Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Re: W2 Box 1 Not Calculating Correctly

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

I have a Payroll Item Deduction that uses the "Other" tax tracking selection. It is an employee deduction that reduces Federal Income Wages (Box 1 wages) but does not reduce Social Security, Medicare, or State Income Tax wages. When I run payroll it works correctly - it reduces the federal taxable income for the amount of the employee deduction. When I run the Tax Form Worksheet for W-2, it also calculates everything correctly there - the total for Box 1 wages is less than Box 3, Box 5, and Box 16 wages by the amount of the deduction. But, when I create the W-2s for the year by selecting "Create Form" for the "Annual Form W-2/W-3", QuickBooks Desktop is not processing it correctly. Box 1 wages are the same as Box 3, Box 5, and Box 16 wages.

How do I correct this? Is it advisable to simply override the Box 1 amount? I can do that, but I have a lot of employees that have this deduction and it seems to me that if QB is calculating correctly when I process payrolls and run reports, then it should process it correctly when I generate the W-2.

Solved! Go to Solution.

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

The W-2 is actually right, as is the tax forms worksheet.

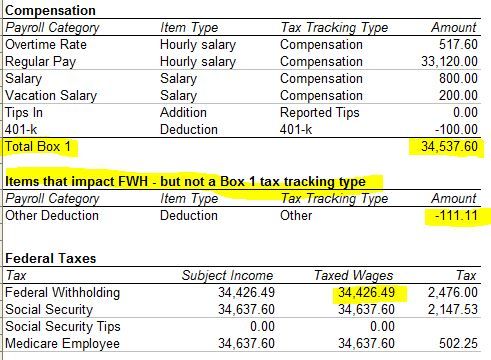

To duplicate this, I set up a deduction with the Other tax tracking type, forced it to reduce Federal withholding, and bypassed the warning I got. Then I used it on a paycheck for -111.11. Then then I ran the Tax form worksheet to see the result.

I got both the the correct number for Box 1, which didn't include the item, and the correct number for Federal taxed wages, which was different.

And also the report showed me the issue with my data/ showed the item that was excluded from Box 1 based on its tax tracking type. I expect you will see this as well when you run your report:

When comparing the actual W-2 with the tax form worksheet, use the number on the line "Total Box 1" not, Taxed Wages, which do not appear on the W-2.

-----------------------------------------

The weird thing about Box 1 is that it correctly does not show wage base (taxed wages) the way the other boxes do, per the W-2 instructions.

Instead it shows the sum of the amounts of various tax tracking types like Compensation and 401k deductions and so on, regardless of their tax settings. You can see the details of how that works on the worksheet, but not on the W-2 form where you see only summaries.

An item with "Other" as the tax tracking type ill now impact Box 1, regardless of its tax settings.

Items with the following tax tracking types will impact Box 1, adding to or reducing it:

Compensation

Reported Tips

457 Distribution

Non-Qualified Plan Distribution

Fringe Benefit

Other Moving Expense

Taxable Group Term Life

SCorp Medical Premium

Simple IRA

401-k

403-b

408-k

457

Dependent Care Flex Spend

Premium Only Plan

Medical Care Flex Spend

HSA Company Taxable

HSA Employee NonTaxable

They will impact the box whether or not they are set up to impact Federal Withholding tax.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

You got it right, @mroy.

Since the data generates correctly when processing your payroll and running reports, creating the W-2s for the year should be the same. Rest assured I’m here to help and guide you on how to get around this issue.

I recommend running the Verify Rebuild utility tool. This scans your company file for errors and fixes them right away. Let me show you how:

To Verify:

- Go to the Window menu and select Close All.

- Then, go to the File menu.

- Select Utilities.

- Click Verify Data.

To Rebuild:

- Go to the File menu.

- Select Utilities.

- Click Rebuild Data.

I've got you this article for more detailed steps: Verify and Rebuild Data in QuickBooks Desktop.

Once done, you can now generate your W-2 seamlessly. In addition to this, you can also invite your employees to workforce and let them view their W-2s online. You can check this article for the complete details: Invite your employees to QuickBooks Workforce to see pay stubs, W-2s.

In case you have other concerns with your W-2s, you can always share them with me. I’ll be around to listen and help you out. Keep safe and more success in your business!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

The W-2 is actually right, as is the tax forms worksheet.

To duplicate this, I set up a deduction with the Other tax tracking type, forced it to reduce Federal withholding, and bypassed the warning I got. Then I used it on a paycheck for -111.11. Then then I ran the Tax form worksheet to see the result.

I got both the the correct number for Box 1, which didn't include the item, and the correct number for Federal taxed wages, which was different.

