Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I used a payroll funding company. They received all payments from client on our behalf. Once all payroll, taxes and fees are taken out, they deposit the "profit" on our business account weekly. How do I properly record this in QB?

It’s great to see you in the Intuit Community, PauHan.

To ensure your records are correct, you’ll have to input all the transactions coming from the payroll funding company and then create a journal entry. This is to mirror what happened to the actual entries.

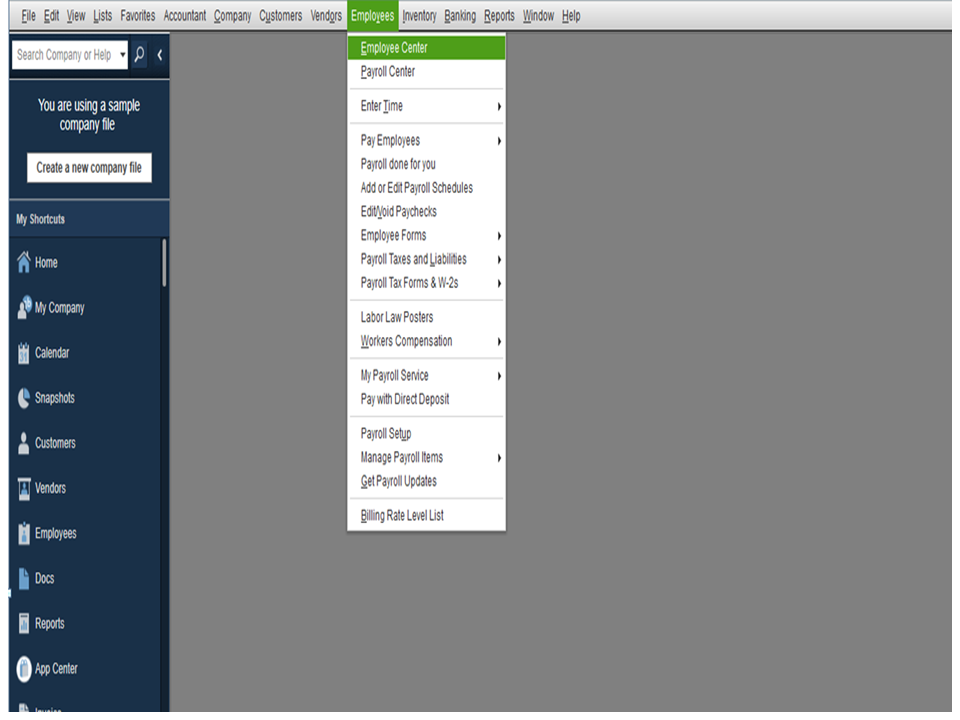

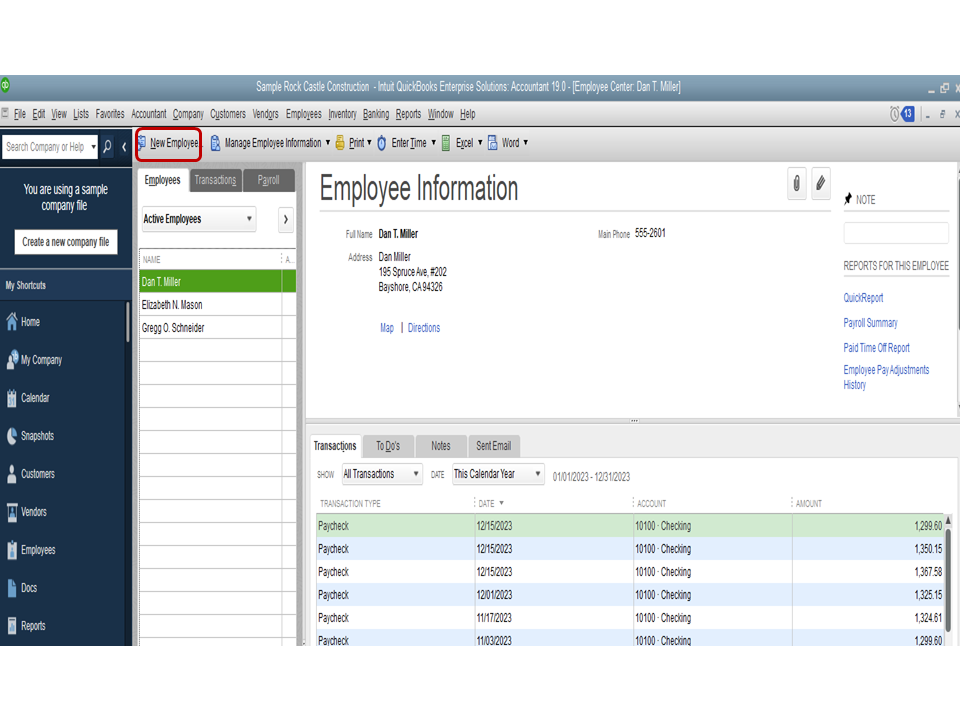

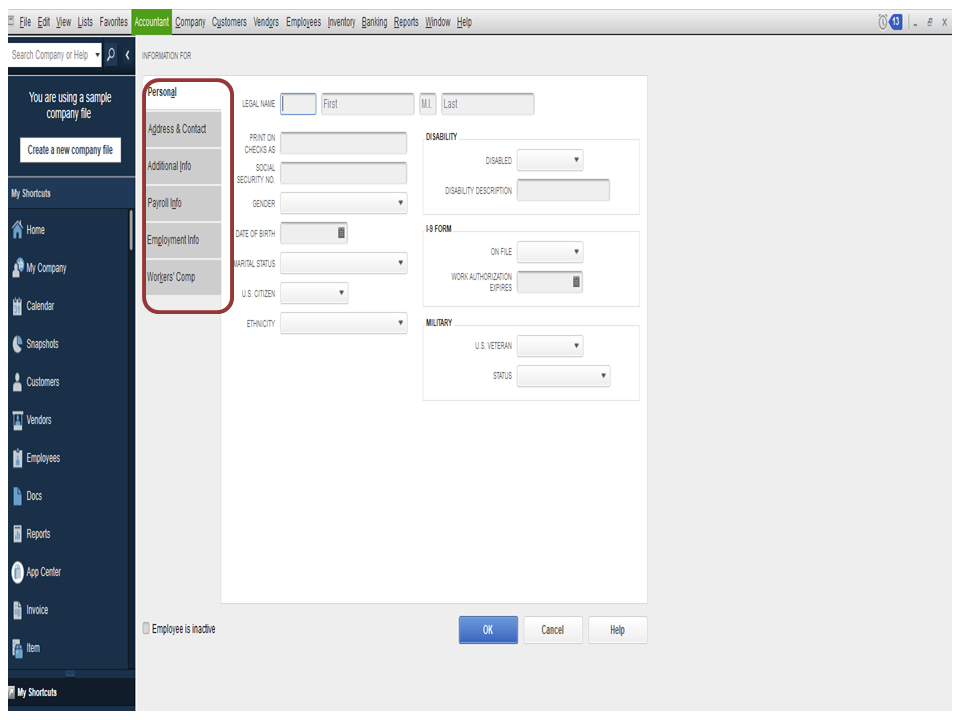

Let’s start by adding the employees. I can help walk you through the steps.

Follow the same process to enter the remaining employees. Next, set up their wages.

The following guide provides an overview of adding an hourly or salary wage item.

Make sure to enter the accounts used to track the transactions in your chart of accounts. For detailed instructions, perform the recommended steps in this article and go directly to the Add or edit an account section: Understand the chart of accounts in QuickBooks.

After setting them up, you can start entering the journal entry. Since the process requires specific posting accounts, I suggest consulting with an accountant for further assistance.

They can provide recommendations on which category to use for the entry.

Stay in touch if you need further assistance while working in QuickBooks. I’ll get back to help you. Enjoy the rest of the day.

Thanks, but that won't work for me I have way to many employees to set one at the time. I received an earning statement from my payroll company every week with totals and that's what I'm looking to enter into QB.

The earning statement I receive contain the following information:

REVENUE = Weekly Invoicing

PAYROLL = Regular and Overtime payroll

EMPLOYER RELATED TAXES = FICA, MED, FUI & SUI

DIRECT EXPENSEN = Commission to payroll company and a reserve fund

Good morning, @PauHan.

Thank you for the feedback by adding employees to your account.

At the time, QuickBooks Desktop doesn't offer an option to add multiple employees at once. I'm going to submit feedback to our Product Development Team for them to review further and consider it soon.

For now, you can follow the steps above that my colleague @Rasa-LilaM provided how to enter in those earnings each week and set up employees.

If you have any more questions or concerns, please don't hesitate to Reply to this thread. Have a safe and productive rest of your day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here