Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMD Tax connect portal has no place to message them. They are user unfriendly. I can only make a virtual online appointment for the end of January.

Email: [email address removed]

I'm trying to upload my W-2 for the state of MD and I'm following all the instructions, but I keep getting the same message on the MD site which is this message

W2REPORT

File extension is incorrect.

Any help would be appreciated.

@Tori9 File extension basically means file type in this context.

Try adding .TXT to the end of the file name so it reads W2REPORT.TXT and try again.

I contacted MD via email listed on Maryland Tax Connect. They responded. They know that QB has an issue and are working with QB to resolve it. It will happen after Jan 20th. They also said that the manual upload will be updated after Jan 23. I am waiting for both of these actions to happen. It took a lot of effort to even get where I at least know to try later in the month.

Thanks for joining this thread, @Tori9. I'll direct you to the best help to ensure you can upload your W2 for Maryland by fixing the error "File extension is incorrect".

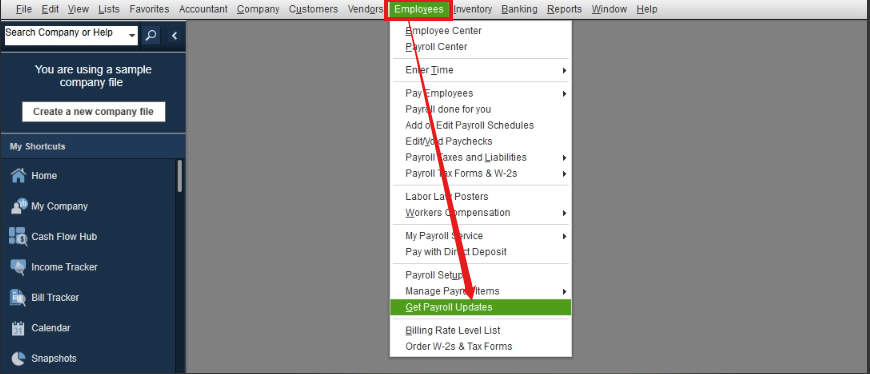

Since following the instructions in uploading your W2 keeps showing an error, I recommend contacting QuickBooks Desktop (QBDT) Payroll support to further investigate and locate the root cause of the issue to resolve it as soon as possible. Here's how:

You can also visit this article to review the process of filing your W2: File your state W-2s with Quickbooks Desktop Payroll Enhanced.

Additionally, check out this reference to guide you in preparing your tax forms QBDT: Year-end checklist for QuickBooks Desktop Payroll.

If you have additional challenges in filing your W2 for the state of Maryland, never hesitate to return here. We'll respond to you promptly. Keep safe always.

Intuit has fixed the problem. I have successfully uploaded a client today (Jan. 24, 2025).

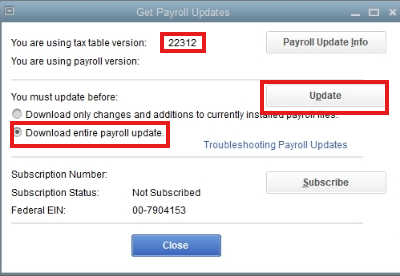

Just run the payroll update within QB to 22504 and run the "E-file State W2" again. Make sure to save the W2REPORT file with the .TXT extension.

Intuit has fixed the problem. I just uploaded successfully for a client today (Jan. 24, 2025) after the latest payroll update.

Just run the payroll update within QB to 22504. Pull the "E-file State W2" again. Make sure to save the W2REPORT file with the .TXT extension.

Hi,

I tried but I'm getting these error messages:

R200008 | Record RF is Required. | Transmission ID 5217537720883, Record indicator RF |

R100005 | Record RF Should Be The Last Record. | Transmission ID 5217537720883, Line number 69, record indicator RV |

Thank you- I did try but got this error message

R200008 | Record RF is Required. | Transmission ID 5217537720883, Record indicator RF |

R100005 | Record RF Should Be The Last Record. | Transmission ID 5217537720883, Line number 69, record indicator RV |

Error codes can be confusing, but you're certainly not on your own when dealing with them, Tori. Allow me to route you in the right direction to help you troubleshoot and e-file W-2 in a .txt file in QuickBooks Desktop (QBDT).

To begin with, please know that the error codes R200008 and R100005 you encountered are related to specific requirements set by your state agency's processing system. These indicate that the Record RF, which is essential for your submission, is either missing or improperly placed. This could be a result of system updates or specific validations enforced by the state agency.

To effectively handle this, I recommend directly contacting your state agency. They will provide the most accurate guidance on how to adjust your submissions to meet their current specifications and assist you through any system-related issues you might be facing.

You can find contact information and additional resources for your state agency on their official website: Access state agency websites for payroll.

Additionally, to further prepare and ensure everything is in order with your tax forms in QBDT, you might find this year-end checklist helpful: Year-end checklist for QuickBooks Desktop Payroll.

If you need further assistance or more detailed explanations about anything, please don't hesitate to get in touch again, Tori. Wishing you a hassle-free submission process moving forward.

I know is very frustrating. These were the errors I got originally before I updated payroll. I was able to upload one client successfully after updating the payroll service within QB.

FYI: Error R100005 requires that this line should be the last line in the text file -- RF [removed] where the number 6 indicates the number of W2s. If there are 200 W2s, then it would be RF [removed]

However, I am running into another error: when I tried to create and upload another client, I am getting a different error message saying "incorrect extension" even though the extension used is the same as the successful one (.TXT). Now I need to figure out how to resolve this one. Very frustrating.

I understand how challenging it is when you encounter error messages when filling out your W-2s in QuickBooks Desktop (QBDT), SelinaLieu. I'll outline some troubleshooting steps to ensure you can continue your W-2 filing.

The "incorrect file extension" error typically means your state portal doesn’t support the file format, even if you're using the correct ".TXT" extension. Since you’ve confirmed that you're using the right format, we can update your tax table to ensure compliance with federal and state regulations, minimizing potential filing errors.

Here's how:

If you encounter errors when updating the Payroll Tax table, check this article for detailed guidance: Get the latest tax table update in QuickBooks Desktop Payroll.

I also recommend updating QuickBooks Desktop to the latest version to access critical fixes, and enhanced features, and optimize overall system performance. For more information, visit this article: Update QuickBooks Desktop to the latest release.

Lastly, make sure your W-2 file is saved with the ".TXT" extension. Sometimes just renaming a file doesn’t actually change its format.

However, if you’re still having issues after following these steps, I recommend reaching out to our Live support team.

Additionally, here are some resources you can check out as a guide to managing your W-2 forms in QuickBooks Desktop:

Your experience is important to us, so please don't hesitate to drop by again in this thread if you need additional assistance when filling W-2s in QBDT.

Hi Jason,

Thank you. I got it to work. I exited out of QB and restarted QB and ran the "E-file State W2" again and it worked.

Hope others got it to work for them too.

You're always welcome, Selina.

We're glad to hear that the steps provided have helped with your issue. And thank you for sharing. We want to ensure our users are on top of their business.

On the other hand, you can visit this link to view payroll tax payments and forms in QuickBooks Desktop Payroll: View your previously filed tax forms and payments.

If there's anything else we can assist you with, please feel free to visit the Community. I wish you a prosperous rest of the year! Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here