Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hello @turbohuffman,

Welcome to the Community. I can share some information about updating the state tax rate in QuickBooks Online.

As of now, there's no update for the new Washington Paid Family and Medical Leave rate in our system. It should be available soon from the dropdown when changing state tax rates.

In case you need the steps, here's how to update:

Also, you can visit this link to learn how to edit your payroll account register in QuickBooks: Change your accounting preferences in QuickBooks Online Payroll.

Please know that I'm just a post away if you have any questions about the tax rates in QuickBooks. I'm always here to help.

Hello @turbohuffman,

Welcome to the Community. I can share some information about updating the state tax rate in QuickBooks Online.

As of now, there's no update for the new Washington Paid Family and Medical Leave rate in our system. It should be available soon from the dropdown when changing state tax rates.

In case you need the steps, here's how to update:

Also, you can visit this link to learn how to edit your payroll account register in QuickBooks: Change your accounting preferences in QuickBooks Online Payroll.

Please know that I'm just a post away if you have any questions about the tax rates in QuickBooks. I'm always here to help.

When is this going to be available? The overall rate also increased from .4% to .6% and that has not been updated. I'm working in both desktop and online and the overall rate can't be manually changed. I can change the employee portion on the desktop.

We are running 2022 payrolls now.

Thanks.

Thanks for joining us, @TracyAFY.

As mentioned by my peer @AlcaeusF, we don't have a specific time frame yet as to when the new rate will be available in QuickBooks. You'll want to follow the above steps to change or add the new rate as a workaround.

In the meantime, for QuickBooks Desktop Payroll, please make sure to get the latest tax table to sync any available payroll update to the program. Refer to this article for the instruction: Get the latest payroll tax table update.

For QuickBooks Online Payroll, it'll be an automatic update.

I'll be adding this link to help you manage your taxes: Year-end checklist for QuickBooks Online Payroll.

Please don't hesitate to reply to this thread if you still have questions or concerns with payroll taxes. I'm more than willing to assist you. Take care and have a nice day ahead.

The newest payroll update, did not update WA-Paid Fam Med Leave Amount Rate or Limit. Since we are a small company, we cannot just go into each employee individually and add a company rate. Normally the correct rate is under Payroll List Amount, and our company portion is Zero. We have already manually updated each employee's portion of the total amount in percentage.

Will QB update the Amount and Limit by Jan 1st? I was just on the phone with QB support and they kept trying to update it and finally said the update will be completed by Jan 1st - I think he was hoping.

The steps you provided still do not allow me to create a new tax rate. It only shows me the same 2021 rates in the dropdown. No place to create new. There is no other workaround either.

We need this elevated and resolved ASAP. We all are running payroll NOW!!!!!

1/3/22 and still no new rates for PFML available on the drop-down menu or an option to change it. QBO is also missing the new WA Cares tax and rates.

I can share some information about tracking paid family and medical leave, @accounting62.

You can go to the Payroll Settings to add a new rate for Washington Paid Family and Medical Leave.

Follow the steps below:

See this article for more information about how the Washington Paid Family and Medical Leave program works and exempts employees: Set up Washington Paid Family and Medical Leave.

You can also check this article for more information about setting up WA Cares Fund payroll tax: Set up Washington Cares Fund payroll tax.

I'm always here if you need more help with your rates and or anything else by leaving a reply below. Keep safe and have a great rest of the day!

Thank you MaryJoyD.

Can you confirm the rate QBO online has been updated to the .6%?

Based on payroll that I ran on Jan 3, I calculate that QB is still using 0.4%. It needs to be changed to 0.6% as you have stated. Unfortunately this rate is not visible in Payroll Settings for us to verify/change.

QB team - we need the rate changed from 0.4% to 0.6% asap

As a less important side note...your employee/employer split incorrectly shows 0.7322% but it needs to state 73.22%. This didn't affect the calculation but it may confuse users.

Ran payroll and everything calculates correctly

Problem resolved - thanks

Quickbooks online has not been updated for the new 2023 rates. The new rates are specified at https://paidleave.wa.gov/updates/ When will the rates be updated?

This is a 2023 problem as well. We are now at 8%, but no update has been done to change the rate. This needs to be expedited.

Under Payroll Item List, we changed the PFML to the current tax rate of .8%. Then for each employee, in Employee Center, double click on employee name, click on Payroll Info, click on Taxes, click on Other, scroll with button down to employee's portion of Family Leave, at bottom change percentage to current rate, as a percentage. Click okay.

It is a hassle to change each employee's percentage manually, but this is the only way we have found to do it.

Still unable to resolve this problem.

Thanks LisaSV for posting instructions, but they don't align with what I am seeing in the QB Online version. For example, don't see a Payroll Item List, Employee Center, employee's portion of Family Leave at bottom change percentage to current rate. I can't even perform equivalent steps compared to the downloaded version that I assume you are looking at.

Why can't the coders just update the software to list 0.8% as the drop-down like they did for the 2022 rate change when it went from 0.6333% to 0.7322? In the Online version this is located in section Payroll Settings, Washington Tax, SUI setup, PFML dropdown list.

Hello there, @turbohuffman.

