Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey there, Louanne.

The company paid taxes and contributions will not show on the employee's paystubs. Only the employee's paid taxes will.

You can pull up the Payroll Details report to view all employee and company paid taxes and contributions.

Here's how:

You can check the screenshot below.

Should you need more help, just get back to this thread.

I did notice that on the 2nd paycheck of 2019 Quickbooks was taking more then the .4 % of gross wages. Which makes me think it was not set up correctly to begin with. I just ran a sample paycheck and it does seem as if Quickbooks is now deducting the 63% of the .4% of gross wages.

Greetings, ismael1.

I'm happy to know that everything seems to be working correctly now in your QuickBooks account. Please know that you can always reach out to us if you ever run into any problems with your payroll in the future.

However, if you prefer to speak with someone over the phone, please contact our dedicated Support Team by following the steps below:

Contact QuickBooks Support

You're always in good hands here in the Community. Thanks for dropping by, I look forward to hearing from you again. Have a great day!

I have the same issue--company is paying 100% of employee contribution, but as we're under 50, we will opt out of the employer portion. What I think I'm going to try is to just make the tax inactive in the payroll item list, and hope by the end of the first quarter, Intuit issues an update that fixes this, and then allow QB to "true up" for the first quarter. Failing that, I'll just manually figure the amounts and send that in, since its coming out of my pocket anyway. Only 10 employees, so not a big deal for me, but for someone with 49 employees...

Hi there, Briank2.

I appreciate you for joining this thread. Allow me to provide additional insights about the Washington State Paid Leave in QuickBooks.

