Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have two questions about the timing of 401K withholding deposits. Using Enhanced Payroll, the program does a pretty good job of setting aside the amounts for both employee and employer contributions. Under the pay liabilities tab, Enhanced Payroll sets up a check with a SEND BY date, usually the first of the month following the month in which the employer cut the employee checks. The IRS/DOL guideline is to deposit into the investment account each employee's money ASAP after they get paid - usually within a couple of days. The timing in Enhanced Payroll is fine if you just get paid once at the end of the month. But if you get paid either weekly or bi-weekly, then you will blow past the couple of days window from when an employee got paid. So, my questions:

1. If the immediacy requirement is true, why does Enhanced Payroll suggest a SEND BY date of the following month?

2. Is there a way to change this in the program so that as soon as a check is cut, the SEND BY date of the associated 401K deposit says something like: SEND TODAY?

Thanks,

EA

Hello there, @EEA.

Thanks for choosing QuickBooks as your business tool. I'm here to share some insights about the timing of 401K withholding deposits.

Most likely the 401K Contribution item is set up for a monthly payment schedule in your QuickBooks. Yes, you have the option to change its frequency to your desire.

I'd be glad to show you how:

For more insights, you can refer to this article: Set up and pay scheduled or custom (unscheduled) liabilities.

That should change the 401K deposit schedule, EEA. Let me know if you have additional questions about taxes and payroll. I'm still here to help you further. Have a good one.

Thank you for the step by step to ensure the timing of the 401 k is correct. I have done this and I am showing that both my 401k employee match & Co match are due to be paid weekly. BUT my Company amount is still not showing up in my Pay Liabilities. The Employee portion is, but the employer is not, it was showing up until 2 weeks ago now it's gone. Do you have any other suggestions to try?

Thanks

LM

Thanks for joining the discussion, @LAM3,

I appreciate you letting us know the outcome when you followed the recommended steps above.

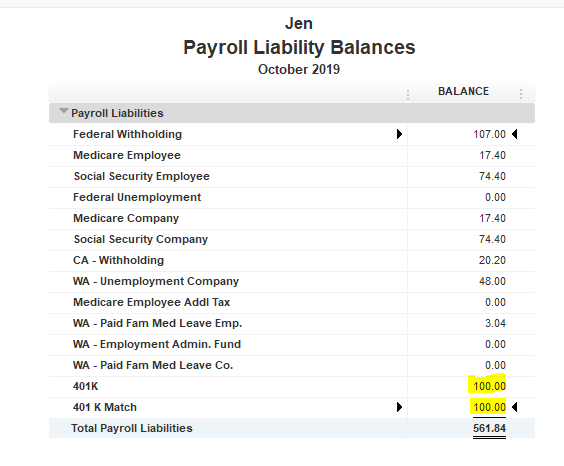

Only payroll liability items that have been set up on a payment schedule will show up in the "Pay Scheduled Liabilities" window. Since you already set up a schedule for the item and the amount still does not reflecting the Payroll Center, let's pull up a report to review the 401k Match contributions.

We can use the Payroll Detail Review report to verify the taxes withheld and the difference. Here's how:

On the report, review if the checks reflect the correct contributions. You can get the correct calculation by multiplying the total wage base of each payroll items to its corresponding tax rate (if applicable). Correct the transactions that doesn't have the match or create a liability adjustment for any discrepancy showing on the report. Here's an article with the complete steps on how to create an adjustment: Adjust payroll liabilities.

Another option is to check if QuickBooks is doing a catch up for previous tax overpayments or review liability checks with dates including the period you need to pay for the 401k Match. We can do that by opening a Payroll Liability Balances report:

To see a list of the transactions that make up the balance, double-click the amount to view the Transaction List report.

Please don't forget to let me know how things goes. I'll be waiting on a standby for your response as I want to make sure you're all set. Have a good one!

'what if you don't pay these weekly and pay them after each payroll which is bi weekly......The frequentcy does not allow for a bi weekly payment

Hi Itsjustmemarci,

Thank you for joining in on the thread. Let me help you out.

You can set the payment frequency to Weekly and make a payment for every 2 weeks worth of liability, or create a custom payment. You can refer to the article about creating custom payment: Pay your non-tax liabilities in QuickBooks Desktop Payroll. Expand this section: Pay an unscheduled liability or create a custom payment.

Let me know if you need more help. Take care and have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here