Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have just started processing payroll for a small business starting in December. All upcoming taxes and other liabilities for my one employee seemed reasonable. I saved for those amounts. When I checked again a week later, those numbers were much higher the original amounts. January's figures seem to be growing quite a bit as well. Nothing has changed on my end. Is this something that increases until processed and the final figures are then stabilized? My federal 941/944/943 went from about $450 to $680 for example.

Solved! Go to Solution.

The amount will only change once you've run payroll, irbki.

If you haven't processed payroll yet, we can pull up the Audit Trail report to validate why the taxes have changed. You can do this by going to the Accountant & Taxes section. Let me guide you with these steps:

If the figure changes even before you run payroll, you can contact our Payroll Support team. They'll check your account why this happens. You can use this screenshot as a guide on how to contact them:

Let me know if there's anything else that I can help.

The amount will only change once you've run payroll, irbki.

If you haven't processed payroll yet, we can pull up the Audit Trail report to validate why the taxes have changed. You can do this by going to the Accountant & Taxes section. Let me guide you with these steps:

If the figure changes even before you run payroll, you can contact our Payroll Support team. They'll check your account why this happens. You can use this screenshot as a guide on how to contact them:

Let me know if there's anything else that I can help.

Thank you!

My 1st qtr 941 is off by $413. I paid each month which drives the 941 I run the 941 it show me as having underpaid by that much and will not allow me to finish. Is QB improperly caculating the withholding? It then gives me a voucher to send in the extra money which I should not even owe, do I? When I go back and look at the checks they are correct to what was paid but not what the 941 is calculating. Why do the numbers not match?

Hi there, @UnityJohn1.

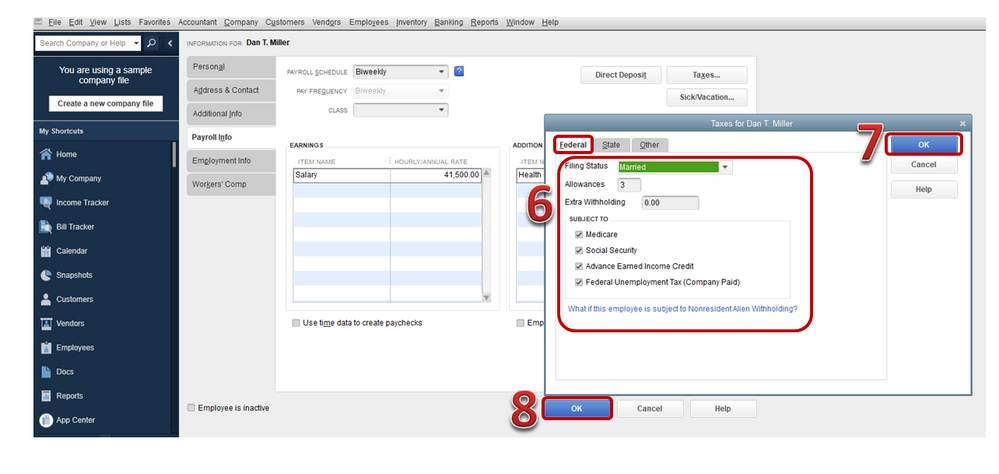

Thank you for reaching out to the Community. Let me share with you some insight about the withholding taxes that calculate incorrectly. If it's federal withholding that does not calculate correctly, you'll need to check the employee's profile is set up properly. QuickBooks calculates the withholding based on these factors:

Please follow the steps below to look over the employees profiles:

To check you can also manually calculating one of the employee's paycheck to see if it matches QuickBooks. To help you figure out the exact withholding amount, please go through the IRS 2020 Publication 15.

You can use the Percentage Method (page 44-45). It's the same method used by QuickBooks to calculate federal withholding.

If you need further assistance calculating federal withholding, you can tag my name directly. I'll be happy to help you. Have a great day!