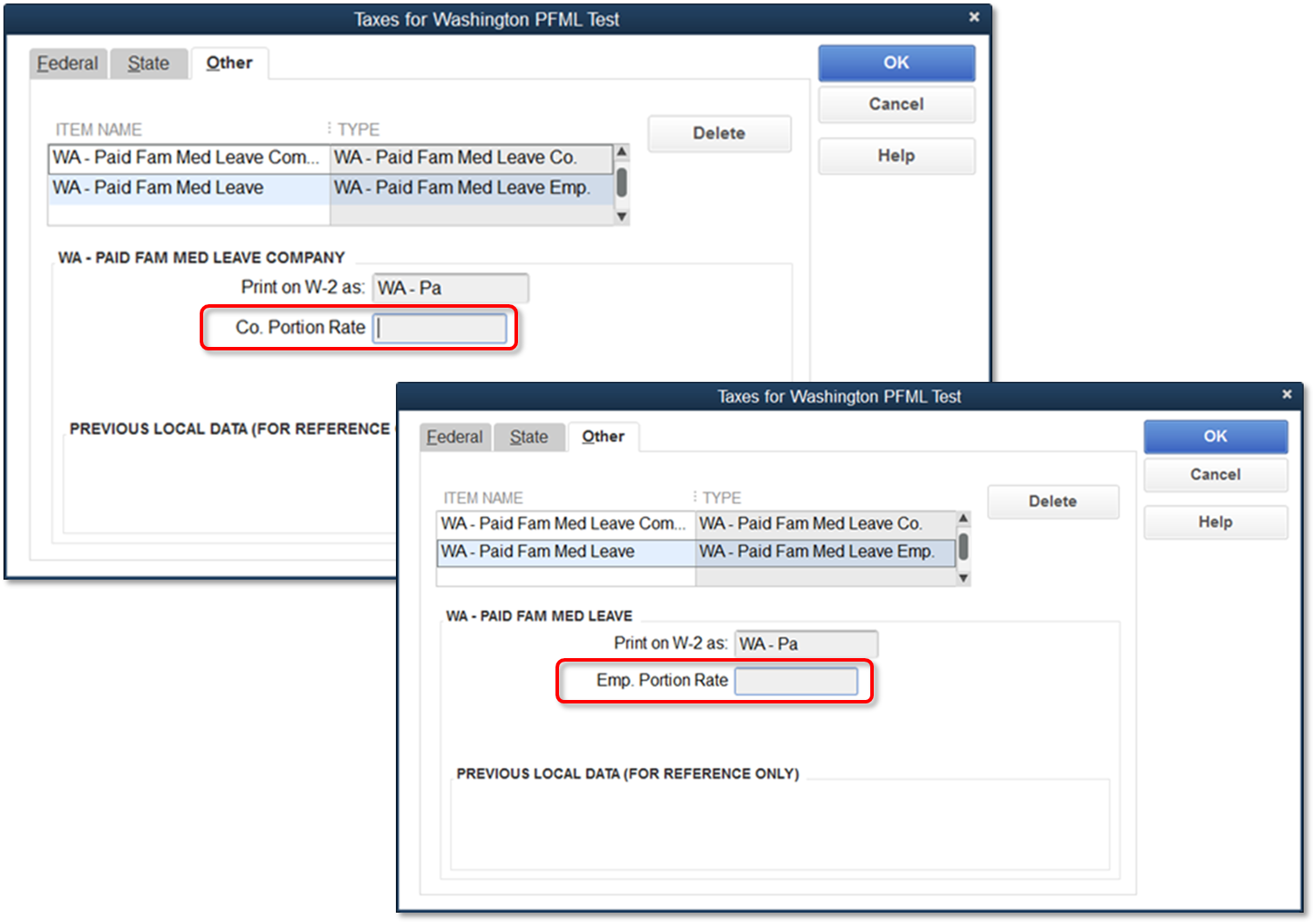

If you're using QuickBooks Desktop, you can setup 100% employer contribution by going to the Payroll Info tab. I'd be glad to show you how below:

To learn more about setting up employee and company contributions in QuickBooks, you can check out this article: Set up employee deductions and company contributions.

Also, QuickBooks Desktop has this auto-correct feature for the amounts from the previous paychecks that have the wrong rate.

Should you have further questions about setting upcontributions in QuickBooks Desktop, just let me know. I'm always here to help.

Actually, that is not quite right for an employer with under 50 employees, who is NOT paying the company portion, but elects to pay the employee portion. If you enter "100" for the percentage of company paid, it will use the .4% rate, meaning the employer is paying both the employee and employer combined rate. That figure, "100", is correct if the employer is paying both premiums. If they have UNDER 50 employees, and only want to pay the employee portion (as allowed under the law) they would enter 63.33 and it would correctly figure the amount.

For example, using "100," would result in a $1,000 salary accruing a liability of $4. But under the law, the liability for an under-50 employer, paying only the employee portion, would be $2.53 ($1,000 * (.4% *.6333)=$2.53)

Thanks for the prompt response,

I can bring some clarity to your concern about the Washington State Paid Leave in QuickBooks Desktop.

Since you have less than 50 employees and only elects to pay the employee portion of the , you'll need to enter 63 in the company portion and 0 for the employee portion.

You can check out this article to understand more about Washington Paid Family and Medical Leave. Please scroll down and proceed to Employers with LESS than 50 employees (Employer NOT required to pay their portion; Employees required to pay their portion).

In case you need assistance in doing this, feel free to reach out to our Payroll Support Specialist.

Here's how you can get in touch with them:

Let me know if there's anything else I can help you with. I'm always around anytime you need. Have a great day ahead.

Uhh...that is pretty much what I said...

For some reason, the line item WA - Paid Fam Med Leave Emp. has disappeaared. If I try to create it, I am told it already exists. However, I cannot add it to any of my employees as it has disappeared from the dropdown menus. Is there a way to download the update again?

Thanks for sharing the steps you've tried, silverstag.

You're right. Since the WA - Paid Fam Leave is missing, you can download the latest tax table. This will ensure your payroll taxes stay updated.

Let me show you how:

Please check out this article for more details: Washington Paid Family and Medical Leave (New Tax 2019).

Once done, try creating a paycheck and verify that the WA - Paid Fam Leave line item is there.

That's it! Let me know the results after trying the steps above. I'm always here to provide you with additional assistance if you need anything else. Have a good one.

2 questions:

1. When will Quickbooks online payroll support employer paid premiums when the employer chooses to pay the taxes for their employees?

2. Currently the deduction in Quickbooks online payroll is automatic for every employee, even those who don;t work enough hours to qualify and therefore do not have to contribute? Will there be an option to choose the tax or not?

Hello @wveysey,

As of now, we don’t have an update yet about the employer-paid premiums. The same goes with the feature to opt or not to deduct and tax an employee's wage.

As a workaround, you can manually edit the amounts while on the process of running the payroll. Let me show you how.