And also the report showed me the issue with my data/ showed the item that was excluded from Box 1 based on its tax tracking type. I expect you will see this as well when you run your report:

When comparing the actual W-2 with the tax form worksheet, use the number on the line "Total Box 1" not, Taxed Wages, which do not appear on the W-2.

-----------------------------------------

The weird thing about Box 1 is that it correctly does not show wage base (taxed wages) the way the other boxes do, per the W-2 instructions.

Instead it shows the sum of the amounts of various tax tracking types like Compensation and 401k deductions and so on, regardless of their tax settings. You can see the details of how that works on the worksheet, but not on the W-2 form where you see only summaries.

An item with "Other" as the tax tracking type ill now impact Box 1, regardless of its tax settings.

Items with the following tax tracking types will impact Box 1, adding to or reducing it:

Compensation

Reported Tips

457 Distribution

Non-Qualified Plan Distribution

Fringe Benefit

Other Moving Expense

Taxable Group Term Life

SCorp Medical Premium

Simple IRA

401-k

403-b

408-k

457

Dependent Care Flex Spend

Premium Only Plan

Medical Care Flex Spend

HSA Company Taxable

HSA Employee NonTaxable

They will impact the box whether or not they are set up to impact Federal Withholding tax.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

RE: Since your W-2 generates correctly when processing payroll and running reports, creating the W-2s for the year should be the same.

You didn't try it or you would not have answered this way.

First a W-2 does not generate when processing payroll. I don't even know what that means.

Second, there is no report within QuickBooks that will recreate Box 1 except for the Tax Form worksheets in Excel and the state W-2 eFile feature. And they both mimic the W-2 and will give you the same number.

Which you would have discovered had you tried it.

There is no need to scare the customer and insinuate that there is something wrong. There is no need to Verify or Rebuild the data. There is nothing wrong.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

Thank you very much for the response, it was very helpful.

I have two follow-up questions.

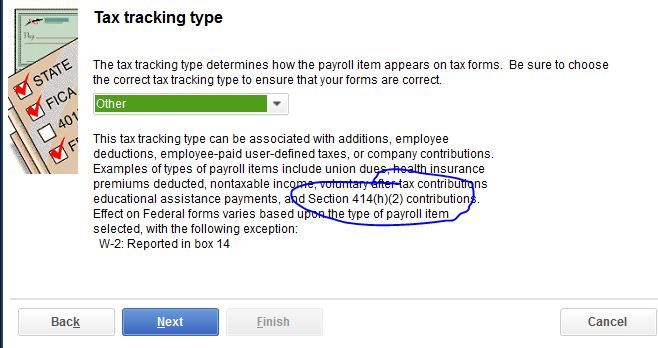

I used the "Other" Tax Tracking type for this Deduction because the QB notes for "Other" indicated that it should be used for Section 414(h)(2) contributions -- which is what these are. They are the employer "pick-up" contributions for the state PERS. So, they are excluded from federal wages for income tax purposes, but are not excluded from wages for FICA tax or state income tax purposes. So, because of that, they should not be included in Box 1 of the W2. Seeing as the W-2 Form is processing as Intuit designed it, would you suggest simply overriding the Box 1 amount in the W-2 Form? Or is there a better way to adjust this (i.e., with a Payroll Adjustment or some other mechanism)?

And, seeing as we just started the new year, should I change the Payroll Item type to something different so that for 2021's W-2 it will process correctly without me having to make any changes? And, if so, which would you suggest? It needs to be excluded from Box 1 (just like 401(k) elective deferrals), but it needs to be reported in Box 14 and not in Box 12 (which is why I didn't select the 401(k) tax tracking type to begin with).

Thanks for all your help!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

RE: They are the employer "pick-up" contributions for the state PERS. So, they are excluded from federal wages for income tax purposes, but are not excluded from wages for FICA tax or state income tax purposes.

If they're employer pick-up contributions, then I don't think you have set the item up right, based on my reading of the IRS rules.

The rules read, in part - with my comments in [brackets]

General Rule for Employee Contributions

Contributions made by the employer to an employee retirement plan (whether the plan provides for elective deferrals or not) are not included in employee income. However, any additional contributions made by the employees are included in income, unless they are made under elective deferral provisions.

[This is IRS-logic-speak and seems to mean that if the company puts money into the plan, the employee does not pay any additional tax, and if the employee contributes, their income is not reduced. A 401k deduction, for example, is excluded from income, meaning it reduces income (and is included in Box1).]

"However, IRC section 414(h)(2) provides that for any plan established by a governmental unit, where the contributions of employing units are designated employee contributions, but the employer “picks up” the contributions, the contributions are treated as employer contributions."

[So, when the employer pays into the fund money instead of the employee doing it from their paycheck, it may be considered a pick up contribution, and if so it does not impact income. This is similar to a 401k match, which is also not included in employee income.]