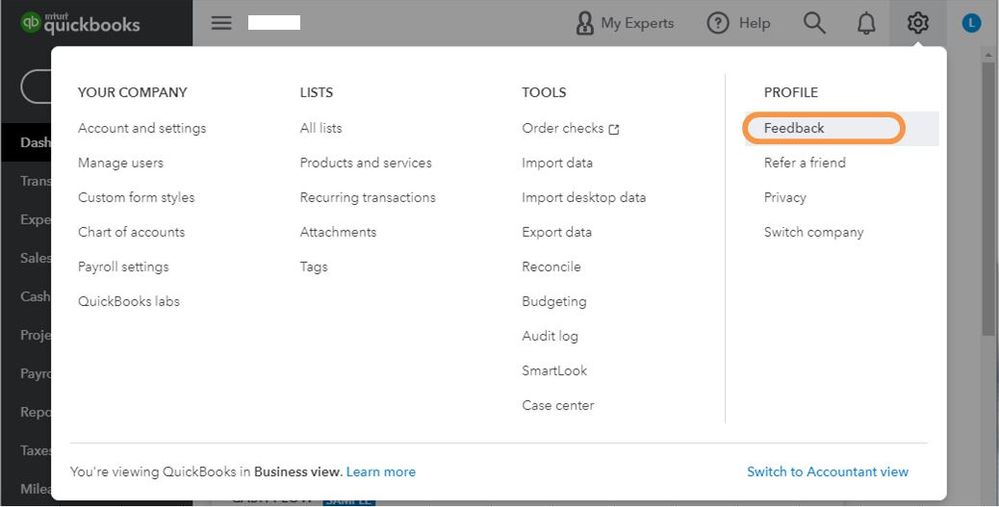

Having automatic updates for WA Paid Family and Medical Leave Premium ER rates would be awesome. I encourage you to add your vote for this one by sending a feature request in the Feedback section within QuickBooks. Our product development team reviews all the feedback we receive to ensure we’re meeting the needs of our customers.

Here's how:

For your reference, check out this link: How to Submit Feedback.

In the meantime, you can adjust these rates in your Payroll settings as you've mentioned. I'm also adding the steps below:

Taxes will deduct from your employees paychecks on the effective date. You may also refer to this article for your convenience: Set up Washington Paid Family and Medical Leave.

If you have any other questions, just let me know and I'll be happy to help. Thanks again for reaching us and have a good day, @turbohuffman.

The QB keeps insisting that we can manually update these rates when it is absolutely not the case for the online payroll platform. They repeatedly give these instructions which are incorrect (See Step 3)

In the meantime, you can adjust these rates in your Payroll settings as you've mentioned. I'm also adding the steps below:

This is a recurring problem each year and needs to be fixed ASAP

I understand how important it is to update the WA Paid Family and Medical Leave Premium ER rates, Beckwith Law Group.

Let me make it up to you by making sure you'll get a detailed explanation why the steps aren't working.

I'd recommend contacting our QuickBooks Payroll Team to investigate why you're unable to manually update the rates. They're equipped with tools to determine the cause. It'll also allow them to submit a ticket to our engineering team to alert them about the issue if necessary.

Here's how:

To ensure you'll be assisted on time, please see our support hours.

Additionally, I've added an article that'll help you wrap up this year’s payroll and prepare for the next with QuickBooks Online: Year-end Checklist.

I appreciate your understanding on this matter. Please know that I'm determined to get this resolved.

FINALLY IT IS FIXED !!!!!!!!!!!

The drop down now shows .7276%

This is the correct portion for the employee withholding https://paidleave.wa.gov/updates/

Thank you

Sorry, just saw your post is very old. Unfortunately, your stated fix will not work for the 2023 PFML rate change that is needed. Since it is a state-wide tax and the rate is the same for everyone, QB does not allow the individual user to go change it. So if you go into Gear Icon/Payroll Settings/Washington tax, it's not there!. More than that, I uploaded the Workmans Comp rate notice to QB and they put in the wrong composite rate. QB rep last night said "their engineers" are working WITH the state to fix the rate - whatever the heck that means. They were able to change the employer/employee percentages but not the rate itself. Seems like it should be easy - since the tax was in place last year. Meanwhile, I will be doing the 2nd payroll of the year with the wrong rate!

Wondering if your calculations came out correct? If you file within quickbooks or go through SAW- because I have a spreadsheet going and noticed that my calculations match the state - using their calculator

https://paidleave.wa.gov/estimate-your-paid-leave-payments/

but even using the corrected rate in my qb it did not pull enough money out of pay checks. It was short by $153.20. I file everything through SAW because I am so tired of quickbooks not calculating correctly.

QBO agrees on gross pay, for example one employee had 3,136 in gross multiplied by 72.76% should be $18.19, which is my calculations and the state calculator- but qbo said it was 13.17. Note it did this on every single employee. It has done this in the past too, I have noticed that our qbo calculations do not start functioning correctly until we are either in 2nd-3rd quarter.

Personally- I check QBO math on all my quarterly reports and payroll because they seem to glitch a lot and ultimately- the State will hold the individual company liable for the reports accuracy and not qb

For reference, my qbo setting:

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here