From there, you can edit the Federal Income Tax and State Income Tax.

I’ve attached screenshots below for your visual reference.

Also, I still recommend seeking help from your accountant or call your tax agency. They could guide you what to do about the deduction.

You can always get back into this post if you have more questions.

That didn't work at all! The only thing I can edit is the federal tax withholding. Changing that number to adjust for the WA State family leave tax would just mess up the federal remittances and employee records.

There must be another workaround for this. Right now it seems the we are illegally withholding taxes from part time employees that are not obligated to pay the tax as they won't qualify for the leave.

Hey there, wveysey.

Thanks for letting us know the result of the steps given by @Mark_R. Let me share some additional information about the Washington Paid Family and Medical Leave in QBOP.

Since your part-time employees are not obligated to pay the taxes, you can exempt them from doing so. You’ll have to go to each of the employee’s profile and update the information.

Here's how:

For the amount withheld, you can reimburse the employee. I'll guide you through the steps:

That should get you on the right track.

If you have any follow-up questions about the process, reach out to me by posting a comment below. I'll be around to assist you further.

I have one employee that WA paid leave doesn't Calculate I cant figure out why only him

Hello, @Sarah-transit.

I'm here to check why does the Washington (WA) paid leave doesn't calculate on your employee.

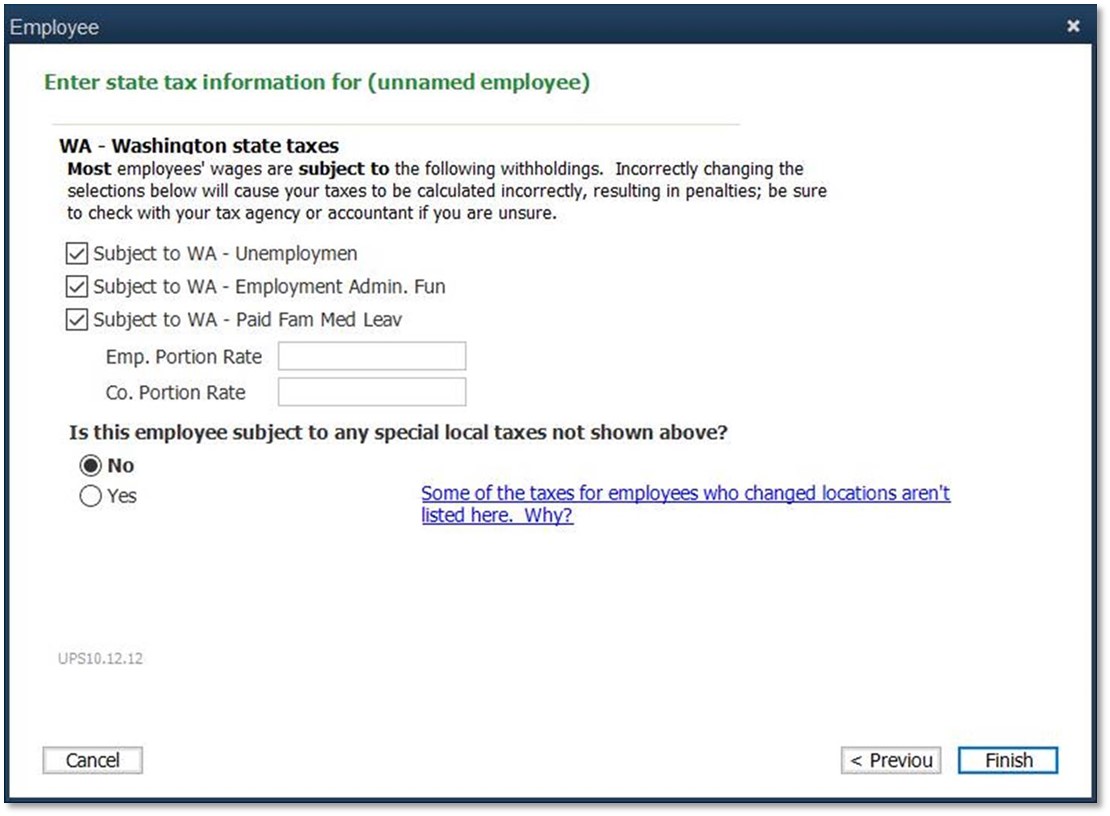

First, you need to make sure that you've set up the WA paid leave to your employee before creating paychecks. One reason why the WA paid leave doesn't calculate is, it wasn't set up on the employee's profile.

