (Pre-Tax)

4. Health Insurance (pre-tax)

5. Health Insurance-Employer paid

As long as AFLAC (Pre-Tax) is always on line 2, then we're good!

Hope that helps!

mh1234567,

Thank you so much!

This was a fantastic solution!

Would you happen to know if we can change the headers

Adjust 1/amt/limit

to be what the column represents such as

AFLAC (Pre-Tax)?

Thanks!

Oh man, I was having this EXACT issue and trying to use ChatGPT to help me through it. Your answer is EVERYTHING! Thank you SO much! I KNEW it had to exist! AI is no substitute for the human brain...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here