The Federal income taxes on the actual checks match the 941, It is the SS/Medicare that is off. Note sure how that can happen as QB calculates the withholding each payroll and then simply rolls the numbers into the 941. doesn't it. But the numbers in the 941 on line 5a and 5c is $30,587 but the amounts QB put in the monthly payroll tax dep would show those lines to be $27,887. A different of $2,700 per year or 112.50 per payroll. As a church our minister is self employed so does not pay SS/Med.

Also notice the form says I have taken Cobra credits and have a balance due. I have not.

The federal income tax matches exactly with the sum of the monthly payments. The FICA/MED is short when adding up the amounts calculated on the 941 form vs what was submitted on each monthly tax payment. When I add up those amounts actually withheld from employees pay plus the company share those amount are based upon a quarterly amount in Line 5a and 5c of $27,887. The 941 shows $30,587 in those lines. Where could the extra $2,700come from?

Hello there, UnityJohn1.

Let's run a Payroll Summary report per employee to track who are those exempt that has taxes withheld from their payroll.

Here are the steps:

If there's a discrepancy, then you'll want to do the Payroll Liability Adjustment. Here's an article for the instructions: Adjust payroll liabilities in QuickBooks Desktop.

You can also reach out to our Customer Care Team to view the data and for further assistance with the adjustment. Before doing so, please check our support hours here.

Here are the steps:

Please keep us posted on how it goes or if you have any additional questions. Take care.

Thanks. i had already done that. The calculations on each employee for FICA/MED are correct. Each employee's calculations are also correct. When I take the total payroll for the quarter and remove the entire compensation for the one exempt employee I get $27,887 which is the number QuickBooks used to calc the FICA/Med for those three months of payroll taxes. Therefore I would deduce that QB did it correctly.

The issue is that the 941 form has plugged in a different number for the adjusted income it uses (5a and 5c) so it calculates the amount owed at $413 more than it should be. I cannot see anywhere where the difference of $2700 could be coming from. What happens if I just override each 5a and 5c and put in the correct number as supported by all of the QB payroll records.

Thanks for adding more details about the issue, @UnityJohn1.

I appreciate you for following the steps provided by my colleague and sharing with us its result. Let’s run the Payroll Item Listing report to see the tax tracking types assigned to your payroll items. This can help identify the items that impact the amounts on Lines 5a and 5c.

Here’s how:

If you’re unsure of the type, I recommend consulting an accountant. They can recommend which one to assign to your payroll items.

This will also ensure all the information displayed on the federal forms is correct. Once you have all the details, let’s go to the Payroll Item List and update the type.

Perform the same process for the remaining items you’re working one. Next, run the Payroll Summary Report and note the amounts for the payroll items with the matching tax tracking types.

To correct the difference, you’ll have to create a wage base adjustment for these pay types.

For detailed instructions about pulling up the Payroll Summary Report and the adjustment process, follow the steps provided by @RenjolynC.

You can also bookmark the following guide for future reference. It provides detailed information on how QuickBooks populates each line and an equivalent report from the desktop program: 941 Form.

Let me know if you need further assistance or questions. I’ll be right here to help and make sure this is taken care of for you. Have a good one.

Have gone through that process. Everything shows as it should. Our biggest single payroll person if the minister who is exempt. We withhold FIT as a convenience and that part calculates correctly. So does everything else. The issue is that the 5a and 5c numbers in the 941 are different that in the actual payroll and there does not seem to be any reason for this. There have been no payroll items added or modified from 2019 to 2020. The 941s ran correctly in 2019 and for the 15 years previously. Now, with no changes, other than it is a new year, suddenly it does not work right. I am at a loss. I can easily fix it. I overrode the 5a and 5 c entries and put in the correct amount from the payroll reports as I can find no justification for the variance. There are no numbers anywhere that add up to the difference in those two lines on the 941 vs the payroll reports. That said, we can only state that, either the 941 is not working correctly or the payroll reports are wrong. I will keep looking and, If I find the problem I will report. And, when I do the 2nd quarter 941, I will report back if it does it again. Thanks to all for your input.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here