Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am trying to prepare W-2c's for a client and I have entered the corrected federal and state wages. When I go to print the forms, the state information is not pulling to any of the forms. I have talked to about 5 different support people, two of which hung up on me. I have wasted about 4 hours and I still don't have an answer as to why this is happening. Beyond frustrated!! Any help would be appreciated!!

Hi there, ShannonH.

Thank you for the detailed information you've provided about your concern in printing forms. I also appreciate you trying to speak with support to fix the issue. This isn't the experience I want you to feel while using QuickBooks Desktop. I'll share troubleshooting steps to ensure you're able to print the forms accurately. Before that, you'll need to assure that your QuickBooks is updated to the latest release and your computer is connected to the printer and that the printer software is installed. Then, follow the steps below.

First, you'll have to your printer if this can print outside of QuickBooks, Here's how:

If that didn't work, please follow the steps below.

If the issue persists, please click this article to see another troubleshooting instruction to fix the printing issue and start following step three: Resolve printing issues.

Please note to make sure that the information is dated for 2020 and the transaction types are paychecks. Since you confirmed that you entered the corrected federal and state wages preparing W3, you'll need run the Payroll Summary report. Then, make sure you've also entered the information that shows from there.

Please click this article to view different information on how various payroll tax forms work in QuickBooks and to see their definitions: Payroll 101.

The Community is always here, so let me know if you have any questions about your tax forms. Have a good one.

Once again, a poor attempt at support. My QB is up to date, I have no problems printing, in or outside of QB. The problem is QB is not populating the state corrected wage information in the PDF that it is creating. I have entered all of the corrected information into W2cs. Again, the problem is that the state corrected information is not populating in the W2c's!!!

Thanks for getting back, ShannonH.

I appreciate you for clarifying your concern. Based on your information, this can be caused by data damage

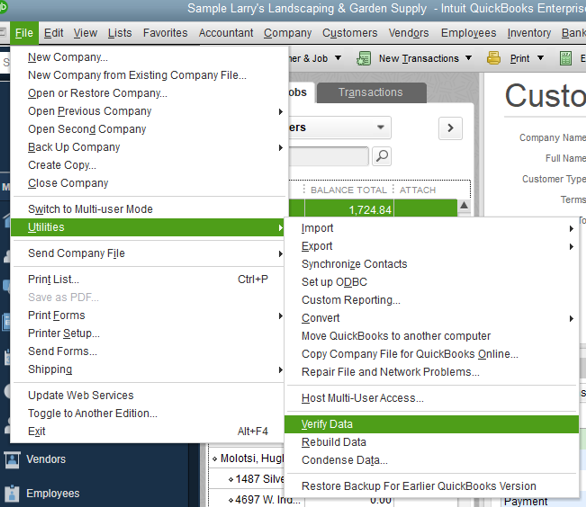

This can be resolved by using the Rebuild Data tool in QuickBooks Desktop. This tool is used to fix any possible data damage within your company file. Let me show you the steps on how to perform this below:

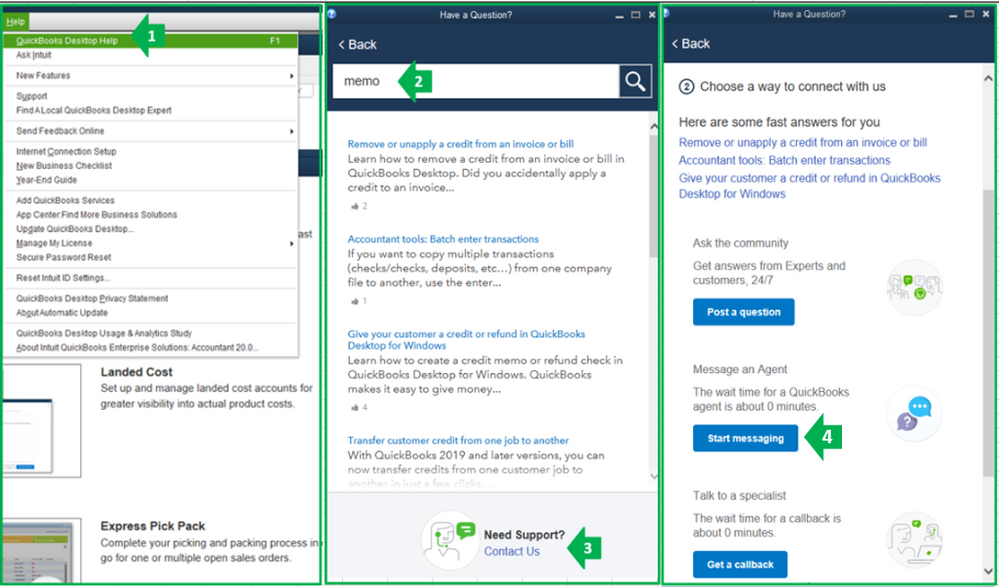

If the issue persists, I suggest contacting our QuickBooks Care Team. They can open your account and investigate the cause to come up with a permanent fix.

Here's how:

Please take note our operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

Get back to me if you have any other concerns while working with W2's or anything about QuickBooks. Have a nice day.

Thanks but if you read my original post, you will know that I spent hours chatting and on the phone with support (about 6.5 hours to be exact) and NO ONE was able to give me an answer.

I'm having the same problem. State corrections not transferring over to the W2-C and W3-C

I'm having the same problem. State correction not transferring to W2-c and W3-c

Hello there, GailB1.

