Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowHappy Monday, @lpenney18. I'm here to explain why you're seeing your Payroll Liabilities showing as negative on the Balance Sheet.

Here's a Community Article that will help you determine why your Payroll Liabilities is showing negative: Payroll Liability and Balance Sheet Report figures explained.

The negative amount shows that there's a tax overpayment. The most common causes of this are:

I've provided the steps below that you'll need to follow to correct the overpayment:

That should get you on the right track! Let me know if you need further assistance. Have a wonderful day.

I have had to override the unemployment tax rate in each employee paycheck for the entire year. In July, I paid FUTA for q1 and q2 even though it didnt reach the threshold for having to pay. Now, employee paychecks are showing negative amounts on paystubs.

It is a small 4 person private practice and I'm using enhanced payroll.

Hi there SR Smith.

Thanks for stopping by the Community, based off of your description of what's going on and what my colleague posted earlier in the thread this can be caused by 1 of 4 things.

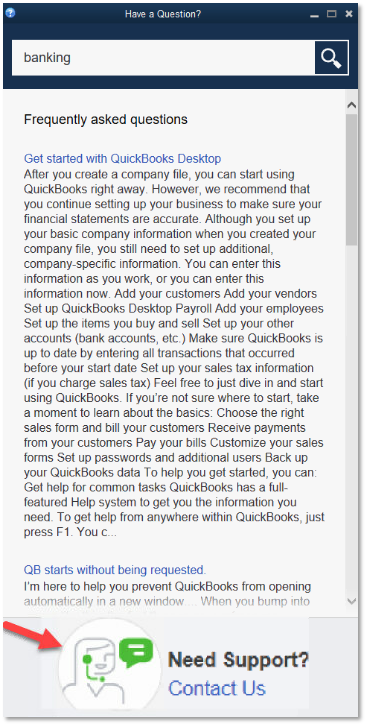

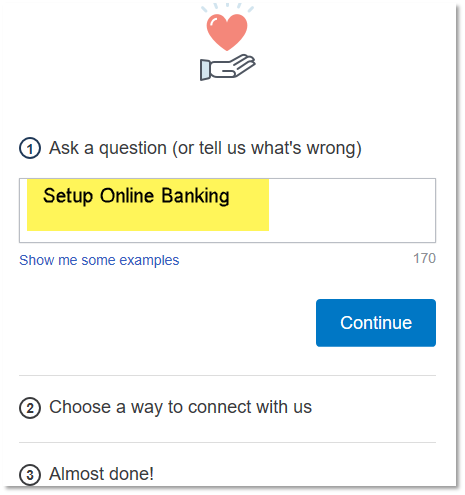

I would recommend going through and reconciling your account and see if that helps when you go to run payroll. Here, you can find a helpful article that breaks down the reconcile workflow. If after that you're still running into issues, I suggest reaching out to our phone support team, this is because they have the ability to dive into your account and see exactly what's going on in a 1-on-1 setting. To reach them you can follow these steps:

Check our support hours and contact us.

If you have any other questions, feel free to post here at any time. Thank you and have a nice afternoon.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here