In Revenue Ruling 2006-43, the IRS clarified the requirements for employee contributions to be considered made, or picked up, by the employer.

- Specifies that the contributions, although designated as employee contributions, are being paid by the employer. For this purpose, the employing unit must take formal action to provide that the contributions on behalf of a specific class of employees of the employing unit, although designated as employee contributions, will be paid by the employing unit in lieu of employee contributions.

[So, being paid by the employer, pick up contributions are not deductions from paychecks and do not impact income.]

The above applies to the income tax treatment of employer pick-ups. In CCA [removed] PDF, the IRS addressed the treatment of pick-ups for social security and Medicare tax (FICA) purposes.

Contributions to a retirement plan that come from salary reduction amounts are subject to FICA. IRC 3121(v)(1)(B) indicates that a salary reduction occurs if the amount shown as wages are less than they would have been but for the contribution.

In order for contributions to be considered paid by the employer, and therefore not subject to FICA, the employer contributions:

- Must be mandatory for all employees covered by the retirement system.

- Must be a salary “supplement” and not a salary reduction – in other words, the employer must not reduce employee salary to offset the amount designated as employee contributions.

[So, I think, if you can designate the amounts put into the plan as paid by the employer, as pick up payments, then if you have not (outside of payroll) reduced the employee salary in order to fund these payments, then FICA taxes are not impacted. If you have reduced the wages, then they may not be pick up payments at all.]

-------------------

Based this (and the rest of the instructions) it appears that pick up payments are

a) Paid by the employer, not an employee deduction

b) Don't change income for the employee

c) May increase FICA if specific rules are not applied

If this is right, to track pick up payments, the item should be set up as a company contribution item, not a deduction. It does not reduce the net paycheck. It may add to SS and Medicare wages and taxes, depending on the rules, and it does not impact federal income wages.

I think.

See this page for the full IRS description

RE: So, because of that, they should not be included in Box 1 of the W2.

No, that not how it works. Even if an item does impact Federal wages, it may not change Box 1, unless you can find that it should in the W-2 instructions.

In this case, for example, the amount of (I think) an employee contribution is reported in box 14. When the employee does their taxes from the W-2, reporting this might reduce their taxable wages.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

I'm having the same problem with our state retirement pension. Did you figure out a way to set it up?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

Hello there, mariceacut,

You can check the payroll item to verify where the specific payroll item appears on the boxes. To set it up, you can follow the steps below:

- Go to the Lists menu.

- Select Payroll Item List and, click the Payroll Item button.

- Hit New. Then, select Custom Setup and click Next.

- Select Company Contribution. Once done, click Next.

- Enter a name for the contribution and click Next.

- In the Liability account drop-down list, select the same liability account that you chose earlier.

- Select an expense account from the Expense account drop-down list, and click Next.

- In the Tax Tracking Type window, select the tax tracking-type classification that matches your plan-type.

- Then, Finish.

To learn more about it, please consider checking this article: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.).

If you need anything else, please comment below. Always take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

Thank you.

My issues is that this an employee contribution to a 401a plan. From what I read it needs to go to box14, and reduce wages in box 1, which it doesn’t do at this time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

Thanks for getting back to us and provide some clarification on your concern, @mariceacut.

At this time, QuickBooks doesn't support the 401a plan for employee contribution. That's why it isn't showing on box14 and doesn't reduce the wages in box1. You might want to check out these articles to learn more about how QuickBooks Desktop populates the boxes on the Form W-2:

Just in case you want to print W-2, feel free to read this article for the detailed steps and information: Print W-2 and W-3 forms.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

W2 Box 1 Not Calculating Correctly

Hi Carol,

Thank you for joining the thread and sharing your experience with us.

Are your W-2 Box 1 calculations also not appearing correct? If you've set up the "Other" tax tracking type similarly to the original user in this thread, it's likely that your calculations are actually correct.

As explained by BigRedConsulting, Box 1 shows the sum of various tax tracking types, such as Compensation and 401k deductions, regardless of whether they're set up to impact Federal Withholding tax. This means that what you're seeing may be accurate, even if it seems counterintuitive.

To ensure accuracy, it's important to verify that your payroll items are properly set up in QuickBooks. This will help the system reflect the correct calculations on your tax forms. I recommend reaching out to your accountant to verify your payroll setup and to provide explanations for what's showing on your W-2 tax forms.

For additional reference on factors affecting the amounts in Box 1 and other boxes on your employees' W-2s, please check out this article: Understand why W-2 box amounts are different.

If you have any further questions or need additional clarification, please don't hesitate to post again, Carol. We're here to ensure you feel confident in your payroll and tax reporting processes.