Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello,

We use QuickBooks Desktop Pro 2019 with QuickBooks Enhanced Payroll. I just ran our quarterly Unemployment Insurance - Quarterly Contribution Report Worksheet for our state and the form automatically generated by QuickBooks showed a contribution due of $102.63 based on our wages and contribution rate.

This amount was validated as correct on our state website when I submitted the form data and was given on the payment page to make that contribution.

However, the Pay Liabilities tab of our Payroll Center in QuickBooks Desktop rounded up to $102.64, so now I show a $0.01 balance for this liability which is incorrect.

What is the best way to clear out this incorrect liability balance amount?

Thank you!

Solved! Go to Solution.

I'll help you clear out the liability in your Payroll Center, Paakaa10.

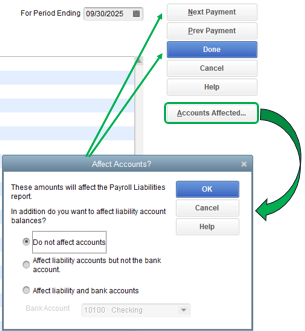

You can create a prior payment entry to remove the remaining balance for state unemployment. Here's how:

Once done, go back to the Payroll Center to check if the amount is no longer there. Here's an article about this feature for more details: Enter Historical Tax Payments in Desktop payroll.

Alternatively, you can also record a negative payroll liability adjustment to clear it out. Follow the steps in this article for guidance: Adjust Payroll Liabilities in QuickBooks Desktop.

You'll also want to check out this article on how to see all the remaining balances you have in QuickBooks: Run Payroll Liability Balances Report.

As always, please don't hesitate to reach out to us again or reply to me if you need anything else.

I'll help you clear out the liability in your Payroll Center, Paakaa10.

You can create a prior payment entry to remove the remaining balance for state unemployment. Here's how:

Once done, go back to the Payroll Center to check if the amount is no longer there. Here's an article about this feature for more details: Enter Historical Tax Payments in Desktop payroll.

Alternatively, you can also record a negative payroll liability adjustment to clear it out. Follow the steps in this article for guidance: Adjust Payroll Liabilities in QuickBooks Desktop.

You'll also want to check out this article on how to see all the remaining balances you have in QuickBooks: Run Payroll Liability Balances Report.

As always, please don't hesitate to reach out to us again or reply to me if you need anything else.

That did the trick; thank you for your help!

I tried this solution for a similar issue but it didn't work in my situation. If you have other suggestions, please help. My payments and liabilities screen shows a payment due for IRS withholding, SSI & Med EE and ER. The issue is in custom liability payments I have zero due. When I 'pay' the scheduled liability the n a credit shows up in custom payments?? I reconciled the whole year (2020) to the W3 and verified all my payments with IRS and I owe zero. I can't figure it out. One would think both custom screen and scheduled screen should have the same balances.

Hello, frr.

I appreciate your efforts in trying out the given solution above. I'm here to ensure you'll get your payroll corrected so you can get back on track.

Checking the correct liability in QuickBooks Desktop Payroll would depend on the date entered in the custom liability check. Let's make sure that the liabilities are accrued on the date the paycheck is issued, not on the pay period of the check.

If the custom date is the same as the paychecks on the liability account, the balance should show the same.

If you create a prior payment, you can follow the steps provided by the colleague above. Then adjust the correct amount on the liability adjustments. This will correct the employee's year-to-date (YTD) information to ensure your forms are correct.

Here’s how to adjust payroll liability:

This article can guide you through the process if you'll want to enter a prior payment history event: Enter historical tax payments in Desktop payroll.

I'm also attaching this link here in case you need help in filing your tax forms: Set up your Federal Forms 940, 941, and 944 for e-file in QuickBooks Desktop.

Keep me posted on how everything turns out by commenting below. I'll be around until you're able to see your payroll liabilities.

My payroll liabilities lists an overdue employer social security tax payment for 12-1-21 - 12-31-21 in amount of $1064.23. Social security payments for 2021 were satisfied for employee and employer in September 2021. This liability came out of the blue. How can I delete that liability payment requirement?

Thanks for joining this thread, @tgeorgelas. I'd be glad to help you remove the liability payroll requirement in QuickBooks Desktop (QBDT).

To get rid of the overdue status and ensure that your tax reports are accurate, you can record them as historical tax payments in QBDT. Follow these steps to proceed:

I've also included an article that will guide you in recording historical payroll information into your QBDT Payroll: Enter Historical Tax Payments in Desktop payroll.

Otherwise, you can also record a negative payroll liability adjustment to clear it out. Here's an article for a detailed process: Adjust Payroll Liabilities in QuickBooks Desktop.

In case you need to track where your business stands in terms of employee expenses, you'll want to customize the payroll and employee reports.

Drop me a comment below if you have any other questions related to your payroll liabilities. I'll be happy to help you some more. Have a good one!

Thanks for your help! I was able to clear the unnecessary pay liabilities.

I'm glad I was able to help you, @tgeorgelas!

I'm happy to provide insights to get you going. If you require any support or have any QuickBooks concerns in the future, please do not hesitate to post here in the Community space. We're always around to back you up.

Thank you again, and have a wonderful day ahead!

II have several LA Unemployment Insurance payments showing past due in may Pay Liabilities tab. I file and pay all of my state taxes online monthly. When I file my return, the system calculates what is owed and I pay by EFT. I record the payments that are withdrawn from my account to balance and reconcile.

According to the state website my account is at a $0 owed balance. However, I show that I have not paid any of the payment due since 02/02/2021 in my QB account. I attempted to go to the Help and use ctrl alt Y to follow the steps to remove each past due amount - and after I followed thee steep, the balance was not removed from the pay liabilities tab. The amounts do not match dollar for dollar with payment I have made so I cannot just show a having written a check for the amounts due each month. Please help me to get rid of this overdue list.

Let's resolve the error you're having to remove the past due amount, @mzdonnag.

There can be some minor data issues with your company file that's why those amounts are still showing even after following the steps provided above. Try running the Rebuild and Verify Utility tool to fix possible data damage on your company file.

Please follow the steps below:

If you still get the same issue, let's try running the QuickBooks File Doctor to fix common issues.

I'm adding this article for more troubleshooting steps: Fix data damage on your QuickBooks Desktop company file.

Refer to this article for more information about finding payroll discrepancies and adjusting your payroll liabilities: Adjust payroll liabilities in QuickBooks Desktop Payroll.

Once done, you can run either the payroll summary report or the payroll liability balances report to check if the amounts to be paid are now correct: Run payroll liability balances report.

If you need any more assistance with your payroll liability or anything else, drop us a line below. Enjoy the rest of your day!

I have this issue but in reverse. My payroll liability amount is correct; however, the contribution amount on the report is not. Is there a way to adjust the report to match the amount that was actually paid out?

lauralynn87, it gives me great pleasure to welcome you to the community. I'm glad you reached out to us. I'm happy to help with your first question in our forum.

The following scenarios are the reasons why you may encounter errors or inaccurate information when you run the Payroll Liability Balances report:

If you encounter scenario 1, here's how to fix it:

You can visit this article to know the steps if you experience the errors for scenarios 2 and 3: Fix a discrepancy on the Payroll Liability Balances report in QuickBooks Desktop Payroll.

Moreover, let's also verify if our contribution item is currently set up. If incorrect, please check out this link to know how to update it: Set up and manage company contributions.

I've also included the following article to learn how to follow wage garnishment orders using QuickBooks Desktop Payroll: Set up and collect garnishments.

Click the Reply button below if you have further questions about managing reports. We're available 24/7. Have a prosperous year with QuickBooks.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here