To learn more about setting up the WA Paid Family and Medical leave, you may check this article: Washington Paid Family and Medical Leave (New Tax 2019).

You're always welcome to add a post/comment below if you have any other payroll questions, I'd be glad to keep helping. Have a good day ahead!

YES IT IS SET UP

Thanks for the response, @Sarah-transit.

I appreciate the time you took to check in with us on the reason behind the WA State Paid Leave not calculating on your employee’s paycheck. It’s my priority that this issue gets taken care of.

Let’s perform some basic troubleshooting steps to see if this is caused by a common browser problem that needs clearing. Sometimes the local internet cache files stores up in the system causing issues in your web pages.

Try switching to a different browser or opening a private window when logging in to QuickBooks. Here’s how:

If it works, clear your browser’s cache to fix the unexpected behavior in the product. Take a look at this article to help you with the process: Delete or Disable cache and temporary internet files in your web browser.

However, if you continue to get the same result, I recommend giving our Customer Care Team a call for further assistance. They can pull up your account in a secure environment, which we are unable to do in public forums, and take a closer look at this issue.

Here’s how to get in touch with phone support:

That should get you pointed in the right direction.

Leave a comment below and let me know how the call goes. I’m always here to keep helping. Have a good one!

WA Paid Family med. doesn't deduct from one employee they are set up same as everyone else

Anyone else having this problem I use QB desktop

Hey there, @Sarah-transit,

I appreciate your time joining our discussion. I can add a bit more about the Washington State Paid Leave in QuickBooks Desktop.

Here are some reasons why your taxes are not calculating correctly:

Let's run a payroll update to refresh your payroll settings. Follow the steps below:

Once done, let's review the tax set up to make sure you don't throw off your tax calculations. Here are some options to check the Washington State Paid Leave set up:

Option 1: In the Employee Center

Option 2: In the Payroll setup

That should rectify the issue, @Sarah-transit. Here's a great article to guide you with the process: Washington Paid Family and Medical Leave (New Tax 2019)

Don't hesitate to let me know if you have questions or need anything. Click the Reply button below to post an update. Have a great weekend!

I am having this same issue after updating to the 21908 payroll update on the desktop (maybe a coincidence?) but it is only affecting one employee - the new one I had just put in. I have checked both the payroll set up and the employee tax-other to make sure all are set properly and they are. The Wa St Pd Medical leave (Empl) is still not calculating for this employee.

Thanks for joining this thread, @DTrav.

Allow me to step in and help ensure to calculate the WA Medical leave tax correctly when creating the employee's paycheck.

If you've already processed the recommended steps provided by my colleague @Anonymous and the issue persists, let's revert the paycheck you create to un-save the data you've entered before getting the tax table update. Then, re-enter the number of hours and other payroll items to check if taxes are now taken out.

Here's how:

For additional reference, you can check this article on how to revert pending paychecks.

Please let me know how it goes by clicking the Reply button below. I'm always here to help if you have additional questions about the payroll taxes. Have a good one.

Problem solved. Here is what I did to fix it. I went into Employees>Payroll Info>Taxes.

"Federal" tab: I unchecked, then rechecked Medicare, Soc Sec, and Fed Unemployment Tax, then went into the "Other" tab and deleted the Wa - Paid Fam Med Leave Empl, then under the drop down arrow added it back in - also added the emp. portion rate % and then clicked ok.

I went back to create the affect employee paycheck and it was calculating and showing on the paycheck.

Very glad it is working again, good luck to you ~ hopefully this works for you as well. :)

It's nice to see you here again, @DTrav,

I’m happy to know you’re back on track, and you're able to surpass the issue with your Washington State Paid Leave item. The resolution you shared will surely help other customers in this forum who are having the same issue.

Please know that the Community has your back, and I'd be glad to help if you ever need further assistance. Also, you are always welcome to share your best practices about QuickBooks with us. Have a great and productive week!

Wondering if QBO online handles the WA paid family medical leave reporting? Looks like QBO has been deducting the premium from each employee. Is the state reporting and payment included in the QBO Full Service Payroll? Or, do I have to submit the quarterly report and payment manually?

Cheers,

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here