Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've been trying to get this to calculate properly and nothing is working. Did Quickbooks ever get this fixed?

Hello there, sheila dobbins. We need to set it up so that QuickBooks will calculate it correctly.

Make sure that your payroll tax table is updated. Also, make sure that the rates are correct. The rates for Washington Paid Family and Medical Leave depends on the number of employees you have. You can follow these steps to set it up:

You can read this article about Washington Paid Family and Medical Leave. This will guide you in setting it up and explain what this tax is. In addition, you can visit their website for additional information.

Reply again if you have more questions with this tax. I'm always here to help you.

So for the WA-pfml...it states that this needs to be finalized before the employee's first check in 2020 is issued. We hired a guy and for the first 2 paychecks we did not have the WA-Pfml payroll item under his name. On his third check we added it but now the system thinks we over paid into WA-PFML so at $1,520.00 the system only wants to figure $0.08 to be taken out....but if I put in $3,040.00 the system will take out $3.93 which is $0.08 more...how do I fix it? Please email me at [email address removed]

Hi there, @ddogg.

Thank you for reaching out to the Community. First, we need to make sure that your payroll tax table is updated. Also, make sure that the rates are set up properly, so it will calculate correctly. The rates for Washington Paid Family and Medical Leave it varies on the number of active employees you have. You can follow my colleague's steps above on how to set it up.

However for sending an email, as much as I love to help you, but this is a public forum, and we don't have access to pull up your account and send an email for security purposes. However, I will route you to the right Customer Support Team for further assistance. As they have the tools to pull up your account in a secure environment and answering any questions you may have about WA Paid Family and Medical Leave.

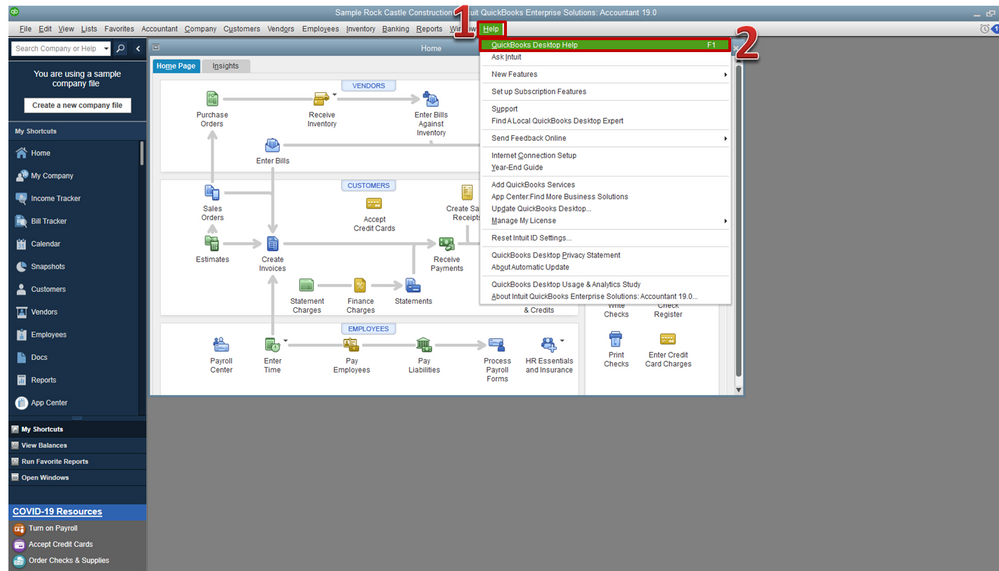

Before doing so, please check out our support hours to ensure that we address your concerns on time. Here's how to connect with our Customer teams:

Just a heads up, we have limited staffing and have reduced our support hours to 6 AM-6 PM PT Monday-Friday due to COVID-19. We will resume normal hours as soon as possible.

For more detailed information about WA.PFML, you can check out this article: Washington Paid Family and Medical Leave. In addition, you can visit their website for additional information.

Please don't hesitate to visit us here in the Community if you have other questions. I'm always here to answer your inquiries. Take care!

Hello,

I just started working with this company as the administrator and I've been tasked to look into FMLA requirements for our company. As we have a total of 15 employees, I've found that we are not required to sign up/participate with FMLA but rather the PFML. My question is at this point in the game, does QB already have these formulas implemented in within the employee section of the program where I can submit the percentage that needs to be taken out of the employee's paycheck? When utilizing QB to calculate the premiums from each employee and having those funds removed before each paycheck is sent out, I will still have to sign up with the state from the ESD webpage, correct?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here