We can try fixing the discrepancies on your payroll forms using the Verify and Rebuild Data Utility process. Let me show you how:

For more details, you can use this link: Verify and Rebuild Data in QuickBooks Desktop. Once done, close QuickBooks first and then reset the systems update and run the latest payroll tax table again.

Here's how to reset the update:

You can follow these steps on how to create and print your corrected Form W-2.

Keep me posted if you need anything else. Take care!

That fix did not work for me. I have the same problem - State corrections are input but not showing up in finished product.

This isn't the kind of experience we want you to have when generating W-2C state corrections in QuickBooks Desktop (QBDT), @DPK1. That's why I'm here to guide you on the next steps you need to take care of the issue.

I appreciate you for performing the possible resolutions provided above. Since the suggested fix didn't work, there's a need to further investigate the cause you're unable to show the state corrections when printing the Form W-2Cs. With this, I'd recommend contacting our Customer Care team. They can securely pull up your account and guide you with a fix.

You'll first have to check out our support hours to ensure we can assist you on time. Here's how:

In the meantime, I'm adding this article to answer the most frequently asked questions about W-2s: General Form and Filing Information. It includes topics about fixing an incorrect W-2 and printing your forms, to name a few.

Let me know if you have other concerns about printing W-2C's state corrections or payroll form inquiries in QuickBooks. I'm just around to help. Take care always.

That didn't solve the problem on the W2-C and W3-C forms to be filed. State correction was on the worksheet but did not transfer on the forms to be files with the IRS, Employee copy and state.

That didn't solve the problem. Corrections for the state are on the worksheet but not on the W2-C and W3-C forms to be filed with the IRS, Employee and State.

I have spent 8+ hours on the phone or chatting with support. How many more hours do you figure it would take? How about get someone to fix the problem!

I ended up having to import the QB file into another accounting software (Accounting CS). If you only have a few W-2's to correct and if you have a Business Services login with the SSA, you can file the W-2C's directly onto their website and it prints all the copies you need. I had about 200 that had to be corrected so this was not a good solution for me. I still can't believe I couldn't get them done in QB!

Hello,

I finally got the state information to print on the W-2c!! You need to have something in the SIT boxes. I am electing to enter the state income tax from original W-2s even though there is no change.

Thank you for this information. I was having the same problem with Quickbooks not printing my State changes to wages until I entered the SIT information.

Thank you!!!!! I have also spent hours trying to figure this out. Definitely a bug in the software.

I was having the same issue, the state information would not print on the W-2C. For some reason you need to enter an amount in the state withholding box for any state information to print.

A QuickBooks software fix would make life easier.

Hey there, @Vickie31.

I'll help you ensure you can print the state information on the W-2C form.

There might be a data damage in your company file. This can be the reason why you're unable to print this information.

Let's update QuickBooks Desktop to its latest release. Performing this action can fix some minor data issues in your company file. Here's how:

Try printing again the W-2 form. If you're still getting a similar result, run the Verify and Rebuild Data tools in QuickBooks Desktop. This will help us in identifying the most commonly known data issues within a company file and fix them.

Let's also ensure that you're using the latest payroll tax table before printing the form. If the issue persists, update or repair your Adobe Reader/Acrobat.

Just keep me posted if you have any other QuickBooks concerns. I'll be more than happy to assist you. Take care!

Thank you for this info!

Me too. Same problem.

Thanks for joining this thread, @lsmeridian.

If you still experience the same thing even after performing the steps provided in this conversation, I'd recommend reaching out to our QuickBooks Desktop (QBDT) phone support team. They can pull up your account in a secure place and further verify the root cause of the issue.

You may also consider browsing through this article to resolve printing problems in QBDT: Resolve printing issues.

In QBDT, it's easy to get a copy of your payroll information, employee details, and data for your business finances by pulling up payroll reports.

I'm always around here in the Community if you have any other QuickBooks-related concerns. Feel free to leave a reply below. I'm just a few clicks away to help. Take care.

Thank you. I filled in the SIT in both the "previous" and the "correct" and was able to get it to show up.

It's 2022 and there is still no bug to fix this issue. Amazing QB!!

It's not a data corruption problem or a printing problem!! I am having this same issue right now. It is a software issue in Quickbooks. Hey Quickbooks....Let your support/engineers know!! Or add it to your instructions in the W2c that you must enter the amount, if unchanged, in the SIT box for it to be correctly added to the form. Quickbooks just tripled our monthly "usage" cost for the Payroll service yet they can't even correct this issue still 2 years from the original post!! Oh and that is on top of the $400+ a year we also have to pay for the payroll service. It is ridiculous that I have to spend an hour trying to figure out what the problem is!

I can see that you did everything you could, @lisaz1. I understand that it's crucial to make the corrections to your W-2Cs to ensure you can submit them on time.

As much as I'd like to help you in getting this thing done right away, we'll need to reach out to our Support Team. This way, we can review this further and figure out how to populate the state corrected wage information on your W-2C form when printing in QuickBooks. Rest assured that our representatives are eager to help you resolve this issue.

Here's how:

If you're using the Pro, Premier, or Plus versions, we're available from 6 AM to 6 PM on Monday through Friday. For Enterprise, you can reach out to us any time, any day. To learn more ways of connecting with us, refer to this article: Contact QuickBooks Desktop Support.

I'd love to hear how the call goes. I'll be around whenever you have further concerns about the W-2C form or any other questions about payroll forms. Stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here