Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I even add a Sales rep that is getting commissions only as a 1099 rep? When they make a sale, how am I able to track the sale to be able to pay them their commission? I am using QuickBooks Plus Online.

I can help you add and track Sales Reps in QuickBooks Online, @JPS148.

Thanks for reaching out to the Community for assistance.

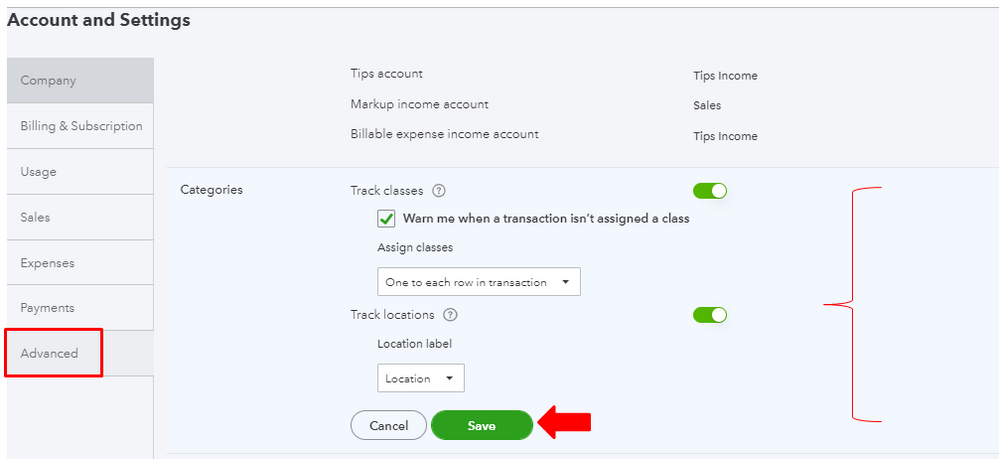

QBO can track Sales Rep by using class and custom fields. This way, you’ll be able to shadow their sales individually. You'll need to turn on the feature first to get started. Here’s how:

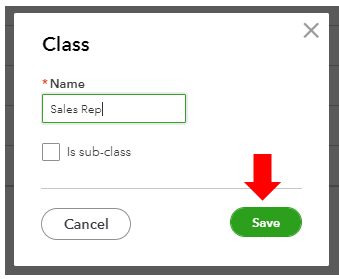

Then you’ll want to create categories for your class after turning the feature on. Please follow these instructions:

To add the Custom field for Sales Rep in QuickBooks, you can check the article to do so. You may also visit this link here to get started with class tracking and its detailed instructions.

Running reports by class will help find out how much each salesperson sold each day.

Don't hesitate to leave a comment below if there's anything else I can help you with the sales rep. I'm always around to ensure your success. Have a great day ahead!

As another option, consider having a sales commission app to integrate with your QBO account.

I'm a Manufacturers's Rep, and I periodically need to pay other rep firms commission, on customers that they brought to the table. These are 1099 Independent Contractors and/or C- Corps. In QB 2021, desktop version, do I set them up as vendors, which they technically are, or as employees? The problem with entering in payments, is that I'm not physically writing any checks, as I am Direct Paying them through my Wells Fargo Business account, and I don't want to make them send me an invoice each month for what I owe them. Is it even possible to do this?

Thanks for joining the Community, ShimmyStein.

You can set up contractors as vendors. Before getting started, I'd recommend having each of them fill out a W-9 if they haven't yet. This gets you all the details you'll need and can make the process quicker. These forms can be downloaded directly from the IRS website.

Once you're prepared, here's how to create contractor profiles:

Next, you can start tracking their payments for 1099s.

As for determining how to properly set up C corporations, you'll want to work with an accounting professional. If you're in need of one, there's an awesome tool on our website called Find an Accountant. All ProAdvisors listed there are QuickBooks-certified and able to provide helpful insights for driving your business's success.

I've additionally included a couple detailed resources about paying contractors that may come in handy moving forward:

Please feel more than welcome in sending a reply if there's any questions. Have a wonderful day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here